About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

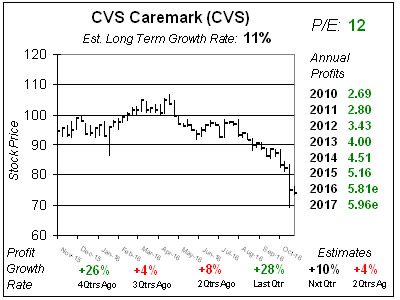

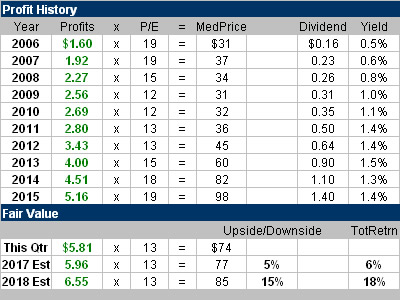

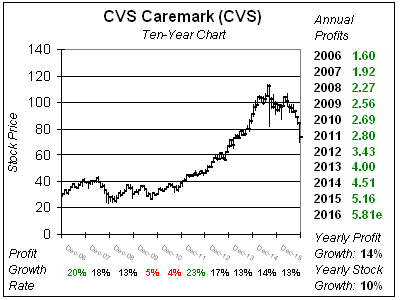

In a shocking turn of events, CVS Caremark (CVS) said it is losing 40 million prescriptions next year and slashed its 2017 profit guidance. CVS is made up of CVS drugstores and Caremark, a pharmacy benefit manager (PBM) that buys drugs in bulk then passes the savings along to its clients. Competition in the PBM space has heated up recently, with UnitedHealth’s OptumRX division taking deals it wouldn’t have in the past. Now the loss of 40 million scripts to Walgreens Boots took down 2017 profit growth estimates from 12% to 3% and more importantly cast a cloud over the ability for PBMs to grow profits in the future. CVS is a good stock, having grown profits every year since 2002. Management is savvy and buys back stock in addition to making smart acquisitions. In 2007 CVS acquired Caremark, a PBM that was/is growing 20% a year and in May 2015 acquired Omnicare, a PBM for seniors. One month later it purchased Target’s pharmacy business of 1600 drugstores.

In a shocking turn of events, CVS Caremark (CVS) said it is losing 40 million prescriptions next year and slashed its 2017 profit guidance. CVS is made up of CVS drugstores and Caremark, a pharmacy benefit manager (PBM) that buys drugs in bulk then passes the savings along to its clients. Competition in the PBM space has heated up recently, with UnitedHealth’s OptumRX division taking deals it wouldn’t have in the past. Now the loss of 40 million scripts to Walgreens Boots took down 2017 profit growth estimates from 12% to 3% and more importantly cast a cloud over the ability for PBMs to grow profits in the future. CVS is a good stock, having grown profits every year since 2002. Management is savvy and buys back stock in addition to making smart acquisitions. In 2007 CVS acquired Caremark, a PBM that was/is growing 20% a year and in May 2015 acquired Omnicare, a PBM for seniors. One month later it purchased Target’s pharmacy business of 1600 drugstores.