Stock (Symbol) |

Celsius (CELH) |

Stock Price |

$111 |

Sector |

| Food & Necessities |

Data is as of |

| August 26, 2022 |

Expected to Report |

| November 9 |

Company Description |

Celsius is engaged in the development, processing, marketing, sale, and distribution of functional drinks and liquid supplements to a range of consumers. Celsius is engaged in the development, processing, marketing, sale, and distribution of functional drinks and liquid supplements to a range of consumers.

The Company’s core offerings include pre- and post-workout functional energy drinks, as well as protein bars. Its flagship brand is CELSIUS, which is a calorie-burning functional energy drink. It seeks to combine nutritional science with mainstream beverages by using its thermogenic (calorie-burning) MetaPlus without the artificial preservatives found in energy drinks or sodas. CELSIUS has no chemical preservatives, aspartame or high fructose corn syrup and is low in sodium. CELSIUS uses good-for-you ingredients and supplements such as green tea (EGCG), ginger, calcium, chromium, B vitamins and vitamin C. Its product line includes CELSIUS Originals, CELSIUS HEAT, CELSIUS BCAA +Energy, CELSIUS On-the-Go, and CELSIUS Sweetened with Stevia. CELSIUS ready-to drink products are packaged in a distinctive 12 ounce sleek. Source: Refinitiv |

Sharek’s Take |

Energy drink maker Celsius’ (CELH) continues to surge — with 150% revenue growth, 140% profit growth, and a stock near All-Time highs. Within the past year, CELH has basically doubled its convenience store locations while direct store delivery revenue tripled. US store count grew 54% year over year to 159,000 last qtr. Just last qtr the company placed another 800 coolers in stores, and 2700 since the beginning of 2021. And club channels (Costco, Sam’s Club, BJ’s Wholesale, etc) revenue was up 415%. And on Amazon, Celsius is the 2nd largest energy drink with a 23% share of the category, with Monster leading at 25% and Red Bull in 3rd place at 11%. And now the company has a partner in its growth stock in Pepsico, which invested $550 in the company and will distribute the drinks in the US and Internationally. Celsius management said Pepsico will grow US growth significantly in the year term, with 40% incremental distribution on top of previous door growth projections over the next year. Pepsico will own 8.5% of CELH via convertible stock. Energy drink maker Celsius’ (CELH) continues to surge — with 150% revenue growth, 140% profit growth, and a stock near All-Time highs. Within the past year, CELH has basically doubled its convenience store locations while direct store delivery revenue tripled. US store count grew 54% year over year to 159,000 last qtr. Just last qtr the company placed another 800 coolers in stores, and 2700 since the beginning of 2021. And club channels (Costco, Sam’s Club, BJ’s Wholesale, etc) revenue was up 415%. And on Amazon, Celsius is the 2nd largest energy drink with a 23% share of the category, with Monster leading at 25% and Red Bull in 3rd place at 11%. And now the company has a partner in its growth stock in Pepsico, which invested $550 in the company and will distribute the drinks in the US and Internationally. Celsius management said Pepsico will grow US growth significantly in the year term, with 40% incremental distribution on top of previous door growth projections over the next year. Pepsico will own 8.5% of CELH via convertible stock.

CELH has a proprietary calorie-burning formulation called MetaPlus, while being as natural as possible, without the artificial preservatives found in many energy drinks and sodas. Management claims drinking the product can help people lose weight. In a ten-week clinical study published in the Journal of International Society of Sports Nutrition, the group who drank one Celsius per day experienced 93% greater fat loss (Source: Celsius Investor Kit). The science has also been backed by six published university clinical studies (Ohio Research and University of Oklahoma). CELH drinks have no artificial preservatives, aspartame or high fructose corn syrup and very low sodium. The main line of CELH products are sweetened with sucralose, the sweetener found in Splenda. Other ingredients include green tea, ginger, calcium, chromium (which controls hunger), Vitamin B and Vitamin C, which work together to enact thermogenesis, a process that boosts the body’s metabolic rate resulting in calorie burn and energy. Last qtr highlights include:

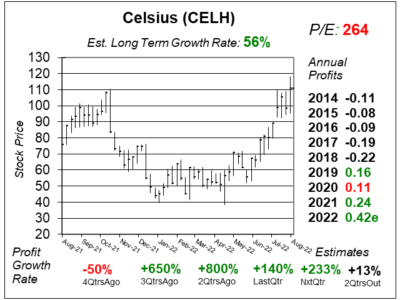

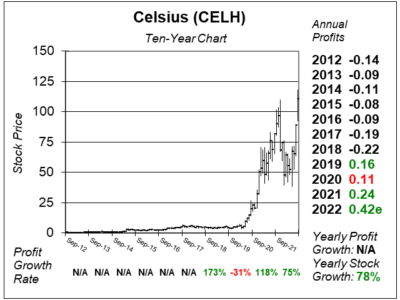

CELH is expected to grow revenue from $314 million in 2021 to $619 million in 2022 and $928 million in 2023. And during the next five years, CELH is expected to grow its share of energy drink market from 3% to 6-7% (Source: Jefferies). The Energy Drink market was around $60 billion market worldwide in 2020, with Celsius management thinking the market could reach $84 billion by 2025 (Source: December 2020 Investor Presentation). CELH has great growth opportunity for the future but the stock is speculative with a P/E at 264. But profits are growing at a triple digit rate and the Estimated Long-Term Growth Rate of 56% is outstanding. CELH is the #1 ranked stock in my Aggressive Growth Portfolio. |

One Year Chart |

CELH stock was a big winner in 2021, then crashed with the rest of the speculative stocks during the Bear Market. But the stock quickly recovered, and is now hitting All-Time highs. CELH stock was a big winner in 2021, then crashed with the rest of the speculative stocks during the Bear Market. But the stock quickly recovered, and is now hitting All-Time highs.

The P/E of 264 seems high, but this is a young company that’s growing rapidly. Thus, I’m valuing the stock on a price-to-sales basis (more below). This P/E was 157 last qtr. CELH has an outstanding Est. LTG of 56% a year, down from 59% last qtr. Look at that triple-digit profit growth. And that’s expcted to continue into next qtr. |

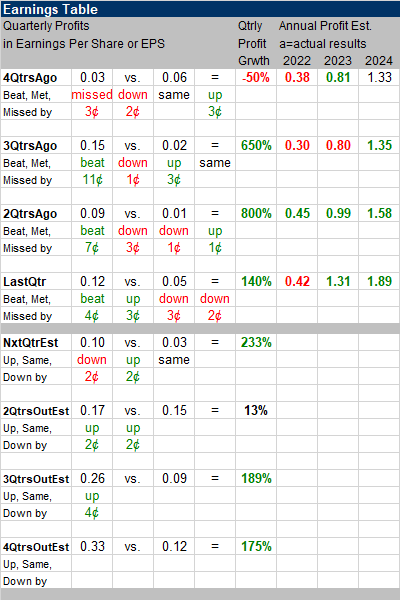

Earnings Table |

Last qtr, CELH reported 140% profit growth, and beat expectations of 60% growth. Revenue increased 137%, over last year. Gross profit margin slightly decreased to 38.5% from 43.4% last year, as a result of increased costs in imported cans and raw materials. But the company is becoming more efficient via full truck shipments and optimization of its six warehouses. Here are the regional highlights: Last qtr, CELH reported 140% profit growth, and beat expectations of 60% growth. Revenue increased 137%, over last year. Gross profit margin slightly decreased to 38.5% from 43.4% last year, as a result of increased costs in imported cans and raw materials. But the company is becoming more efficient via full truck shipments and optimization of its six warehouses. Here are the regional highlights:

Celsius is the #1 brand driving category growth with 34% of the growth in the entire energy drink category. Walmart had 700% growth. The company is the #1 brand in fitness channels. Annual Profit Estimates all increased this qtr. Qtrly Profit Estimates are for 233%, 13%, 189%, and 175% growth the next 4 qtrs. Notice the 2QtrsOut estimate is low due to tough comparisons from the year-ago period. |

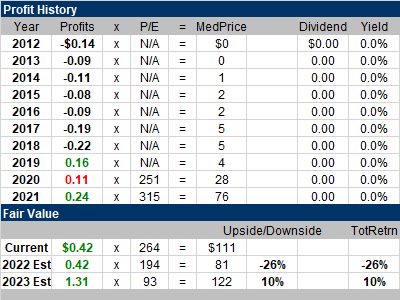

Fair Value |

CELH has been publicly traded for more than a decade. The $0 stock prices you see here in the table are when the stock was selling for less than $0.50. My Fair Value jumps from 6x annual revenue estimates back to 10x, which is what I had it at 3QtrsAgo. For comparison, Monster stock sells for 7.4x revenue estimates now, and it sold for 9x revenue in 2021 and 11x in 2020. But on the other hand, Pepsico bought Rockstar for around 4x revenue: CELH has been publicly traded for more than a decade. The $0 stock prices you see here in the table are when the stock was selling for less than $0.50. My Fair Value jumps from 6x annual revenue estimates back to 10x, which is what I had it at 3QtrsAgo. For comparison, Monster stock sells for 7.4x revenue estimates now, and it sold for 9x revenue in 2021 and 11x in 2020. But on the other hand, Pepsico bought Rockstar for around 4x revenue:

Current qtr: 2022 Fair Value: 2023 Fair Value: |

Bottom Line |

CELH has been a volatile stock that past two years, and has shook out a lot of investors along the way. I almost sold at the recent lows around $40. CELH has been a volatile stock that past two years, and has shook out a lot of investors along the way. I almost sold at the recent lows around $40.

This article ws fantastic. And I’m now bullish again on the company’s prospects. But the price-to-sales ratio is high, so I would be hesitant in buying more shares here. CELH ranks #1 in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 1 of 17Conservative Stock Portfolio N/A |