Stock (Symbol) |

Cadence Design Systems (CDNS) |

Stock Price |

$244 |

Sector |

| Technology |

Data is as of |

| October 5, 2023 |

Expected to Report |

| December 19 |

Company Description |

Cadence Design Systems, Inc. is an electronic system designing company. Cadence Design Systems, Inc. is an electronic system designing company.

The Company’s Custom IC Design and Simulation offerings are used by its customers to create schematic and physical representations of circuits down to the transistor level for analog, mixed-signal, custom digital, memory and radio frequency (RF) designs. Its Digital IC Design and Signoff solutions are used to create logical representations of a digital circuit or an integrated circuit (IC) that can be verified for correctness prior to implementation. The Company’s Functional Verification products are used by its customers to verify that the circuitry or the software they have designed is consistent with the functional specification. Its IP offerings consist of pre-verified, customizable functional blocks. Its System Design and Analysis offerings are used by its customers to develop printed circuit boards (PCBs) and advanced IC packages and to analyze electromagnetic, electro-thermal and other multi-physics effects. Source: Refinitiv |

Sharek’s Take |

Cadence Design Systems (CDNS) is seeing increasing adoption for its AI portfolio which includes Cerebrus, an automated chip design platform, Verisium, an AI-powered verification platform, and Fidelity CFD Software, a multi-physics simulation program. Here’s more about each:

Cadence Design Systems was founded in 1988 with the merger of ECAD and SDA Systems, two startups in the electronic design automation (EDA) space. With 30 years of software expertise, Cadence has risen to become a leader in electronic system design. The company offers software, hardware, services, and reusable integrated circuit (IC) blocks to help customers develop complex electronic devices and systems, as well as conduct verification tasks to ensure that systems are working correctly. Partners include NVIDIA which is using Candence to accelerate EDA, system analysis, and AI, as well as Tesla which deploys Cadence solutions for the development of its Dojo AI supercomputer. Here are the company’s main segments:

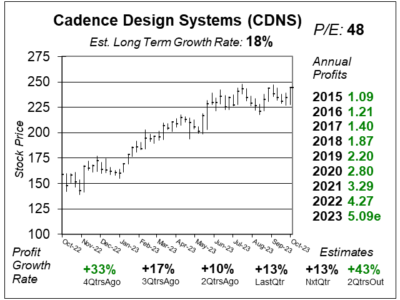

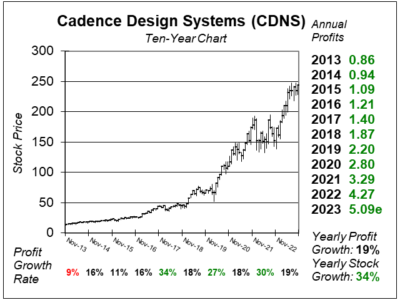

CDNS has been an amazing stock this past decade as its climbed more than ten-fold in price the past decade. The stock was $13 or so ten years ago and is now almost $250. The stock has an Estimated Long-Term-Growth Rate of 18%. And the company seems to be growing profits at around that rate now. Management does not pay dividends but repurchased 6.6 million shares for $1 billion in fiscal 2022. CDNS on the radar for the Growth Portfolio. With a P/E of 46, the stock seems rich. I’d love the see the shares pull back to buy in. |

One Year Chart |

CDNS has been trading between $220 and $250 since the stock broke into the $220s in May. These charts were made on 10/7 when the shares were $244. The stock close at $250 on Friday, and broke out to new All-Time highs last week. CDNS has been trading between $220 and $250 since the stock broke into the $220s in May. These charts were made on 10/7 when the shares were $244. The stock close at $250 on Friday, and broke out to new All-Time highs last week.

The stock has a P/E of 48, which is slightly above my Fair Value of 45. That seems high though. Looking at this chart, the stock was around $150 a year ago and made $4.27 for the year, so the P/E was ~35 then. The Est. LTG is 18%. That’s a healthy growth rate. |

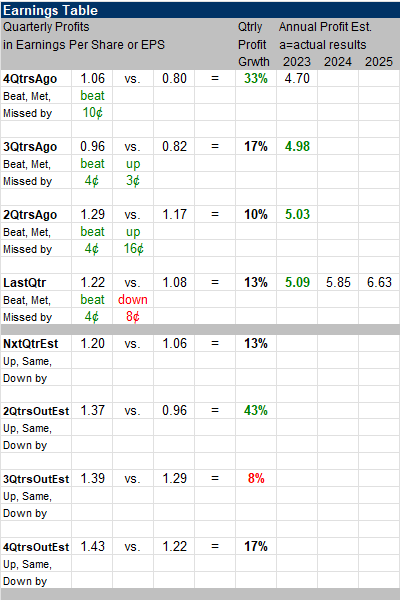

Earnings Table |

Last quarter CDNS grew profits 13% and met analyst estimates. Revenue grew 13% year-over-year and beat estimates of 11%. Last quarter CDNS grew profits 13% and met analyst estimates. Revenue grew 13% year-over-year and beat estimates of 11%.

Revenue growth was led by Digital IC Design, Verification, and System Design. The company saw increased adoption for its Digital IC tools (revenue +15%), particularly for advance node and market-shaping customers. Secular demand for the company’s hardware platforms also drove revenues to the verification business (+27%). Growth in System Design (+23) was led by a multiyear agreement with Samsung Foundry. Annual Profit Estimates for 2023 increased this qtr. Management raised their guidance for total revenue in fiscal 2023, but revenue is still expected to grow 14% year-over-year. Qtrly Profit Estimates are 13%, 43%, 8%, and 17% for the next 4 qtrs. Analysts expect revenue to grow 11% next qtr. Management noted that a large number of hardware systems deliveries are scheduled for late September and early October, thus pushing back the majority of these deliveries in the last qtr of the fiscal year. |

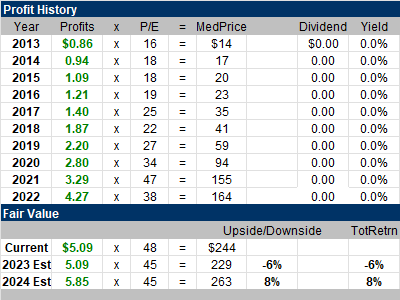

Fair Value |

My Fair Value P/E is 45. The stock has a 48 P/E now, which makes the fairly valued. My Fair Value P/E is 45. The stock has a 48 P/E now, which makes the fairly valued.

This stock seems to have around 6% downside for the year ahead. |

Bottom Line |

Cadence Design Systems (CDNS) has been a publicly traded company all the way back from 1998, but the stock only started growing at a faster pace in 2017 when it broke out at $30. The stock has been on an upward trajectory since and the stock has grown more than 7x since 2017. Cadence Design Systems (CDNS) has been a publicly traded company all the way back from 1998, but the stock only started growing at a faster pace in 2017 when it broke out at $30. The stock has been on an upward trajectory since and the stock has grown more than 7x since 2017.

This company has a bright future with AI. Investors are aware of this, thus the P/E is mighty high. But the valuation is high, and leaves little upside in the short-term. CDNS is on the radar for the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |