Stock (Symbol) |

Alibaba (BABA) |

Stock Price |

$187 |

Sector |

| Retail & Travel |

Data is as of |

| November 8, 2019 |

Expected to Report |

| January 28 |

Company Description |

Alibaba is principally engaged in online and mobile commerce through products, services and technology. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com). Source: Thomson Financial Alibaba is principally engaged in online and mobile commerce through products, services and technology. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com). Source: Thomson Financial |

Sharek’s Take |

Alibaba (BABA) stock could rise 100% within the next two years, and I’m not just creating hype. The stock currently sells for 23x current year earnings (2019) estimates of $7.27. But profits just grew 36%, so I think the stock should have a higher multiple of 33x. Additionally, profits are expected to climb from $7.27 this year to $9.10 next year and then to $11.37 two years from now. So if in two years the stock sells for 33x 2021 profit estimates of $11.37 it would be $375, which is double the current $187 price. This is all hypothetical, as we small investors cannot (1.) know what kind of multiple investors will price the stock at and (2.) we can’t influence how much Alibaba makes. Alibaba (BABA) stock could rise 100% within the next two years, and I’m not just creating hype. The stock currently sells for 23x current year earnings (2019) estimates of $7.27. But profits just grew 36%, so I think the stock should have a higher multiple of 33x. Additionally, profits are expected to climb from $7.27 this year to $9.10 next year and then to $11.37 two years from now. So if in two years the stock sells for 33x 2021 profit estimates of $11.37 it would be $375, which is double the current $187 price. This is all hypothetical, as we small investors cannot (1.) know what kind of multiple investors will price the stock at and (2.) we can’t influence how much Alibaba makes.

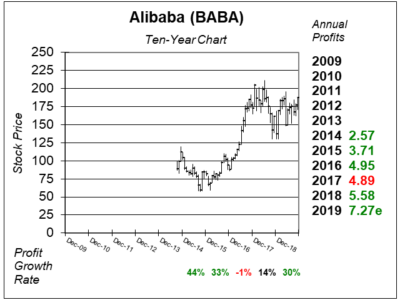

Alibaba had its 20 year anniversary past September, and the stock is already one of the top large-cap growth stocks in the world. Still, its growth opportunity is large. The National Bureau of Statistics of China’s data says China’s e-commerce market increased 24% year-over-year in 2018 (source: Guotai Junan Securities). Company management says a growing middle class and more affluent middle class purchasing levels are rising are the reasons for the company’s strong revenue growth (40% last qtr) and it isn’t concerned with slowing China exports because it believes the Chinese economy is shifting from an export economy to a domestic consumption economy. Management stated digitization — i.e. nicer mobile phones using apps with new retail technology — is helping to boost results. During Fiscal 2018, 86% of Alibaba’s revenue came from its Core Commerce division, which includes two main e-commerce sites are Tmall and Taobao. Tmall is China’s biggest business to consumer site. Taobao is a consumer-to-consumer site like eBay. BABA also has a Cloud Computing division and a Digital Media and Entertainment division, but each contributed just 7% and 6% of total company revenue, respectively during the fiscal year. Cloud computing a had a 84% increase in sales last year. Digital media, which includes Youku Tudou, China’s YouTube, grew 23%. Alibaba added 20 million customers last qtr, with more than 70% from less-developed areas. Alibaba stock has been With an Estimated Long Term Growth Rate of 26% per year I think the P/E should be 33. The stock currently has a 19 P/E if I look out to 2020 earnings estimates. Thus, BABA seems like a bargain. My Fair Value is $300 next year and $375 in 2021, which equates to 60% upside next year and 100% in two years. No hype, just math. BABA shoots to the top of my Growth Portfolio and Aggressive Growth Portfolio Power Rankings. A US/China trade deal could be a catalyst to push the stock higher, but either way BABA is looking good as it just broke out of a 6-month base. |

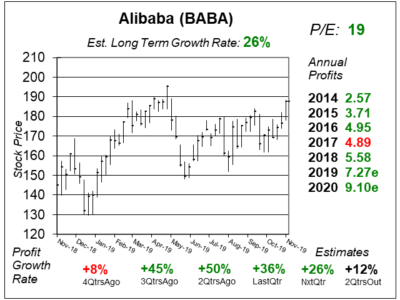

One Year Chart |

This stock has been basing since it fell out of bed last May. This week it had a clean breakout past $180 and is now $187. This stock has been basing since it fell out of bed last May. This week it had a clean breakout past $180 and is now $187.

The Est. LTG of 26% is excellent for a large company like this. If the company can grow profits at that rate the next three years, and the valuation (the P/E) stays the same the stock would double in three years. Since BABA is in its Fiscal Year 4th qtr, I’m calculating the P/E on 2020 estimates. The P/E of 19 is absurdly cheap. The P/E was 25 the prior two qtrs. |

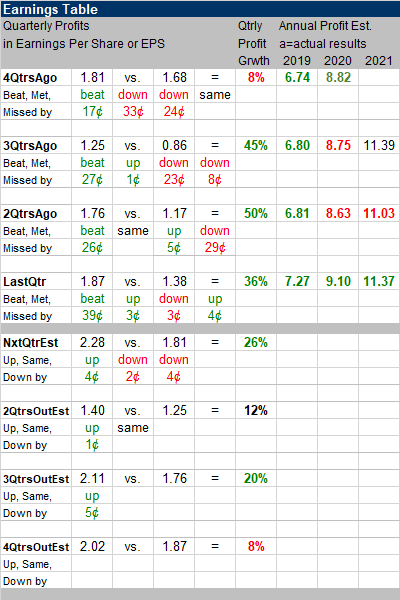

Earnings Table |

Last qtr BABA delivered 36% profit growth, which easily beat estimates of 7% as sales jumped a remarkable 40%. Last qtr BABA delivered 36% profit growth, which easily beat estimates of 7% as sales jumped a remarkable 40%.

Annual Profit Estimates increased across the board, with 2019-2021 expected growth rates now at 30%, 25% and 25%. It’s absurd this stock would have a 19 P/E with that kind of growth. Qtrly profit Estimates are 26%, 12%, 20% and 8% the next 4 qtrs. With the way the company has been whipping profit estimates, its conceivable profit growth could continue to grow at the rates we’ve seen the past three qtrs. |

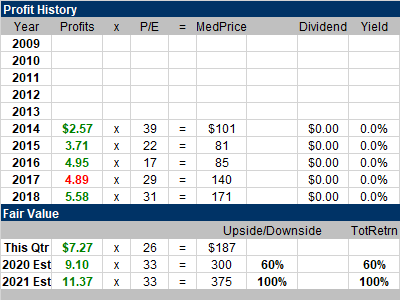

Fair Value |

Chinese stocks have been under pressure the past two years, yet this stock was worthy of 29 and 31 P/Es during that time. And now the outlook for the company is better because it’s been beating the street handily, upping current year estimates, and growing strong whether we have a US/China trade deal or not. The company is a juggernaut. And I feel the P/E should be between 30 and 35. So I set my Fair Value at 33. Chinese stocks have been under pressure the past two years, yet this stock was worthy of 29 and 31 P/Es during that time. And now the outlook for the company is better because it’s been beating the street handily, upping current year estimates, and growing strong whether we have a US/China trade deal or not. The company is a juggernaut. And I feel the P/E should be between 30 and 35. So I set my Fair Value at 33.

With 2020 and 2021 estimates currently at $9.10 and $11.37, my Fair Value prices are $300 in 2020 and $375 in 2021. The latter would be a gain of 100% in two years. I’m not hyping up BABA, I’m just using simple math. |

Bottom Line |

Alibaba’s (BABA) has been a frustrating stock the past two years. But the P/E’s fallen from 36 to 19 during that time. Now I’m basing my P/E on 2020 estimates, but still. A teens valuation seems way too low. Alibaba’s (BABA) has been a frustrating stock the past two years. But the P/E’s fallen from 36 to 19 during that time. Now I’m basing my P/E on 2020 estimates, but still. A teens valuation seems way too low.

Alibaba has been delivering some amazing numbers the past few qtrs, and I’ve been pushing the stock up in my Power Rankings, but what we didn’t have before now is other people backing the stock. With BABA breaking out this week, I think now might be the time the stock runs higher, and possible gets the valuation it deserves. BABA moves up from 7th to 1st in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. I will be increase my position in client accounts. |

Power Rankings |

Growth Stock Portfolio

1 of 38Aggressive Growth Portfolio 1 of 16Conservative Stock Portfolio N/A |