Stock (Symbol) |

Alibaba (BABA) |

Stock Price |

$168 |

Sector |

| Retail & Travel |

Data is as of |

| September 26, 2017 |

Expected to Report |

| Nov 9 |

Company Description |

BABA is a holding company. The Company is principally engaged in online and mobile commerce through products, services and technology. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com). Source: Thomson Financial BABA is a holding company. The Company is principally engaged in online and mobile commerce through products, services and technology. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com). Source: Thomson Financial |

Sharek’s Take |

Alibaba (BABA) got a lot of headlines after its IPO in 2014. Then the stock fell in 2015 and investors lost interest in the stock. In 2016 the stock tried to rally — and did go up some — but faded late. This year, 2017, BABA is doing fantastic. The stock has doubled year-to-date, and my indications are for the stock to continue higher. Two qtrs ago managment said 2017 revenue would grow 45-49%– well above analyst estimates of 31% growth — and I felt the stock should go materially higher on the news. Since then it has — from $140 to more than $183 recently — but I feel the stock should be more than $200. Here’s last qtr’s divisional year-over-year sales growth: Alibaba (BABA) got a lot of headlines after its IPO in 2014. Then the stock fell in 2015 and investors lost interest in the stock. In 2016 the stock tried to rally — and did go up some — but faded late. This year, 2017, BABA is doing fantastic. The stock has doubled year-to-date, and my indications are for the stock to continue higher. Two qtrs ago managment said 2017 revenue would grow 45-49%– well above analyst estimates of 31% growth — and I felt the stock should go materially higher on the news. Since then it has — from $140 to more than $183 recently — but I feel the stock should be more than $200. Here’s last qtr’s divisional year-over-year sales growth:

The company’s two main e-commerce sites are Tmall, China’s biggest business to consumer site, and Taobao, a consumer-to-consumer site like eBay. BABA also owns Youku Tudou, China’s YouTube. Management even buys back stock as well, with a $6 billion stock buyback plan in place. Profit growth just surged from 39% to 64% and looking ahead I think profits could grow an average of 50% or more for the next year. Alibaba has the size to grow and leave smaller players in the dust, and with China doing 15% of its commerce online, that means there’s lots of opportunity to capture a chunk of the remaining 85%. With excellent fundamentals and an undervalued stock, BABA is the best stock in my Power Rankings. |

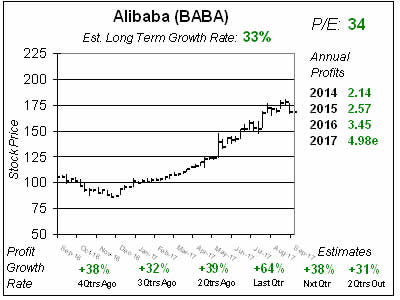

One Year Chart |

Sales grew 56% year-over-year last qtr, with profit growth ballooning to 64%, which was way above estimates of 26%. Qtrly profit estimates soared and now stand at 38%, 31%, 61% and 30%. The Est. LTG jumped from 28% last qtr to 33% this qtr. The P/E of 34 makes this stock is undervalued. Note these charts were done a couple weeks ago, and since then the stock has gone from $168 to $183. Sales grew 56% year-over-year last qtr, with profit growth ballooning to 64%, which was way above estimates of 26%. Qtrly profit estimates soared and now stand at 38%, 31%, 61% and 30%. The Est. LTG jumped from 28% last qtr to 33% this qtr. The P/E of 34 makes this stock is undervalued. Note these charts were done a couple weeks ago, and since then the stock has gone from $168 to $183. |

Fair Value |

Profit estimates surged after the company reported. 2017’s estimates jumped from $4.56 to $4.98 , 2018’s from $5.96 to $6.56 and 2019’s from $7.55 to $8.52. With the strong beat-and-raise I’m taking my Fair Value up from 3x earnings to 42x. The combination of higher profit estimates and a higher expected valuation (P/E) take my 2017 Fair Value price from $160 to $209. 2018’s Fair Value jumps from $209 to $276. Remember these charts were done a couple weeks ago when BABA was $168. Now it’s $183 and I feel even after the rise the stock’s still undervalued. Profit estimates surged after the company reported. 2017’s estimates jumped from $4.56 to $4.98 , 2018’s from $5.96 to $6.56 and 2019’s from $7.55 to $8.52. With the strong beat-and-raise I’m taking my Fair Value up from 3x earnings to 42x. The combination of higher profit estimates and a higher expected valuation (P/E) take my 2017 Fair Value price from $160 to $209. 2018’s Fair Value jumps from $209 to $276. Remember these charts were done a couple weeks ago when BABA was $168. Now it’s $183 and I feel even after the rise the stock’s still undervalued. |

Bottom Line |

Alibaba’s wasn’t a great stock after it went public, and that took investor attention away. But now the fundamentals are on fire and so is the stock. Still, even after a double so far in 2017 I think the shares have huge upside. BABA ranks 1st in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. Alibaba’s wasn’t a great stock after it went public, and that took investor attention away. But now the fundamentals are on fire and so is the stock. Still, even after a double so far in 2017 I think the shares have huge upside. BABA ranks 1st in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

1 of 34Aggressive Growth Portfolio 1 of 15Conservative Stock Portfolio N/A |