About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

BABA is a holding company. The Company is principally engaged in online and mobile commerce through products, services and technology. The Company provides retail and wholesale marketplaces available through both personal computer and mobile interfaces in the PRC and internationally. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com) and the online business-to-business marketplace that focuses on global trade among businesses from around the world. Source: Thomson Financial

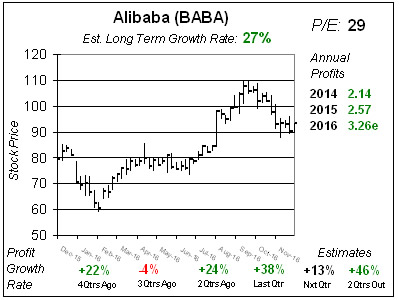

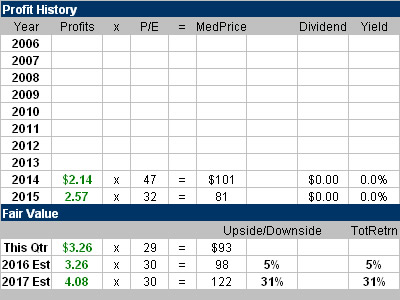

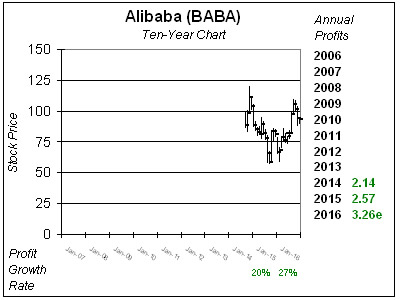

BABA is a holding company. The Company is principally engaged in online and mobile commerce through products, services and technology. The Company provides retail and wholesale marketplaces available through both personal computer and mobile interfaces in the PRC and internationally. Retail marketplaces and services operated by the Company include the China online shopping destination (Taobao Marketplace); the China brands and retail platform (Tmall); the China group buying site that offers products by aggregating demand from consumers through limited time discounted sales (Juhuasuan), and the global consumer marketplace targeting consumers around the world (AliExpress). Wholesale marketplaces operated by the Company include the online China wholesale marketplace (1688.com) and the online business-to-business marketplace that focuses on global trade among businesses from around the world. Source: Thomson Financial Alibaba (BABA) is growing very rapidly, but the fundamentals aren’t as perfect as some of the other Internet names. Alibaba posted 38% profit growth last qtr — blowing past the 24% estimate — as sales surged 55%. But afterwards, analysts didn’t up earnings estimates. They lowered them. Still, profits are expected to climb 25% in 2017. With a p/E of 29, on 2017 earnings estimates, this stock isn’t cheap nor is it expensive. One could argue this stock is worth 35 or 40 times earnings and you wouldn’t get a complaint from me. But there are things that aren’t perfect with the company. Lowering of profit estimates is one, and BABA isn’t very transparent in its financials and makes outside investments that are cloudy. On the bright side, owning Alibaba is like owning another Amazon.

Alibaba (BABA) is growing very rapidly, but the fundamentals aren’t as perfect as some of the other Internet names. Alibaba posted 38% profit growth last qtr — blowing past the 24% estimate — as sales surged 55%. But afterwards, analysts didn’t up earnings estimates. They lowered them. Still, profits are expected to climb 25% in 2017. With a p/E of 29, on 2017 earnings estimates, this stock isn’t cheap nor is it expensive. One could argue this stock is worth 35 or 40 times earnings and you wouldn’t get a complaint from me. But there are things that aren’t perfect with the company. Lowering of profit estimates is one, and BABA isn’t very transparent in its financials and makes outside investments that are cloudy. On the bright side, owning Alibaba is like owning another Amazon.