Stock (Symbol) |

American Express (AXP) |

Stock Price |

$233 |

Sector |

| Financial |

Data is as of |

| April 22, 2024 |

Expected to Report |

| July 18 |

Company Description |

American Express Company is a globally integrated payments company. American Express Company is a globally integrated payments company.

The Company provides its customers with access to products, insights, and experiences that builds business. It operates under four segments: U.S. Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS), and Global Merchant and Network Services (GMNS). USCS offers travel and lifestyle services as well as banking and non-card financing products. CS offers payment and expense management, banking and non-card financing products. CS also issues corporate cards and provides services to select global corporate clients. ICS also provides services to international customers, including travel and lifestyle services, and manages certain international joint ventures and its loyalty coalition businesses. GMNS provides multi-channel marketing programs and capabilities, services and data analytics. It provides credit and charge cards to consumers, small businesses, mid-sized companies and corporations. |

Sharek’s Take |

American Express (AXP) reported excellent results last quarter as Young Americans and International customers sparked growth. Overall, AXP delivered 39% profit growth on 11% revenue growth. US Millenials and Gen Z customers are still a real catalyst for the company, as their spending last quarter was up 15% from a year-ago. AXP added 3.4 million cards last quarter and Millennials and Gen Z made up more than 60% of all the new consumer accounts globally. Company wide, spending was up 7% on an F/X adjusted basis, with US spending up 8% and International up 13% (adjusting for F/X). US small to medium business spending continues to be soft. Internationally, individuals, small-medium sized businesses, and large businesses all increased spending at double-digit rates. American Express (AXP) reported excellent results last quarter as Young Americans and International customers sparked growth. Overall, AXP delivered 39% profit growth on 11% revenue growth. US Millenials and Gen Z customers are still a real catalyst for the company, as their spending last quarter was up 15% from a year-ago. AXP added 3.4 million cards last quarter and Millennials and Gen Z made up more than 60% of all the new consumer accounts globally. Company wide, spending was up 7% on an F/X adjusted basis, with US spending up 8% and International up 13% (adjusting for F/X). US small to medium business spending continues to be soft. Internationally, individuals, small-medium sized businesses, and large businesses all increased spending at double-digit rates.

American Express is a globally integrated payments company in providing credit and charge cards to individuals and businesses with high credit scores. The company is both a card issuer (like Chase and Citi) and a card network (like MasterCard and Visa). American Express’ integrated payments platform has direct relationships with Merchants and Card Members, creating a closed loop so Amex has direct access to information. The company can analyze info on spending to underwrite risk, reduce fraud and do targeted marketing. What makes American Express special is its Membership Rewards program, which include benefits such as airport lounge access, dining experiences, and other travel benefits. The company has been attracting younger, Millennial and Gen Z customers. In the US, these customers were more than 60% of new accounts in 2023. In addition, 75% of new Consumer Platnum and Gold accounts acquired in the US were from this group of individuals. Here’s a short history of American Express:

AXP engages in businesses comprising four operating segments:

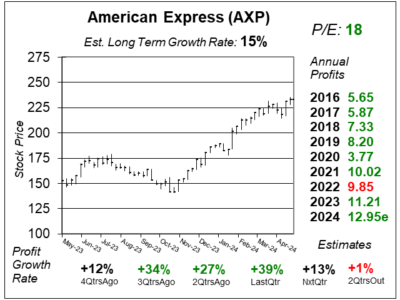

American Express is a reasonably safe stock that is part of the Dow Jones Industrial Average. This stock does have some credit risk, as the company holds credit card loans, unlike Visa and MasterCard. There have been years during the past decade when profits haven’t hit All-Time highs. Thus, this stock doesn’t have the great certainty that MasterCard and Visa possess. AXP spent $5.3 billion on stock buybacks and dividends in 2023. The dividend was just increased 15% to $2.80 on an annualized basis. AXP has an Estimated Long-Term Growth Rate of 15% and a dividend yield of 1%. I used to consider this a ten percent grower (Est. LTG + yield) long term, but now management aspirations are mid-teens profit growth so I feel this is a 15% grower. AXP is part of the Conservative Portfolio. With a P/E of just 18, this stock has room to move higher. |

One Year Chart |

I like this chart! It is currently moving on an uptrend. I like this chart! It is currently moving on an uptrend.

Qtrly profit growth has been great in the past three quarters. Analysts have an Est. LTG of 15% on this stock. Note profits are expected to hit record highs of $12.95 this quarter. |

Earnings Table |

Last qtr, American Express delivered 39% profit growth and beat estimates of 23% growth. Revenue increased 11% and beat expectations of 10%. The company acquired 3,4 million new cards during the quarter. Last qtr, American Express delivered 39% profit growth and beat estimates of 23% growth. Revenue increased 11% and beat expectations of 10%. The company acquired 3,4 million new cards during the quarter.

AXP’s Billed Business grew 7% and was driven by 6% growth in Goods & Services spending and 8% growth in Travel & Entertainment spending. US Consumer grew billings by 8% this quarter. Millennial and Gen Z customers grew their billings by 15%. Millennials and Gen Z continued to drive AXP’s highest billed business growth within this segment. International Card Members spending was up by 13%. As AXP continues to see double-digit spending growth from international consumers, SMBs, and large corporate customers. Annual Profit Estimates are higher this qtr. Management re-affirms full-year guidance of 9%-11% profit growth even in a softer spending environment. Analysts think profits will grow a healthy 16% this year. Qtrly profit Estimates are for 13%, 1%, 19%, and 3% growth the next 4 qtrs. Analysts estimate AXP’s revenue will grow 10% next quarter. |

Fair Value |

This stock currently has a P/E of 18 when we look at 2024 profit estimates. This stock currently has a P/E of 18 when we look at 2024 profit estimates.

My Fair Value is a P/E of 22, and if we use 2024 profit estimates, that equates to a $285 stock, which is around 22% higher than the recent quote. If we use 2025 estimates with P/E of 22, stock price would be $327, upside of 40%. |

Bottom Line |

American Express (AXP) has had an erratic profit history. Also, the stock hasn’t been a steady grower the past decade. And below 10% profit growth/stock growth during the last ten years is good but not great. American Express (AXP) has had an erratic profit history. Also, the stock hasn’t been a steady grower the past decade. And below 10% profit growth/stock growth during the last ten years is good but not great.

AXP is a faster growing company than it used to be, and the stock should be rewarded with a higher P/E ratio. Young customers continue to sign up, while International growth is becoming a bigger story. AXP stays at 4th in the Conservative Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Growth Portfolio 4 of 25 |