Stock (Symbol) |

American Express (AXP) |

Stock Price |

$206 |

Sector |

| Financial |

Data is as of |

| February 6, 2024 |

Expected to Report |

| April 18 |

Company Description |

American Express Company is a globally integrated payments company. American Express Company is a globally integrated payments company.

The Company provides its customers with access to products, insights, and experiences that builds business. It operates under four segments: U.S. Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS), and Global Merchant and Network Services (GMNS). USCS offers travel and lifestyle services as well as banking and non-card financing products. CS offers payment and expense management, banking and non-card financing products. CS also issues corporate cards and provides services to select global corporate clients. ICS also provides services to international customers, including travel and lifestyle services, and manages certain international joint ventures and its loyalty coalition businesses. GMNS provides multi-channel marketing programs and capabilities, services and data analytics. It provides credit and charge cards to consumers, small businesses, mid-sized companies and corporations. |

Sharek’s Take |

American Express (AXP) broke out in a big way after the company reported profits. The shares — which were weak though much of 2023 — have gone from around $140 last November to more than $200 now. What was the reason for the strong move? Perhaps low delinquency rates. Accounts 30+ days past due were 1.3% last quarter, up from 1.2% the prior quarter and below the pre-pandemic 1.5% (in Fiscal 2019 Q4). Net Write-off Rares were 2.0%, up from 1.8% a quarter earlier and below the pre-pandemic 2.2%. US Millenials and Gen Z customers are a real catalyst for the company, as their spending last quarter was up 15% from a year-ago. American Express (AXP) broke out in a big way after the company reported profits. The shares — which were weak though much of 2023 — have gone from around $140 last November to more than $200 now. What was the reason for the strong move? Perhaps low delinquency rates. Accounts 30+ days past due were 1.3% last quarter, up from 1.2% the prior quarter and below the pre-pandemic 1.5% (in Fiscal 2019 Q4). Net Write-off Rares were 2.0%, up from 1.8% a quarter earlier and below the pre-pandemic 2.2%. US Millenials and Gen Z customers are a real catalyst for the company, as their spending last quarter was up 15% from a year-ago.

American Express is a globally integrated payments company in providing credit and charge cards to individuals and businesses with high credit scores. The company is both a card issuer (like Chase and Citi) and a card network (like MasterCard and Visa). American Express’ integrated payments platform has direct relationships with Merchants and Card Members, creating a closed loop so Amex has direct access to information. The company can analyze info on spending to underwrite risk, reduce fraud and do targeted marketing. What makes American Express special is its Membership Rewards program, which include benefits such as airport lounge access, dining experiences, and other travel benefits. The company has been attracting younger, Millennial and Gen Z customers. In the US, these customers were more than 60% of new accounts in 2023. In addition, 75% of new Consumer Platnum and Gold accounts acquired in the US were from this group of individuals. Here’s a short history of American Express:

AXP engages in businesses comprising four operating segments:

American Express is a reasonably safe stock that is part of the Dow Jones Industrial Average. This stock does have some credit risk, as the company holds the credit card loans, unlike Visa and MasterCard. There have been years during the past decade when profits haven’t hit All-Time highs. Thus, this stock doesn’t have great certainty as MasterCard and Visa possess. AXP spent $5.3 billion on stock buybacks and dividends in 2023. The dividend was just increased 15% to $2.80 on an annualized basis. AXP has an Estimated Long-Term Growth Rate of 15% and a dividend yield of 1%. I used to consider this a ten percent grower (Est. LTG + yield) long term, but now management aspirations are mid-teens profit growth so I eel this is a 15% grower. AXP is part of the Conservative Portfolio. With a P/E of jsut 16 this stock has room to move higher. |

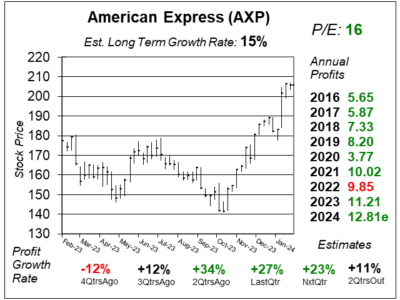

One Year Chart |

The stock broke out in a big way recently. Now I don’t know where its headed next. But with a P/E of only 16, AXP seems like a bargain. Looking back at AXP’s history, the stock has often traded at a P/E of 14 to 17. Perhaps the stock can get a higher multiple (P/E) now that its growing The stock broke out in a big way recently. Now I don’t know where its headed next. But with a P/E of only 16, AXP seems like a bargain. Looking back at AXP’s history, the stock has often traded at a P/E of 14 to 17. Perhaps the stock can get a higher multiple (P/E) now that its growing

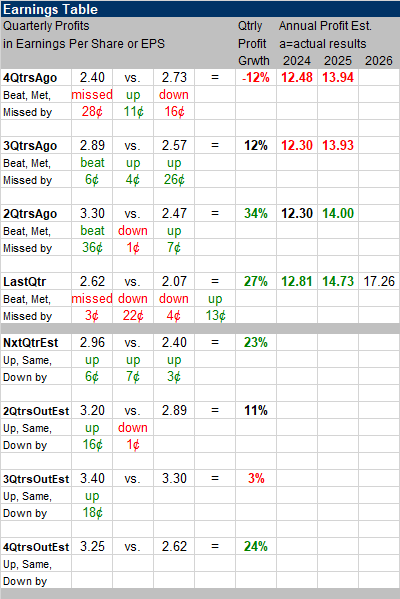

Qtrly profit growth has been great the past two quarters. Estimates for next quarter are good too (+23%) but that’s because comparisons from the year-ago period are easy (-12%). Analysts have an Est. LTG of 15% on this stock, same as last qtr. |

Earnings Table |

Last qtr, American Express delivered 27% profit growth and missed estimates of 28% growth. The miss was due to Argentina devaluing their currency. That’s fine, I’m ok with that. Revenue increased 11% and missed expectations of 13%. Total Network Volumes grew 6%. The company acquired 2.9 million new cards during the quarter. Last qtr, American Express delivered 27% profit growth and missed estimates of 28% growth. The miss was due to Argentina devaluing their currency. That’s fine, I’m ok with that. Revenue increased 11% and missed expectations of 13%. Total Network Volumes grew 6%. The company acquired 2.9 million new cards during the quarter.

AXP’s Billed Business grew 6% and was driven by 5% growth in Goods & Services spending and 9% growth in Travel & Entertainment spending. Restaurant spending remains AXP’s largest T&E category while airline spending growth slowed in the quarter. Annual Profit Estimates are higher this qtr. For 2024, management expects revenue growth of 9% to 11%. Qtrly profit Estimates are for 23%, 11%, 3%, and 24% growth the next 4 qtrs. Analysts estimate AXP’s revenue will grow 10% next quarter. |

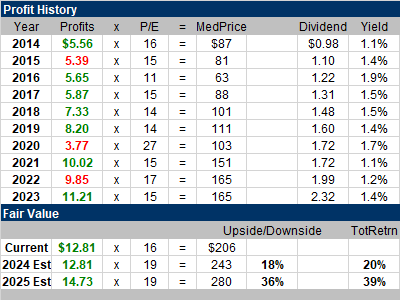

Fair Value |

This stock currently has a P/E of 16 when we look at 2023 profit estimates. This stock currently has a P/E of 16 when we look at 2023 profit estimates.

My Fair Value is a P/E of 19, and if we use 2024 profit estimates, that equates to a $243 stock, which is around 18% higher than the recent quote. I honestly think this stock is worthy of a 22 P/E. But I dodn’t want to jump right in and place my Fair Value at that valuation. Let’s see if the company can earn it. Notice the P/E has been in the mid-teens much of the past decade. |

Bottom Line |

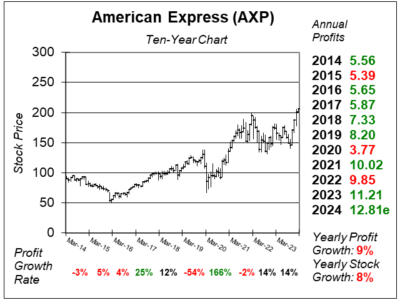

American Express (AXP) has had an erratic profit history. Also, the stock hasn’t been a steady grower the past decade. And below 10% profit growth/stock growth during the last ten years is good but not great. American Express (AXP) has had an erratic profit history. Also, the stock hasn’t been a steady grower the past decade. And below 10% profit growth/stock growth during the last ten years is good but not great.

AXP is a faster growing company than it used to be, and the stock should be rewarded with a higher P/E ratio. I imagine the P/E could rise to 20 over time. AXP stays at 6th in the Conservative Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Growth Portfolio 6 of 27 |