About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Amgen Inc. (Amgen) is a biotechnology company. The Company is engaged in discovering, developing, manufacturing and delivering human therapeutics. The Company’s sales and marketing forces are located in the United States and Europe. In the United States, it sells its products to pharmaceutical wholesale distributors. The Company also markets certain products directly to consumers through direct-to-consumer print and television advertising, as well as through the Internet. Outside the United States, the Company sells its products to healthcare providers and/or pharmaceutical wholesale distributors. The Company’s products include Neulasta (pegfilgrastim)/NEUPOGEN (filgrastim), Enbrel (etanercept), XGEVA/Prolia (denosumab), ESAs (erythropoiesis-stimulating agents), Sensipar/Mimpara (cinacalcet), Kyprolis and Evolocumab, among others. Source: Thomson Financial

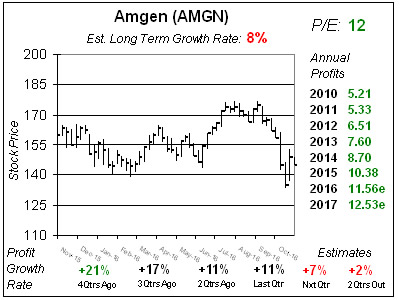

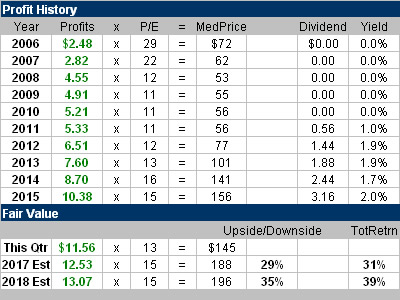

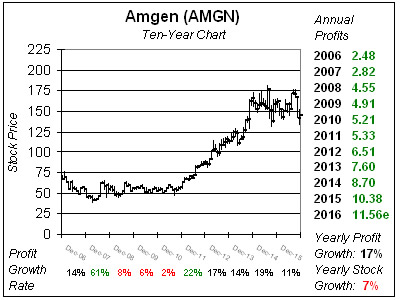

Amgen Inc. (Amgen) is a biotechnology company. The Company is engaged in discovering, developing, manufacturing and delivering human therapeutics. The Company’s sales and marketing forces are located in the United States and Europe. In the United States, it sells its products to pharmaceutical wholesale distributors. The Company also markets certain products directly to consumers through direct-to-consumer print and television advertising, as well as through the Internet. Outside the United States, the Company sells its products to healthcare providers and/or pharmaceutical wholesale distributors. The Company’s products include Neulasta (pegfilgrastim)/NEUPOGEN (filgrastim), Enbrel (etanercept), XGEVA/Prolia (denosumab), ESAs (erythropoiesis-stimulating agents), Sensipar/Mimpara (cinacalcet), Kyprolis and Evolocumab, among others. Source: Thomson Financial During the past three qtrs shares of Amgen have gone from $150 to $174 and now $145. The main reason for the volatility is Biotechs rallied as Clinton is lost her lead in the presidential election, then tanked in the days leading up to the election as it seemed Clinton would win. AMGN gets a lot of its growth off price increases, which Clinton vowed to combat, and now the company can raise prices as it normally does, but I remember hearing Amgen management had already had planned to not raise prices next year. Amgen is the daddy of biotech stocks, having gone from $1 to $150 since 1990. In 2011 it became the first biotech to start issuing dividends and has increased the dividend each year since — from $0.56 to $4.00 in just 5 years. The company has multiple blockbusters on the market, and a robust pipeline with 10 new drugs expected by 2019 including late stage drugs to combat osteoporosis, migraines and heart failure. AMGN also sports a 50% profit margin, up from around 40% a few years ago. Amgen is one of America’s safest stocks. Management systematically underpromises to overdeliver and also buys back stock to help boost profits. This year it expects to buyback $3 billion in stock, vs a $108 billion market cap. AMGN has an Estimated Long-Term Growth rate of 8% in addition to a 2% yield, for an estimated total return of 10% per year (hypothetically). At 12x earnings, this stock is a solid value for conservative investors with solid upside long-term.

During the past three qtrs shares of Amgen have gone from $150 to $174 and now $145. The main reason for the volatility is Biotechs rallied as Clinton is lost her lead in the presidential election, then tanked in the days leading up to the election as it seemed Clinton would win. AMGN gets a lot of its growth off price increases, which Clinton vowed to combat, and now the company can raise prices as it normally does, but I remember hearing Amgen management had already had planned to not raise prices next year. Amgen is the daddy of biotech stocks, having gone from $1 to $150 since 1990. In 2011 it became the first biotech to start issuing dividends and has increased the dividend each year since — from $0.56 to $4.00 in just 5 years. The company has multiple blockbusters on the market, and a robust pipeline with 10 new drugs expected by 2019 including late stage drugs to combat osteoporosis, migraines and heart failure. AMGN also sports a 50% profit margin, up from around 40% a few years ago. Amgen is one of America’s safest stocks. Management systematically underpromises to overdeliver and also buys back stock to help boost profits. This year it expects to buyback $3 billion in stock, vs a $108 billion market cap. AMGN has an Estimated Long-Term Growth rate of 8% in addition to a 2% yield, for an estimated total return of 10% per year (hypothetically). At 12x earnings, this stock is a solid value for conservative investors with solid upside long-term.