U.S. stocks slipped on Thursday as the market took a breather following recent record highs. The retreat came amid persistent uncertainty surrounding the U.S. government shutdown, now stretching beyond its first week.

U.S. stocks slipped on Thursday as the market took a breather following recent record highs. The retreat came amid persistent uncertainty surrounding the U.S. government shutdown, now stretching beyond its first week.

Overall, S&P 500 dipped 0.3% to 6,735, while Nasdaq edged down 0.1% to 23,025.

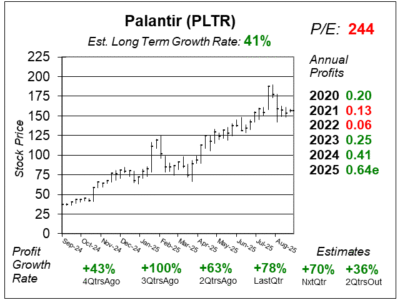

Chart of the Day

Here is the one-year chart of Palantir (PLTR) as of September 8, 2025, when the stock was at $156.

Here is the one-year chart of Palantir (PLTR) as of September 8, 2025, when the stock was at $156.

Palantir is rolling in business from American companies at an insane rate. Last quarter, the company grew revenue in its US Commercial operating segment 93% year-over-year. That was almost double! In addition, Total Contract Value booked from US companies was $843 million last quarter, 222% higher than the $377 million the sales team closed in the year-ago period.

No wonder the stock is flying high, as it is tough to grasp how big the pie is for Palantir.

The growth is fueled by accelerating demand for Palantir’s Artificial Intelligence Platform (AIP), which enables customers to deploy AI agents that drive real-world impact from day one. Companies like Walgreens and AIG credit Palantir’s software with automating billions of decisions, drastically improving efficiency and transforming their operations.

Management emphasized AIP is not just software customer use, it is the foundation they are building their software on, making Palantir the platform of choice for long-term enterprise AI.

PLTR is currently in our Growth Portfolio.