The stock market ended lower on Tuesday, as investors weighed worries over the government shutdown, which is already in its second week. Meanwhile, concerns on the profitability of AI rollout, resulting in a drop in Oracle’s (ORCL) shares.

The stock market ended lower on Tuesday, as investors weighed worries over the government shutdown, which is already in its second week. Meanwhile, concerns on the profitability of AI rollout, resulting in a drop in Oracle’s (ORCL) shares.

Overall, S&P 500 fell 0.4% to 6,715, while NASDAQ declined 0.7% to 22,788.

Chart of the Day

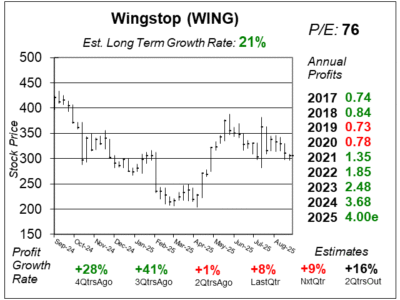

Here is the one-year chart of Wingstop (WING) as of September 8, 2025, when the stock was at $305.

Here is the one-year chart of Wingstop (WING) as of September 8, 2025, when the stock was at $305.

Wingstop (WING) was amazing a year ago. It grew profits 63% as revenue climbed 45%. The stock had just completed a $200 to $400 move in a year before settling down. Those results from last year are tough to beat. So now we have a stock that is digesting its gains as year-over-year results grow more modestly.

Wingstop delivered 6% profit growth last quarter, as revenue increased only 12%. David Sharek, Founder of School of Hard Stocks, is fine with this. Food, labor and supply costs play a big factor in short-term results. Long-term, this is a great franchise that is expanding locations rapidly.

Wingstop has developed a game-changing new kitchen it calls Smart Kitchen, which is up and running in 1,000 U.S. restaurants. The system had a significant impact, reducing ticket times by 40% and shortening the waiting time from 18–20 minutes to approximately 10 minutes. Every location is set to have a Smart Kitchen by the end of the year.

WING is part of our Growth Portfolio. The big picture here is that the company has more than 2,500 locations now with a potential of 10,000 locations long-term. Management also sees a path to $3 million in revenue per location, up from around $2 million today.