Stock (Symbol) |

Alphabet (GOOGL) |

Stock Price |

$186 |

Sector |

| Technology |

Data is as of |

| February 10, 2025 |

Expected to Report |

| April 29 |

Company Description |

Alphabet’s segments include Google Services, Google Cloud, and Other Bets. Alphabet’s segments include Google Services, Google Cloud, and Other Bets.

The Google Services segment includes products and services such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes Google’s infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment includes earlier stage technologies that are further afield from its core Google business, and it includes the sale of health technology and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform enables developers to build, test, and deploy applications on its infrastructure. Google Workspace collaboration tools include applications, such as Gmail, Docs, Drive, Calendar, Meet, and various others. The Company also has various hardware products. Source: Refinitiv |

Sharek’s Take |

Alphabet (GOOGL) is set to spend $75 billion on capital expenditures (CapEx) in 2025. This would be a 42% increase versus the $52.5 billion spent in 2024. Management is aggressively expanding its AI infrastructure and cloud computing capabilities, and is expected to grow headcount in 2025. In Search, Google implemented AI Overviews, short answers to questions that appear right on the search page instead of users having to click a like to a website. AI Overviews are increasing user engagement, and are now available in 100 countries. While these investments are for long-term growth and aim to speed up product development and roll out new tech faster than ever, profit growth is expected to moderate in 2025. Profit growth is projected to decelerate from 39% in 2024 to just 11% in 2025. Alphabet (GOOGL) is set to spend $75 billion on capital expenditures (CapEx) in 2025. This would be a 42% increase versus the $52.5 billion spent in 2024. Management is aggressively expanding its AI infrastructure and cloud computing capabilities, and is expected to grow headcount in 2025. In Search, Google implemented AI Overviews, short answers to questions that appear right on the search page instead of users having to click a like to a website. AI Overviews are increasing user engagement, and are now available in 100 countries. While these investments are for long-term growth and aim to speed up product development and roll out new tech faster than ever, profit growth is expected to moderate in 2025. Profit growth is projected to decelerate from 39% in 2024 to just 11% in 2025.

Founded in 1998, Alphabet’s mission is to organize the world’s information and make it universally accessible. The company’s main division, Google Search, performs more than a trillion searches per year. Alphabet’s brands include Google, YouTube, Android, Google Chrome, Google Maps, Gmail, Pixel, Google Cloud, and Waymo. Here are Alphabet’s main divisions:

Alphabet is a conservative growth stock with a good growth rate. Prior to 2022, the company had profits up every year since its IPO outside of 2017 (which was only down as it switched its accounting practices to a more conservative stance). The stock has an Est. LTG of 20% a year, and a P/E of 21. I think the P/E should be 27. That implies a 29% upside by the end of 2025. Management recently issued its first quarterly dividend, of $0.20 per share. Management also buys back stock. In 2024, management has returned almost $70 billion to shareholders vie stock buybacks and dividends. GOOGL is part of my Growth Portfolio, Conservative Growth Portfolio, and Aggressive Growth Portfolio. |

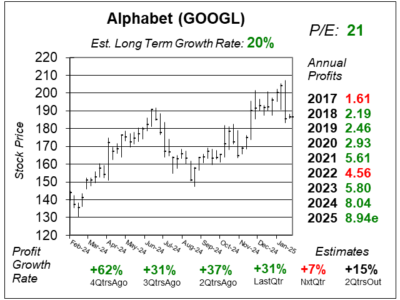

One Year Chart |

This stock has been good for the past year. The shares fell a bit after earnings when the company stated it would spend $75 billion on CapEx. This stock has been good for the past year. The shares fell a bit after earnings when the company stated it would spend $75 billion on CapEx.

With a P/E of 21, I think the stock is currently undervalued. My Fair Value is a P/E of 27. The Estimated Long-Term Growth Rate is a solid 20%. This figure was 22% last quarter. Notice Estimates show profit growth is expected to slow to just 7% next qtr. But note growth was exceptional 4QtrsAgo, so comparisons are tough. I would be happy with 15% to 20% growth this year. |

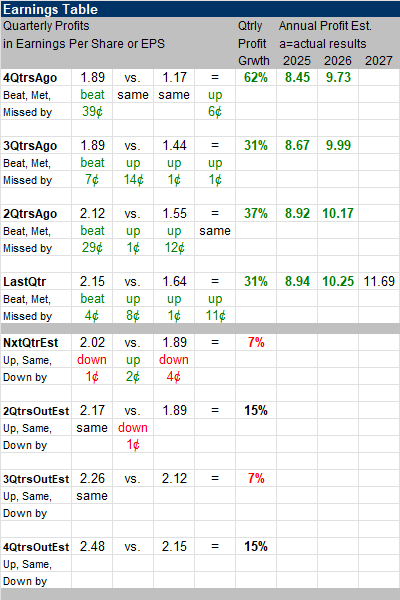

Earnings Table |

Last qtr, Alphabet delivered 31% profit growth and beat expectations of 29%. Revenue increased 12%, just as expected. Operating margin increased to 32% compared to 27% in year-ago period. Last qtr, Alphabet delivered 31% profit growth and beat expectations of 29%. Revenue increased 12%, just as expected. Operating margin increased to 32% compared to 27% in year-ago period.

AI overview is now in more than 100 countries, and Circle to Search is available on over 200 million devices. Circle to search is a Google feature that lets you search for information on your screen by circling, tapping, or highlighting without switching apps. Circle to Search users start over 10% of their searches using it. YouTube ads also drove strong growth as it used in US election advertising, doubling spending in the 2020 elections. Annual Profit Estimates increased this qtr. Wow, I’m surprised. Here’s profit estimates for the upcoming years: 2025 $8.94 Qtrly Profit Estimates for the next 4 qtrs are 7%, 15%, 7%, and 15%. Analysts think revenue will grow 10% next quarter. |

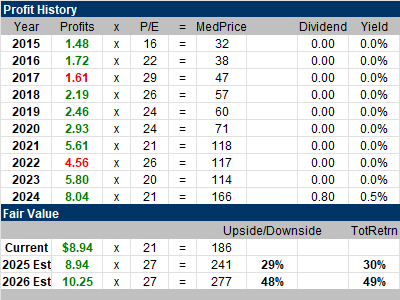

Fair Value |

My Fair Value P/E is 27. My Fair Value P/E is 27.

The stock is $186 this quarter and has a P/E of 21. My Fair Value is a 27 P/E, that’s $241 a share. I believe this stock has 29% upside for 2025 and 48% upside for 2026. In 2017, GOOGL changed its accounting practices to more conservative accounting, and that’s why profits declined that year. |

Bottom Line |

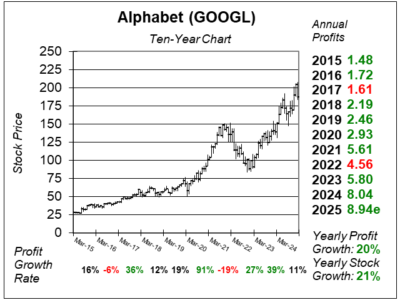

Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher was a big one (116%) and the stock had to digest some gains. Now the stock is trending higher once again. Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher was a big one (116%) and the stock had to digest some gains. Now the stock is trending higher once again.

Alphabet is spending $75 billion on CapEx and yet the company is still expected to grow profits at a decent rate this year. Remarkable. I really like this stock for the Conservative Portfolio. It’s got a great combo of growth and safety, and ranks 1st in the Power Rankings. In the Growth Portfolio, the stock stays at 4th in the Power Rankings. GOOGLE stays at 8th in the Aggressive Growth Portfolio Power Rankings. This portfolio prioritizes rapid growing companies, and GOOGL’s profit growth might be just 15% to 20% this year. |

Power Rankings |

Growth Stock Portfolio

4 of 30Aggressive Growth Portfolio 8 of 14Conservative Stock Portfolio 1 of 22 |