Stock (Symbol) |

Visa (V) |

Stock Price |

$312 |

Sector |

| Financial |

Data is as of |

| November 19, 2024 |

Expected to Report |

| January 23 |

Company Description |

Visa is a payments technology company that provides digital payments across more than 200 countries and territories. Visa is a payments technology company that provides digital payments across more than 200 countries and territories.

The Company connects consumers, merchants, financial institutions, businesses, strategic partners and government entities to electronic payments. The Company’s transaction processing network, VisaNet, facilitates authorization, clearing and settlement of payment transactions and enables to provide its financial institution and merchant clients a range of products, platforms and value-added services. Its products/services include transaction processing services and Visa-branded payment products. The Company also offers Tink, an open banking platform that enables financial institutions, fintech and merchants to build financial products and services and move money. Tink enables its customers to move money, access aggregated financial data, and use smart financial services such as risk insights, and others. Source: Refinitiv |

Sharek’s Take |

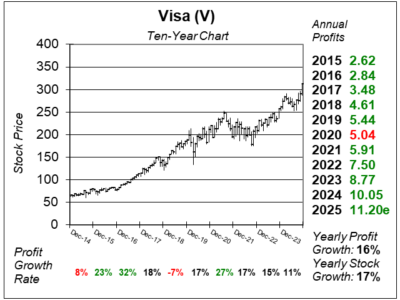

Visa (V) performed well last qtr, as consumer spending remained consistent across income levels. Overall, V delivered its typical 16% profit growth on 12% revenue growth. Profits were actually up 17% on a constant currency basis. There’s little to say about this amazing company. It’s just a steady high-teens grower. And its been that way since its IPO back in 2008. Just buy-and-hold. Here are some other highlights from last qtr (with year-over-year growth rates):

Visa is the world’s leader in digital payments, with more than 15,000 financial institutional clients. The company was founded more than 60 years ago with the idea to make payments between consumers and businesses, also known as C2B. Today, Visa is working on expanding the ways that money can flow digitally, via person-to-person payments (P2P), business-to-consumer transactions (B2C), and business-to-business (B2) transactions. Visa has a catalyst in Visa Direct. Visa Direct allows people to move money between bank accounts globally, including friends and family. Visa Direct and had 10 billion transactions in Fiscal 2024, up from 7.5 billion the year before, and commercial payments volume reached $1.7 trillion. V has been a great stock for conservative investors — and growth investors too. The stock has an excellent safety rating, an Estimated Long-Term Growth Rate of 13%, a dividend yield of less than 1%, and a stock buyback program. This stock is appreciated among institutional investors for its consistent sales/profit/stock growth. Its business model doesn’t rely on a big sales or R&D budget, so management has loads of cash coming in to buy back stock. In Fiscal 2024, management returned $16.7 billion in share repurchases. Visa is part of the Conservative Growth Portfolio, Growth Portfolio., and Aggressive Growth Portfolio. |

One Year Chart |

The stock’s been rising recently. But that’s taken away from the stock’s upside. Last qtr I felt the stock had near-term upside of 22%. This quarter its 15%. The stock’s been rising recently. But that’s taken away from the stock’s upside. Last qtr I felt the stock had near-term upside of 22%. This quarter its 15%.

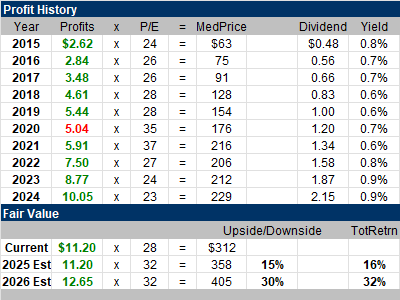

The P/E was just 24 last quarter. The stock was a bargain at $264. Now the shares are $312 and the P/E is 28. Qtrly profit growth looks good. Estimates show growth might slow, but I don’t think so. V should beat the street. The Est. LTG of 13% same as the last qtr. Visa is normally a high-teens grower. |

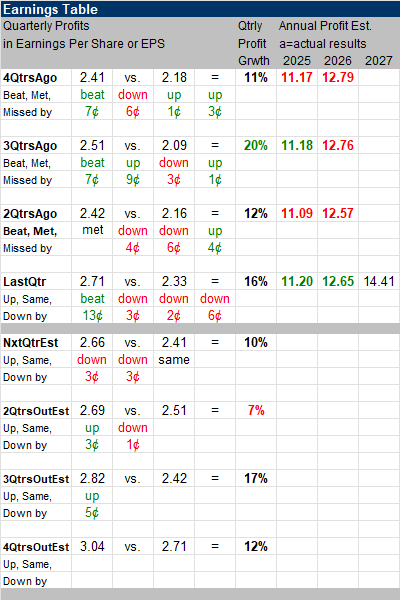

Earnings Table |

Last qtr, Visa delivered 16% profit growth and beat estimates of 11%. Revenue increased 12%, year-on-year, above the estimates of 10%. Last qtr, Visa delivered 16% profit growth and beat estimates of 11%. Revenue increased 12%, year-on-year, above the estimates of 10%.

Tap-to-pay penetration climbed to 82% globally (excluding the U.S.), with U.S. penetration reaching 54%. Visa Direct recorded a 38% yoy increase in transactions. Annual Profit Estimates are up this quarter. Note the company just ended Fiscal 2024 Qtrly profit Estimates are for 10%, 7%, 17%, and 12% profit growth over the next 4 qtrs. For next qtr, analysts think revenue will climb 8%. |

Fair Value |

The stock currently has a P/E of 28. I feel the P/E should be 32. The stock currently has a P/E of 28. I feel the P/E should be 32.

My Fair Value for 2025 is $358 a share, giving the stock around a 15% upside in my opinion. V has a Fiscal Year end on September 30th. |

Bottom Line |

Visa’s (V) a well oiled machine, with consistent revenue and profit growth. I believe 2020 is the only year this company had negative profit growth since its IPO in 2008. Management buys back billions in stock and pays a dividend that’s risen every year since 2009. Visa’s (V) a well oiled machine, with consistent revenue and profit growth. I believe 2020 is the only year this company had negative profit growth since its IPO in 2008. Management buys back billions in stock and pays a dividend that’s risen every year since 2009.

Visa has a lot going for it, if you’re an investor who would be pleased with a 17% or so total return long-term (hypothetically of course). Notice in the ten-year chart the stock’s grown 17% a year the past decade. V stays at 5th in the Conservative Portfolio Power Rankings. Visa stays at 15th in the Growth Portfolio Power Rankings. The stock moves from 12th to 13th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

15 of 30Aggressive Growth Portfolio 13 of 14Conservative Stock Portfolio 5 of 22 |