The stock market was up on Tuesday, with the S&P 500 and NASDAQ closing at new records. Investors now await the earnings report of NVIDIA (NVDA) which is set to be released on Wednesday.

The stock market was up on Tuesday, with the S&P 500 and NASDAQ closing at new records. Investors now await the earnings report of NVIDIA (NVDA) which is set to be released on Wednesday.

Overall, S&P 500 grew 0.3% to 5,321, while NASDAQ rose 0.2% to 16,833.

Tweet of the Day

Due to elevated end market demand, it is reported that Nvidia $NVDA and AMD $AMD have fully booked out TSMC’s $TSM advanced packaging capacity through the end of this year and next year.

— Beth Kindig (@Beth_Kindig) May 15, 2024

Chart of the Day

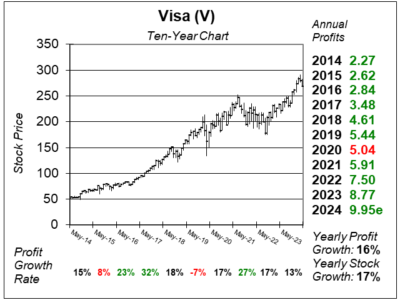

Here is the ten-year chart of Visa (V) as of April 30, 2024, when the stock was at $269.

Here is the ten-year chart of Visa (V) as of April 30, 2024, when the stock was at $269.

Visa is seeing relative stability within its business drivers, as profits climbed 20% last quarter on a 10% increase in revenue. Overall, payments volume increased 8% year-over-year. Cross-border transactions, excluding those within Europe, surged by 16%. Visa is seeing more growth in consumer payments, with the company having a potential market of over $20 trillion worldwide. Consumer payment opportunities include:

- Getting more people to use cards versus cash & check.

- Extending Visa as a bill payment method, instead of ACH and other electronic transactions.

- Converting cards that run primarily on domestic networks in other countries to Visa cards.

Visa is capturing more share in consumer payments by expanding the number of Visa credentials (especially in Europe), enabling tap-to-pay and boosting safer ecommerce transactions.

Visa is part of our Conservative Growth Portfolio and Growth Portfolio.