The stock market closed higher on Tuesday as Producer Price Index came in above estimates. It gained 0.5% from the previous month, higher than the 0.3% estimates.

The stock market closed higher on Tuesday as Producer Price Index came in above estimates. It gained 0.5% from the previous month, higher than the 0.3% estimates.

The more important reading on inflation, or the Consumer Price Index, is expected to be released on Wednesday.

Overall, S&P went up 0.5% to 5,247, while NASDAQ grew 0.8% to 16,511.

Tweet of the Day

For the first time in over a year and a half, the VIX "fear gauge" is firmly in an uptrend. This ends a historically prolonged stretch of calm conditions over short-, medium- and long-term time frames.

The end of the most recent streak of the VIX's 50-day average being below its… pic.twitter.com/w093Q8l1TC

— SentimenTrader (@sentimentrader) May 2, 2024

Chart of the Day

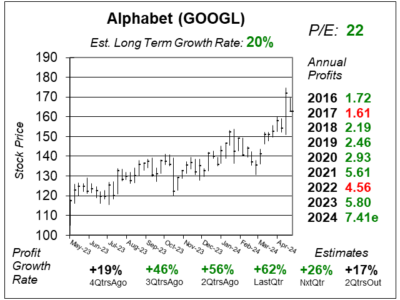

Here is the one-year chart of Alphabet (GOOGL) as of April 30, 2024, when the stock was at $163.

Here is the one-year chart of Alphabet (GOOGL) as of April 30, 2024, when the stock was at $163.

Alphabet reported splendid results last quarter, with profits up 62% on a 15% rise in revenue. Strong performance was seen in Search, YouTube, and Cloud, with positive momentum from the Gemini AI era. Gemini is a family of multimodal AI large language models that have capabilities in language, audio, code and video understanding. Gemini 1.5 Pro was rolled out in February and is the new and improved version. One big improvement is that it can understand long passages of text better than ever before. It can also handle different types of information, like audio, video, text, and more. This is not only great for users, but also a game-changer for advertisers too. Gemini generates text and image assets for Performance Max ad campaigns, leading to better ad quality and higher conversion rates (63% increase in campaign creation, 6% increase in conversions).

On YouTube, AI looks at what users like and do to suggest videos they will enjoy, keeping them watching for longer. Google has consolidated AI model-building teams under Google DeepMind to streamline development.

GOOGL is part of our Growth Portfolio, Conservative Growth Portfolio, and Aggressive Growth Portfolio. With a P/E of 21, the stock is very reasonable.