Stock (Symbol) |

Lockheed Martin (LMT) |

Stock Price |

$426 |

Sector |

| Industrials & Energy |

Data is as of |

| February 21, 2020 |

Expected to Report |

| April 21 |

Company Description |

Lockheed Martin Corporation is a security and aerospace company. The Company operates through four segments. Aeronautics segment is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of military aircraft, including combat and air mobility aircraft, unmanned air vehicles and related technologies. Missiles and Fire Control segment provides air and missile defense systems; fire control systems; manned and unmanned ground vehicles, and energy management solutions. Rotary and Mission Systems segment provides design, manufacture, service and support for a range of military and civil helicopters; mission systems and sensors for rotary and fixed-wing aircraft; simulation and training services, and unmanned systems and technologies, among others. Space Systems segment is engaged in the research and development, design, engineering and production of satellites, strategic and defensive missile systems and space transportation systems. Source: Thomson Financial Lockheed Martin Corporation is a security and aerospace company. The Company operates through four segments. Aeronautics segment is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of military aircraft, including combat and air mobility aircraft, unmanned air vehicles and related technologies. Missiles and Fire Control segment provides air and missile defense systems; fire control systems; manned and unmanned ground vehicles, and energy management solutions. Rotary and Mission Systems segment provides design, manufacture, service and support for a range of military and civil helicopters; mission systems and sensors for rotary and fixed-wing aircraft; simulation and training services, and unmanned systems and technologies, among others. Space Systems segment is engaged in the research and development, design, engineering and production of satellites, strategic and defensive missile systems and space transportation systems. Source: Thomson Financial |

Sharek’s Take |

Lockheed Martin (LMT) is poised to grow its Space division as billionaires have created a new space race. The potential for growth in Space is there, but for now the division isn’t growing very fast. Space grew revenue 11% in 2019, as company revenue increased 11%. That’s not much, thus I’m not impressed. But space travel has growth opportunity. Space stocks are climbing right now. Lockheed Martin (LMT) is poised to grow its Space division as billionaires have created a new space race. The potential for growth in Space is there, but for now the division isn’t growing very fast. Space grew revenue 11% in 2019, as company revenue increased 11%. That’s not much, thus I’m not impressed. But space travel has growth opportunity. Space stocks are climbing right now.

Lockheed Martin is one of the largest defense contractors in the world. The company was founded as Lockheed in 1926 and merged with Martin Marietta in 1995 to form Lockheed Martin. Lockheed was originally an aircraft company, that went on to produce the P-38J Lightning fighter aircraft which was widely used in World War II. Martin Marietta was founded in 1961 and built the original intercontinental ballistic missile (ICMB). In 1993 Martin Marietta acquired General Dynamic’s space systems division. Lockheed Martin now operates four business segments, along with the percentage of total company sales during 2019:

Lockheed Martin is a safe Blue Chip stock with a good Estimated Long Term Growth Rate of 9% per year in addition to a dividend yield north of 2%. But profits have been humming since Trump was elected President (+36% in 2018 and +25% in 2019). The company had free cash flow of $6 billion in 2019, spent 2.5 billion on dividends and $1.2 billion on stock buybacks. LMT has increased its dividend every year since 2003. The stock has a reasonable P/E of 18, and I feel it should be 20. Lockheed Martin has nice upside here, but if a Democrat wins the Presidential Election in November the stock could suffer a setback. LMT is part of the Conservative Growth Portfolio. |

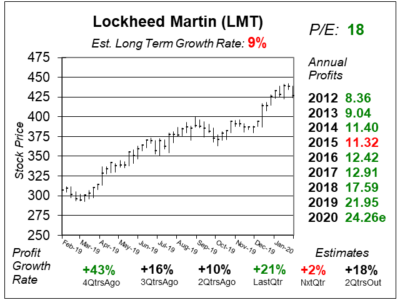

One Year Chart |

This stock broke out in early January after political wargames between the U.S. and Iran. This stock broke out in early January after political wargames between the U.S. and Iran.

The Est. LTG of 9% is down from 14% last qtr, but this is really more of a 9% grower than it is a 14% one anyway. The P/E of 18 is reasonable. |

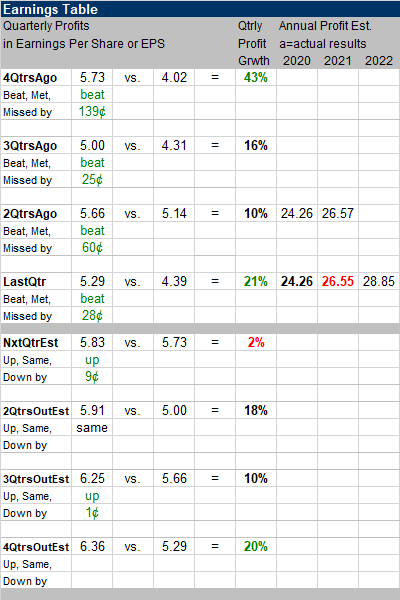

Earnings Table |

Last qtr, LMT delivered profit growth of 21% which beat analyst estimates of 14%. Revenue increased 10%. Last qtr, LMT delivered profit growth of 21% which beat analyst estimates of 14%. Revenue increased 10%.

Annual Profit Estimates are similar to last qtr. Qtrly profit Estimates are for 2%, 18%, 10% and 20% profit growth the next 4 qtrs. Note: LMT did have a big qtr 4QtrsAgo (+43%) as the Fire Control divisions delivered 60% profit growth. Thus, NxtQtrEst estimate is low due to tough comparisons to the year-ago period. |

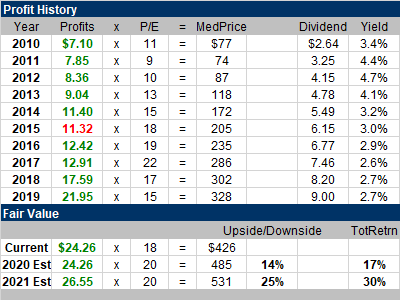

Fair Value |

My Fair Value is a P/E of 20, which gives investors solid upside in 2020 and 2021. Also note the dividend is nice and high, thus this stock has the potential to provide solid returns during the next two years. My Fair Value is a P/E of 20, which gives investors solid upside in 2020 and 2021. Also note the dividend is nice and high, thus this stock has the potential to provide solid returns during the next two years. |

Bottom Line |

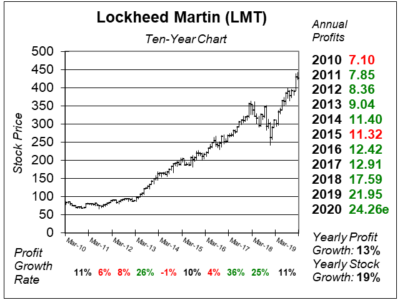

Lockheed Martin (LMT) used to be a slow grower profit-wise earlier in the decade. But since 2018 profits have been climbing faster with Trump being President of the United States. Lockheed Martin (LMT) used to be a slow grower profit-wise earlier in the decade. But since 2018 profits have been climbing faster with Trump being President of the United States.

Friction between the U.S. and Iran caused this stock to break out last qtr, and this qtr I’m looking at this stock as a play on the space race. LMT ranks 9th in the Conservative Portfolio Power Rankings. That’s down 1 from 8th last qtr. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 9 of 34 |