Lockhead Martin (LMT) is Delivering Slow Profit Growth & the Stock is Slacking

With countries around the world increasing defense budgets, Lockeed Martin (LMT) should be growing nicely. But its not.

With countries around the world increasing defense budgets, Lockeed Martin (LMT) should be growing nicely. But its not.

Lockheed Martin (LMT) jumped 9% after the Israel-Hamas War broke out as countries are expected to spwnd more on defense.

Lockd Martin (LMT) saw good sales growth last quarter in its Aeronautics (+17%) and Space (+12%) operating segments.

Lockheed Marting (LMT) got a nice boost to revenue from its Space division. And International tensions are boosting demand.

Lockheed Martin (LMT) is getting a lot of orders for its F-35 fighter jets. But a mishap has caused deliveries to be delayed.

Increased defense spending worldwide should mean more F-35 fighter deals getting done with Lockheed Martin (LMT).

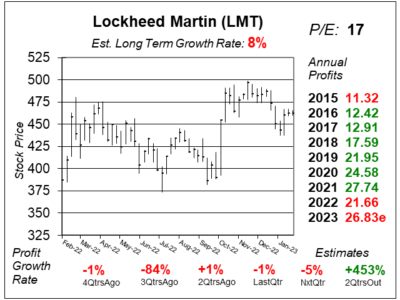

High production costs hurt Lockheed Martin’s (LMT) profits last qtr, but LMT might get a $30 billion contract for F-35s later on.

Lockheed Martin (LMT) is getting a lot of new orders for the F-35 fighter. But it’ll will take a while to make and deliver them.

Higher government defense spending will likely help efense contractor Lockheed Martin (LMT), maker of the F-35 fighter.

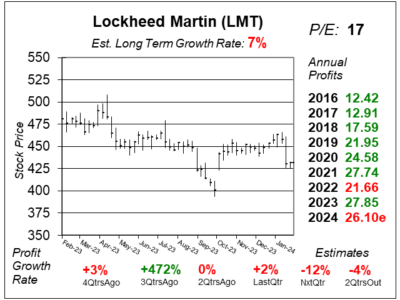

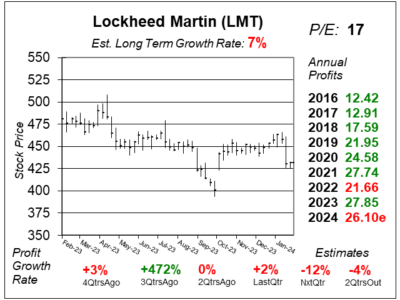

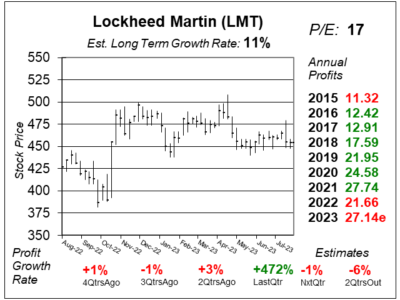

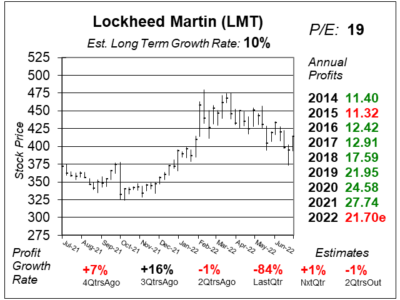

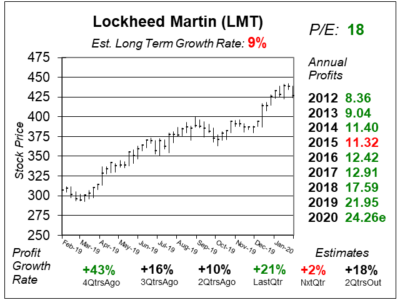

Lockheed Martin (LMT) grew profits 7% last qtr, and 7% growth is expected the next 3 qtrs. Is that enough growth?

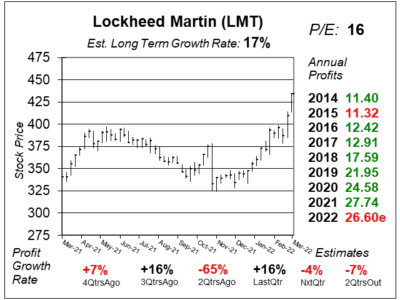

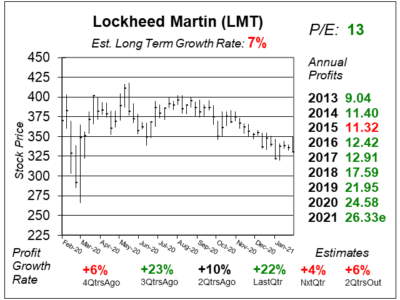

Lockheed Martin (LMT) stock has a P/E of only 13. I see 36% upside this year if the P/E gets to 16 & profits grow 7%,

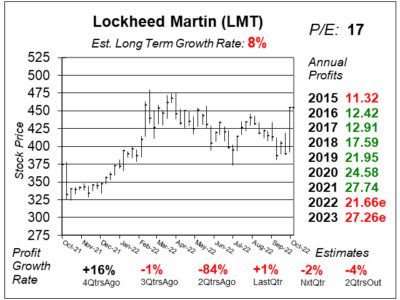

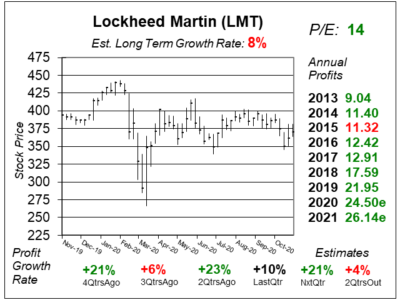

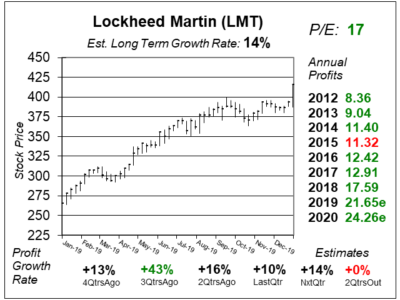

Lockheed Martin (LMT) is expected to continue to grow at solid rates into the next Presidency, and with a 14 P/E LMT is a value.

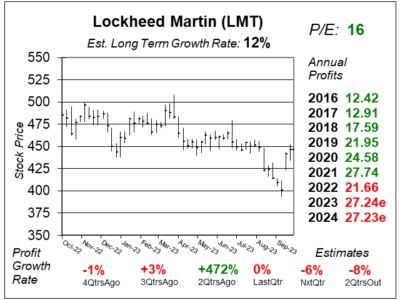

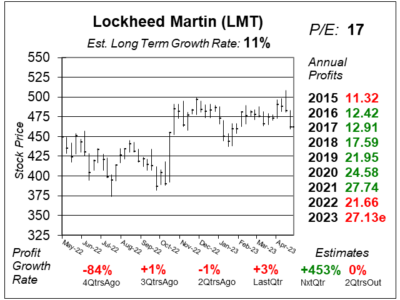

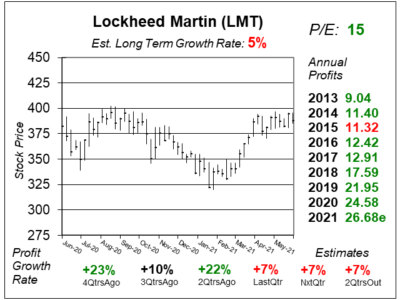

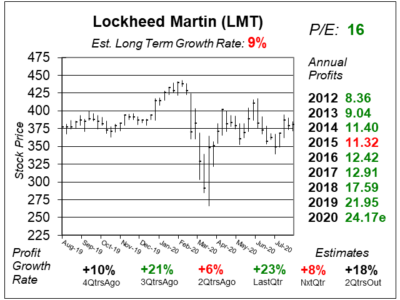

Lockheed Martin (LMT) delivered a strong quarter with 23% profit growth on 12% sales growth. With a 16 P/E, its a deal.

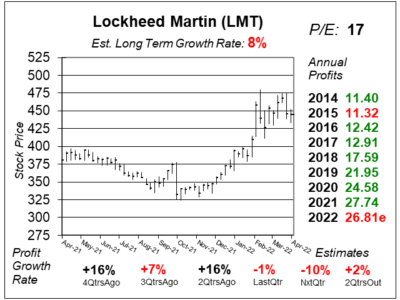

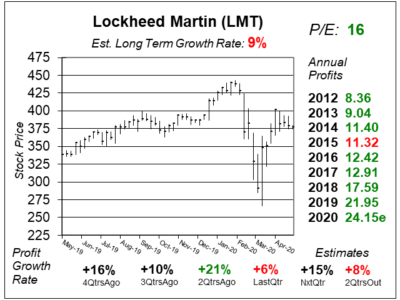

Lockheed Martin (LMT) is an essential business, thus profits are expected to keep climbing during the next year.

As billionaires jump into a new space race, and Trump spends on Defense, Lockheed Martin (LMT) is poised to deliver.

Lockheed Martin (LMT), maker of the F-35 fighter, is a key component in the wargames being played in foreign countries.