About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2024).

David's delivered 7 years of +40% returns in his 22 year career, including 106% in 2020.

His book The School of Hard Stocks can be purchased on Amazon.com.

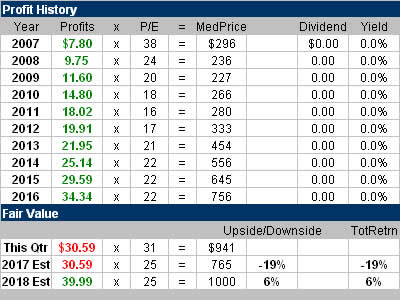

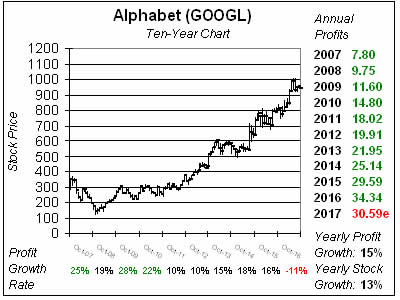

Alphabet (GOOGL) has had its profit estimates slashed twice this year. Four qtrs ago analysts felt the company could earn $41, then the figure was slashed to $33 as the company decided to expense stock options. Estimates rose to $34 the following qtr and now stand at $31 as the EU fined the company $2.7 billion for violating antitrust laws. Although estimates have been on the decline, the fundamental outlook is still solid. GOOGL is growing revenue around 20% a qtr, which is absurdly good for a company this size — with the biggest contributors to growth being mobile ads and YouTube. Longer term, this company has the might to conquer AI, which will be a future catalyst for growth. The company just rolled out new machine learning features for Google Maps, YouTube, Gmail and Google Photos (which now has 500 million users who back up 1.2 billion photos and videos a day). GOOGL stock is up for the year even though the company is expected to have negative profit growth for 2017. With a a P/E of 31 the valuation is high. I remember last year pounding the table to buy the stock as the P/E was just 19. The good news is profit are expected to climb from around $30 this year to around $40 next year — and I feel investors will find that hunky dory. Still, my 2018 Fair Value is $1000 a share which is just 6% higher than the recent quote. All-in-all this is a quality stock with a high safety rating that should be a fixture in portfolios for both conservative investors and growth investors alike. I just don’t think there’s near-term upside here thus GOOGL isn’t a large holding in my managed portfolios. Longer-term I imagine both profits and the stock will continue to compound in at a high-teens rate.

Alphabet (GOOGL) has had its profit estimates slashed twice this year. Four qtrs ago analysts felt the company could earn $41, then the figure was slashed to $33 as the company decided to expense stock options. Estimates rose to $34 the following qtr and now stand at $31 as the EU fined the company $2.7 billion for violating antitrust laws. Although estimates have been on the decline, the fundamental outlook is still solid. GOOGL is growing revenue around 20% a qtr, which is absurdly good for a company this size — with the biggest contributors to growth being mobile ads and YouTube. Longer term, this company has the might to conquer AI, which will be a future catalyst for growth. The company just rolled out new machine learning features for Google Maps, YouTube, Gmail and Google Photos (which now has 500 million users who back up 1.2 billion photos and videos a day). GOOGL stock is up for the year even though the company is expected to have negative profit growth for 2017. With a a P/E of 31 the valuation is high. I remember last year pounding the table to buy the stock as the P/E was just 19. The good news is profit are expected to climb from around $30 this year to around $40 next year — and I feel investors will find that hunky dory. Still, my 2018 Fair Value is $1000 a share which is just 6% higher than the recent quote. All-in-all this is a quality stock with a high safety rating that should be a fixture in portfolios for both conservative investors and growth investors alike. I just don’t think there’s near-term upside here thus GOOGL isn’t a large holding in my managed portfolios. Longer-term I imagine both profits and the stock will continue to compound in at a high-teens rate. Wow, revenue growth was 21% last qtr. That’s amazing. When you look at the recent profit history keep in mind the company is accounting for stock options in its profit statement, which is why growth was slow in recent qtrs. The EU fine was absorbed last qtr, and now that’s out of the way. Looking ahead, profit growth is expected to be

Wow, revenue growth was 21% last qtr. That’s amazing. When you look at the recent profit history keep in mind the company is accounting for stock options in its profit statement, which is why growth was slow in recent qtrs. The EU fine was absorbed last qtr, and now that’s out of the way. Looking ahead, profit growth is expected to be  With my Fair Value at $765 its easy to see why GOOGL hasn’t been going up. But I feel many investors are looking ahead to next year. I do want to point out GOOGL should have a higher valuation than it used to because its accounting for stock options now.

With my Fair Value at $765 its easy to see why GOOGL hasn’t been going up. But I feel many investors are looking ahead to next year. I do want to point out GOOGL should have a higher valuation than it used to because its accounting for stock options now. Alphabet has been a solid stock since the Financial Crisis & recession of 2007/2008. And even though profits are expected to fall this year, the stock is still in an uptrend. It’s amazing the company is growing sales at 20%, but that just goes to show what a juggernaut the company really is. I expect YouTube and AI to give the company growth opportunity into the next decade. Overall this is a solid core holding fro both growth and conservative investors. GOOGL ranks 31st in the 34 stock

Alphabet has been a solid stock since the Financial Crisis & recession of 2007/2008. And even though profits are expected to fall this year, the stock is still in an uptrend. It’s amazing the company is growing sales at 20%, but that just goes to show what a juggernaut the company really is. I expect YouTube and AI to give the company growth opportunity into the next decade. Overall this is a solid core holding fro both growth and conservative investors. GOOGL ranks 31st in the 34 stock