Today, Friday May 6, 2022, the stock market continued to decline, but failed to hit its lows. The S&P 500 fell 0.7% on the day — a day after a 3.6% decline yesterday that seemed like capitulation.

Stocks are searching for a bottom, but the economy is running so strong the Federal Reserve might choose to deliberately put the country into a recession. My current take on the market (the S&P 500) is its slightly overvalued, but could decline further to the 40-month exponential moving average, where savvy institutions look to invest at:

- Today’s close: 4123

- Fair Value: 3955 (-4% from here)

- 40-Month Moving Average: 3735 (-9% from here)

Yesterday, 94% of the stocks on the New York Stock Exchange were down on the day, a true signal at market bottoms. Not more than one bad day could hit during the next few months, but that was a positive step in the wrong direction, as capitulation has arrived.

Cloudflare Stock Tanks, Company is Doing Fine

Cloudflare (NET) was down 16% today to close at $66.

Cloudflare (NET) was down 16% today to close at $66.

Here’s my Fair Value on NET as of last qtr. At the time the stock was $120 and sold for 42x 2022 revenue estimates and I thought it was worth 25x revenue, or $72 a share. The stock was too high to buy. Now with the stock at $66, it’s buyable again.

Yesterday, NET reported earnings of $0.01 in earnings per share (EPS) which beat our estimates of $0.00. Revenue grew 54% which is the norm for this company that’s grown revenue 50% on a compounded rate for the past five years. Management is trying to grow rapidly, and is purposely trying to have no profits right now. I’m cool with that.

NET has been a long-term holding for us, as I originally got investors invested in July 2020 ~$40. I’ve sold most of my client’s shares, and have taken profits on multiple occasions. Cloudflare is an amazing company and I want to hold the stock through the Bear Market. Once the stock gets to its proper price-sales-multiple it could rise at the rate future revenue does, which could be 50% a year.

Chart of the Day

Chart of the Day

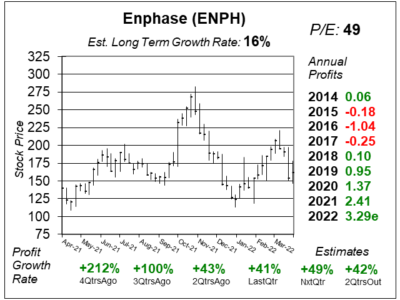

Here’s a one-year chart of ENPH, done April 29th when the stock was $161. I’m looking to buy this stock, which closed the day at $166.

Enphase Energy (ENPH) is a leading supplier of solar and battery systems. Enphase specializes in solar energy storage, for home or commercial buildings. And with oil prices now around $100 per barrel due in part by the Ukraine-Russia war, ENPH stock has been shooting higher. I believe high oil prices will convince Americans to buy more electric vehicles, and that will boost demand for storage units from Enphase.

Note the P/E on ENPH is 49 in the chart. Is that too high? It’s tough to get a Fair Value on this stock, I don’t have any comparisons. What’s Enphase really worth?

So I put a multiple of 45 on the stock and that gives me a 2020 Fair Value price of $148 a share, which the stock hit three times during the past market correction.

Overall, this stock could be a market leader in the next Bull Market. The industry has good government backing right now. I can’t say the same for the stock market.