Stock (Symbol) |

Baidu.com (BIDU) |

Stock Price |

$170 |

Sector |

| Technology |

Data is as of |

| December 15, 2016 |

Expected to Report |

| Feb 23 – 27 |

Company Description |

Baidu, Inc. (Baidu) is a Chinese-language Internet search provider (ISP). Baidu serves three types of online participants, which include users, customers and Baidu Union Members. The Company offers a Chinese-language search platform on its Website, Baidu.com. It provides Chinese-language Internet search services to enable users to find relevant information online, including Web pages, news, images, documents and multimedia files, through links provided on its Websites. It designs and delivers its online marketing services primarily on its Baidu.com Website to its online marketing customers. As of December 31, 2014 the Company had approximately 813,000 active online marketing customers. Its online marketing customers consist of small and medium enterprises (SMEs) throughout China, domestic companies and Chinese divisions or subsidiaries of multinational companies. Source: Thomson Financial Baidu, Inc. (Baidu) is a Chinese-language Internet search provider (ISP). Baidu serves three types of online participants, which include users, customers and Baidu Union Members. The Company offers a Chinese-language search platform on its Website, Baidu.com. It provides Chinese-language Internet search services to enable users to find relevant information online, including Web pages, news, images, documents and multimedia files, through links provided on its Websites. It designs and delivers its online marketing services primarily on its Baidu.com Website to its online marketing customers. As of December 31, 2014 the Company had approximately 813,000 active online marketing customers. Its online marketing customers consist of small and medium enterprises (SMEs) throughout China, domestic companies and Chinese divisions or subsidiaries of multinational companies. Source: Thomson Financial |

Sharek’s Take |

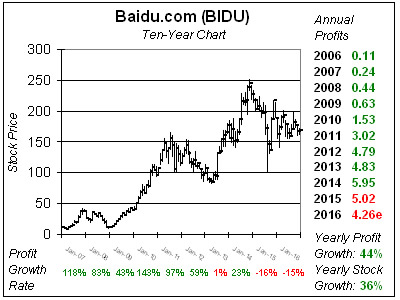

Baidu (BIDU) used to be a darling of a stock. China’s largest search engine is up more than ten-fold the past ten years even though the stock has been around this price since late 2013. In fact, profits hit a record high of $5.95 in 2014 and have been on the decline since. In 2015 the company went on a spending spree to diversify away from its core search business, a move I’ve always disagreed with. Outside investments management has made include a Brookstone type retail store that sells things like a wireless fishfinder, and autonomous cars. What’s startling is now revenue growth is in decline. According to Thomson Reuters BIDU’s sales fell 1% last qtr, a decline from 10% revenue growth three months earlier. What’s more is the company slashed this qtr’s revenue estimate by 10% and now analysts expect profit growth of -29% on -1% sales growth. Over the last 4 qtrs analysts have dropped 2017’s profit estimate from $8.79 to $7.91. $6.22 and now $5.65. BIDU no longer fits the mold of a stock I would typically own, but it has to stay on the radar as it has enormous capabilities to be a world-class stock once again. Baidu (BIDU) used to be a darling of a stock. China’s largest search engine is up more than ten-fold the past ten years even though the stock has been around this price since late 2013. In fact, profits hit a record high of $5.95 in 2014 and have been on the decline since. In 2015 the company went on a spending spree to diversify away from its core search business, a move I’ve always disagreed with. Outside investments management has made include a Brookstone type retail store that sells things like a wireless fishfinder, and autonomous cars. What’s startling is now revenue growth is in decline. According to Thomson Reuters BIDU’s sales fell 1% last qtr, a decline from 10% revenue growth three months earlier. What’s more is the company slashed this qtr’s revenue estimate by 10% and now analysts expect profit growth of -29% on -1% sales growth. Over the last 4 qtrs analysts have dropped 2017’s profit estimate from $8.79 to $7.91. $6.22 and now $5.65. BIDU no longer fits the mold of a stock I would typically own, but it has to stay on the radar as it has enormous capabilities to be a world-class stock once again. |

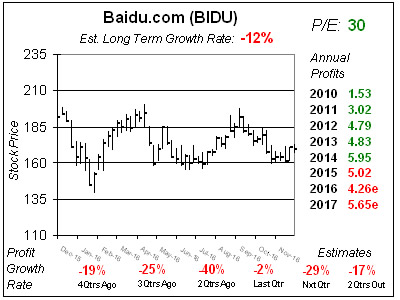

One Year Chart |

Analysts have a negative Estimated Long-Term Growth Rate on this stock -12%. Wow. This number has been negative three straight qtrs. Qtrly profit growth and even Estimates are all negative. What’s good? BIDU beat the street last qtr, but these estimates had been lowered by 3x the amount of the beat in prior qtrs. Also, 2016 estimates didn’t decline this time (due to the big beat), but 2017’s and 2018’s did. Also, profit growth is expected to come back later in 2017 as qrtly Estimates are for -29%, -17%, 24% and 12% profit growth the next 4 qtrs. Let’s see if these don’t decline in the coming qtrs. Analysts have a negative Estimated Long-Term Growth Rate on this stock -12%. Wow. This number has been negative three straight qtrs. Qtrly profit growth and even Estimates are all negative. What’s good? BIDU beat the street last qtr, but these estimates had been lowered by 3x the amount of the beat in prior qtrs. Also, 2016 estimates didn’t decline this time (due to the big beat), but 2017’s and 2018’s did. Also, profit growth is expected to come back later in 2017 as qrtly Estimates are for -29%, -17%, 24% and 12% profit growth the next 4 qtrs. Let’s see if these don’t decline in the coming qtrs. |

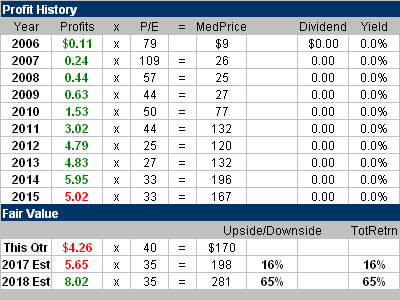

Fair Value |

I feel BIDU is worth 35x earnings, which gives the stock good upside from here. But annual estimates have been declining so I don’t have a lot of faith in these Fair Values. I feel BIDU is worth 35x earnings, which gives the stock good upside from here. But annual estimates have been declining so I don’t have a lot of faith in these Fair Values. |

Bottom Line |

Baidu has been a fantastic stock the last decade, but now profits aren’t growing like they used to. What surprised me most about this report is the company isn’t even growing sales anymore — wow! I continue to keep BIDU on the radar, but there are plenty of other Chinese internet stocks growing rapidly that people can invest in. Baidu has been a fantastic stock the last decade, but now profits aren’t growing like they used to. What surprised me most about this report is the company isn’t even growing sales anymore — wow! I continue to keep BIDU on the radar, but there are plenty of other Chinese internet stocks growing rapidly that people can invest in. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |