Google’s Re-Entry into China is Bad News for Baidu

Google is setting up to re-enter the Chinese search market, where it was once the #1 search engine. That’s bad for Baidu.com (BIDU).

Google is setting up to re-enter the Chinese search market, where it was once the #1 search engine. That’s bad for Baidu.com (BIDU).

Chinese search engine Baidu (BIDU) posted solid results last qtr, but still the stock couldn’t break out to All-Time highs. Here’s why.

Baidu.com (BIDU) was the king of search engines in China. Then apps took hold, with people using the app to do searches. Now the company is moving into Artificial Intelligence.

Baidu (BIDU) is still getting a majority of its revenue from search engine advertising, but Baidu seems to be making strides in Artificial Intelligence. Will it succeed?

Management at Baidu (BIDU) is focused on artificial intelligence, but 86% of company revenue is derived from online ads, so will this company be able to adjust?

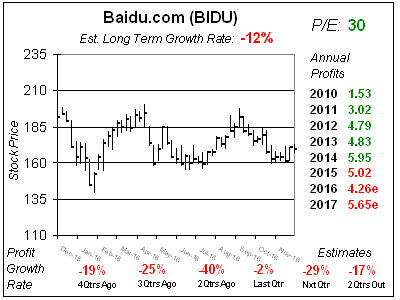

Baidu.com (BIDU) is cranking up its profit growth. But investors don’t forget what the company — and the stock — did during the past three years.

China’s leading search engine, Baidu.com (BIDU), used to be a star in the stock market. Now the company isn’t growing sales or profits.

Baidu’s (BIDU) been diversifying its business by investing in other things like self-driving cars, meanwhile the money is in its search business.

In less than two years Baidu.com’s (BIDU) 2016 earnings estimates have been cut in half. Still, profits might make a comeback — next year.

Baidu.com (BIDU) is set to report profits today, so let’s take a look at the stock and see if its a good idea to buy in ahead of the news.

Baidu (BIDU) has been rising even though its fundamentals are declining at an alarming rate.

Baidu.com (BIDU) just slashed profit estimates as it spends to grow, but the stock is free-falling and thus I will sell it from the Growth Portfolio.

Baidu (BIDU) is spending to grow, but its profits aren’t growing right now. 2016 could be good.

Once again management at Baidu (BIDU) decides its going to spend, which means less profit.

Baidu (BIDU) beat the street & raised estimates again, and moves up to #1 in my Power Rankings.

Baidu.com (BIDU) has figured out mobile ads and now profits are set to soar through 2016. I will add BIDU to the Aggressive Growth Portfolio.

Baidu’s (BIDU) R&D spending slowed last quarter, and if that continues profits will be able to flow once more.

Baidu.com (BIDU) lowered profit estimates big time. There’s better values than BIDU in the Chinese internet space.

This quarter I’m giving Baidu.com (BIDU) a big bump in its valuation. Now the stock has a lot of upside going into 2014.

Shares of Baidu.com (BIDU) have shot from $85 to $140 since last quarter. Seriously. China’s largest search engine just bought a video company and a wireless company.

Baidu.com (BIDU) is up on news it will become the king of online video in China. But BIDU has a bigger problem: how to make money off cell search.

Baidu.com (BIDU) is having to transition itself from PC to mobile advertising. The stock’s weak yet very undervalued right now.

Investors have soured on Baidu.com (BIDU) because of a little competition. Baidu still has 80% of the Chinese search market, no big deal. BIDU is a top pick for 2013.

Last quarter, Baidu’s (BIDU) grew sales 63% and profits 72% mainly because each seach advertiser spent 35% more than they did last year

Investors were not impressed with Baidu.com’s (BIDU) latest quarter, and they sent shares down 10%. Momentum has slowed, but the stock’s still undervalued.

Observers feel China’s slowing growth will slow Internet ad spending and hamper Baidu.com (BIDU). If this is slowing growth, I’ll take it.

Baidu.com (BIDU) isn’t getting enough attention. Sales and profits keep growing around 90% but investors are too focused on the market to notice. Look for a big 2012.

Baidu.com’s (BIDU) profits have doubled in six consecutive quarters and earnings estimates continue to climb higher. There’s not a bit of red on BIDU’s One-Year Chart or Earnings Table. BIDU’s in a zone.

Baidu.com (BIDU) is a great stock right now. The stock is off its highs, so if you wanted to buy BIDU (or get some more) this is the time.

Baidu (BIDU) is the king of small business advertising in China as more than 99% of all its customers are small companies. When large corporations decide to jump on the bandwagon, we could see BIDU on steroids.

Baidu.com (BIDU) just broke out today after the company took business to a new level last quarter. China’s internet search leader is now growing faster than ever — that means its stock should be higher than ever.

Left: BIDU’s one-year chart shows profits are expected to continue to grow in the triple-digits for the the next two quarters.