Update: Ultimate Software (ULTI) announced on February 4, 2019 it will be acquired by Hellman & Friedman in all-cash transaction for $331.50/share. The stock jumped 20% on the news. Today, March 8, 2019 I will sell ULTI from the Growth Portfolio. Below is the original post published on November 30, 2018 at 12:17pm

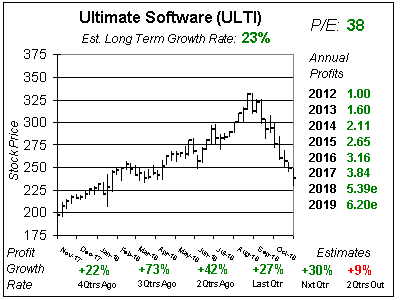

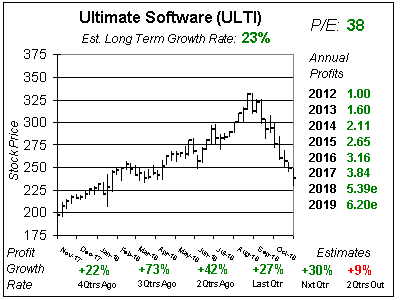

HR software provider Ultimate Software (ULTI) has gone from flying high to crash and burn since last qtr. And it’s really no fault of its own. The stock market has taken tech stocks down a notch, with ULTI getting slammed from $307 to $238 (-22%) since my report last qtr.

Ultimate Software has 4842 employees supporting more than 40 million people records develops and operates cloud-based human resource software. The company was founded in 1990 by Scott Scherr, the current CEO, went public in 1998, and went to a cloud-based platform in 2002. Revenue since 2002 has grown at a CAGR of more than 20% — with record revenue each year. Recurring revenue accounts for 80% of sales and the company has a 95% customer retention rate. Ultimate’s UltiPro platform processes payroll, benefits, and time clock abilities. Optional add-ons include recruiting and new employee tools, as well as its Talent Management suite which is composed of Performance Management, Talent Predictors and Succession Management. Ultimate Software is trying to go after bigger customers, but that’s Workday’s turf — and Workday might have better software. And Paycom is the leader in small business HR. Last qtr, Ultimate acquired PeopleDoc, a once France-based human resources company. PeopleDoc doubled its European revenue every year between its launch in 2010 and 2013, and will be counted on to provide International growth opportunity for the company.

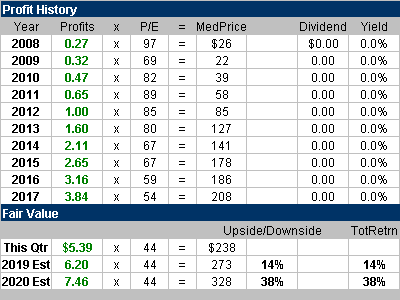

ULTI stock is usually richly valued. Last qtr the P/E was 56, which I thought was WAY high for a company with an Estimated Long Term Growth Rate of 23% a year. This qtr the P/E is 38. That’s still rich for a normal 23% grower, but ULTI’s recurring revenue stream gives investors more certainty into the future, thus the P/E should be higher. Management has roughly 94% visibility into its 2019 revenue growth target of 20% — which assumes no new sales — which to me signals profit growth of at least 20% next year. ULTI will be added to the Growth Portfolio this qtr. I owned the stock in the past, got shook out, and have been waiting for an opportunity to get back in. Note: ULTI will be bought today, 11/30, and the stock is currently $264. The charts and data shown here are from 11/19, when the stock was $238. |

Wow, such a HUGE decline in these shares, which was primarily due to tech stocks getting trampled. That’s good though, because this stock was overvalued last qtr (It was $307 and I thought it was worth $274). Wow, such a HUGE decline in these shares, which was primarily due to tech stocks getting trampled. That’s good though, because this stock was overvalued last qtr (It was $307 and I thought it was worth $274).

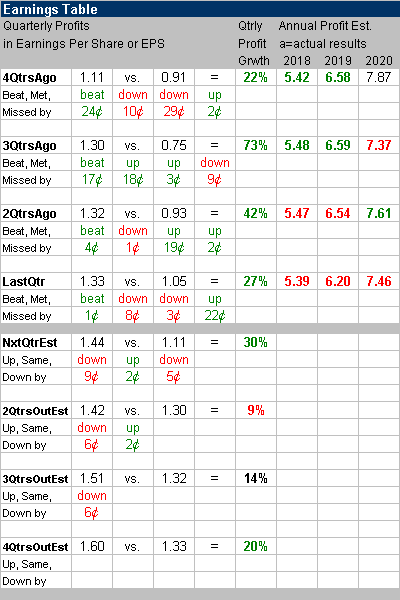

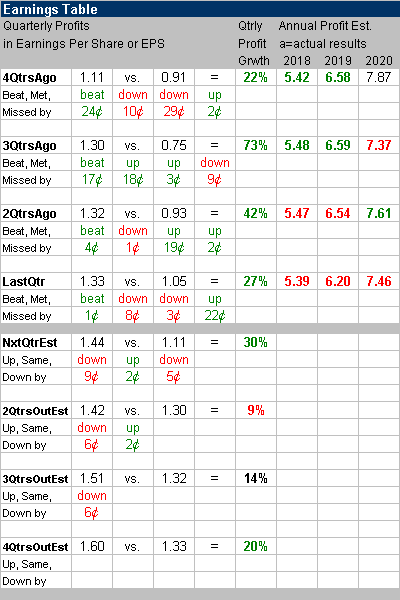

This year, accounting changes have pushed profits into the period the deal was signed, thus software stocks have abnormally high profit growth. Also, ULTI went on a hiring spree 7 qtrs ago, which took a bit out of profits. Thus the 73% growth it had 3 qtrs ago was due in part to easy comparisons.

The Est. LTG of 23% a year seems about right. Future acquisitions might be able t boost this. The P/E of 38 is very good for this stock. It was 56 last qtr, but we were looking at 2018 estimates then. This qtr I’m looking ahead to 2019. |

Last qtr ULTI delivered 27% profit growth, which was a little better than estimates of 26%. Sales increased 22%. Last qtr ULTI delivered 27% profit growth, which was a little better than estimates of 26%. Sales increased 22%.

The only bad things I see in this report are the evaporating profit estimates. Both qtrly and annually. That’s a concern.

Another concern is ULTI was whipping profit estimates three and four qtrs ago, and only beat by a penny last qtr.

Qtrly Estimates for the next 4 qtrs are 30%, 9%, 14% and 20%. That 9% qtr is up against tough comparisons from the year-ago-period (73%), so that’s fine.

|

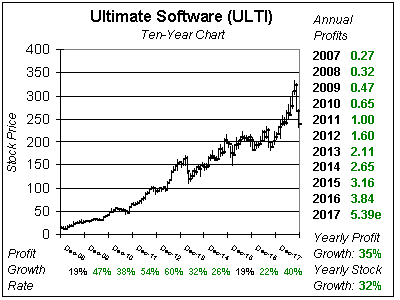

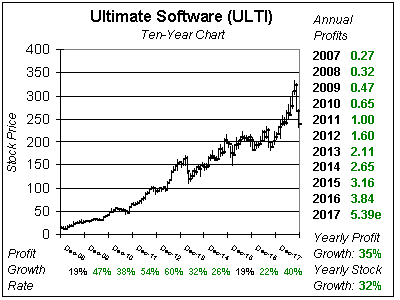

Ultimate Software has been a stellar stock during the past decade. During the past year it made a parabolic run higher, and needed to come down. Done. Now the stock looks to be back at its trendline. Put a ruler up to the screen along the chart pattern to see what I mean. Ultimate Software has been a stellar stock during the past decade. During the past year it made a parabolic run higher, and needed to come down. Done. Now the stock looks to be back at its trendline. Put a ruler up to the screen along the chart pattern to see what I mean.

I feel this stock is underappreciated in the investment world, as it signs long-term deals with employers for HR work, which provides the company with a steady stream of sales and profits.

ULTI will be added to the Growth Portfolio, where it will rank 32nd in the Power Rankings. This will be my third HR software company in the portfolio, and I don’t want to take too much risk by having too much money in this one sector. |

Last qtr ULTI delivered

Last qtr ULTI delivered  This stock has always had a rich valuation, so we shouldn’t be alarmed paying 38x earnings for a 23% grower. Although the anticipated growth for 2019 isn’t great, I feel this stock could be 38% higher in two years, and if you don’t buy in you won’t have the opportunity to get that gain.

This stock has always had a rich valuation, so we shouldn’t be alarmed paying 38x earnings for a 23% grower. Although the anticipated growth for 2019 isn’t great, I feel this stock could be 38% higher in two years, and if you don’t buy in you won’t have the opportunity to get that gain. Ultimate Software has been a stellar stock during the past decade. During the past year it made a parabolic run higher, and needed to come down. Done. Now the stock looks to be back at its trendline. Put a ruler up to the screen along the chart pattern to see what I mean.

Ultimate Software has been a stellar stock during the past decade. During the past year it made a parabolic run higher, and needed to come down. Done. Now the stock looks to be back at its trendline. Put a ruler up to the screen along the chart pattern to see what I mean.