About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

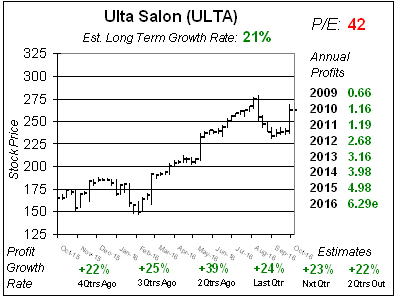

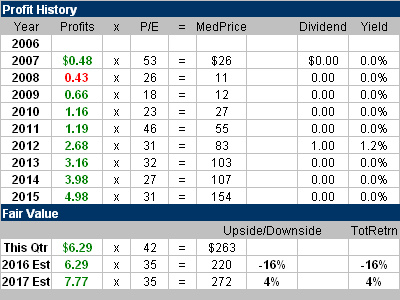

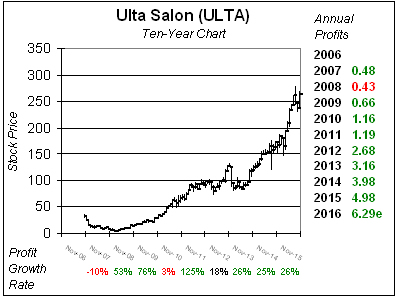

Ulta Salon (ULTA), the largest beauty store in America, expects at least 20% profit growth to continue through 2017, 2018 and 2019. Shares jumped on the news, but now sell for a lofty 42x earnings. Last qtr the company delivered 24% profit growth on 22% sales growth with a 14% increase in same store sales. Same store sales growth of 14% might be the best of any retailer today — and SSS greater than 10% in a previous qtr is usually a catalyst to send a stock higher during the current qtr. This is a great stock with an excellent management team which uses statistics and analytics to achieve superior performance. Instead of relying on discounts and price promotions, Ulta uses a sophisticated loyalty program then targeted offers and utilizes loyalty points as currency. Its website offers tremendous growth opportunity as e-commerce was 5.5% of sales in 2012, is 6% of sales today and is on track to be 10% by 2019. Ulta Salon has a 4% of the overall US beauty market (6% of products and 1% of services). This is a fantastic stock, and probably one of my worst mistakes as a money manager was not buying this when it was on my radar back in 2009. And I still make the mistake of passing on the stock, but with the shares up so much this year I’m going to be patient and look for a pullback to get in.

Ulta Salon (ULTA), the largest beauty store in America, expects at least 20% profit growth to continue through 2017, 2018 and 2019. Shares jumped on the news, but now sell for a lofty 42x earnings. Last qtr the company delivered 24% profit growth on 22% sales growth with a 14% increase in same store sales. Same store sales growth of 14% might be the best of any retailer today — and SSS greater than 10% in a previous qtr is usually a catalyst to send a stock higher during the current qtr. This is a great stock with an excellent management team which uses statistics and analytics to achieve superior performance. Instead of relying on discounts and price promotions, Ulta uses a sophisticated loyalty program then targeted offers and utilizes loyalty points as currency. Its website offers tremendous growth opportunity as e-commerce was 5.5% of sales in 2012, is 6% of sales today and is on track to be 10% by 2019. Ulta Salon has a 4% of the overall US beauty market (6% of products and 1% of services). This is a fantastic stock, and probably one of my worst mistakes as a money manager was not buying this when it was on my radar back in 2009. And I still make the mistake of passing on the stock, but with the shares up so much this year I’m going to be patient and look for a pullback to get in.