Stock (Symbol) |

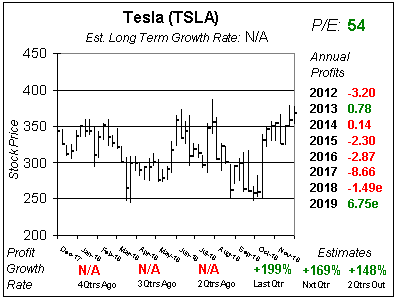

Tesla (TSLA) |

Stock Price |

$368 |

Sector |

| Energy & Commodities |

Data is as of |

| December 14, 2018 |

Expected to Report |

| Feb 5 |

Company Description |

Tesla Motors, Inc. is a United States-based company, which designs, develops, manufactures and sells electric vehicles, electric vehicle powertrain components and stationary energy storage systems. TSLA sells and produces the Model S and Model X electric cars, Supercharger charging stations and Powerwall, a home battery. Source: Thomson Financial Tesla Motors, Inc. is a United States-based company, which designs, develops, manufactures and sells electric vehicles, electric vehicle powertrain components and stationary energy storage systems. TSLA sells and produces the Model S and Model X electric cars, Supercharger charging stations and Powerwall, a home battery. Source: Thomson Financial |

Sharek’s Take |

Last qtr, Tesla (TSLA) cracked a profit for the first time in a long time. And now the stock could be on its way to propelling higher the next time the stock market rallies. Why? Profit estimates have surged higher the past two qtrs, and now analysts feel the company could go from losing money in 2018 to making $6.75 in 2019 then delivering $11.10 in profits in 2020. Also, TSLA beat the street last qtr. So we could have a situation with a company having a catalyst (Model 3), beating the street, upping estimates, and posting triple-digit profit growth. That’s a formula for success for stock market leaders. Here’s Tesla’s annual delivery history: Last qtr, Tesla (TSLA) cracked a profit for the first time in a long time. And now the stock could be on its way to propelling higher the next time the stock market rallies. Why? Profit estimates have surged higher the past two qtrs, and now analysts feel the company could go from losing money in 2018 to making $6.75 in 2019 then delivering $11.10 in profits in 2020. Also, TSLA beat the street last qtr. So we could have a situation with a company having a catalyst (Model 3), beating the street, upping estimates, and posting triple-digit profit growth. That’s a formula for success for stock market leaders. Here’s Tesla’s annual delivery history:

Tesla’s current lineup includes the Model S, a luxury sedan, Model X, an all-wheel drive SUV with falcon wing doors and seating for 7, and the Model 3, Tesla’s entry into the mainstream market. Tesla delivered around 2000 cars per week last year and just delivered 5000 a week during June. Now there’s word the company is making 7000 Model 3’s per week. In addition there is significant growth opportunity for Tesla overseas. Tesla is selling cars in China, but has ocean transportation costs and tariffs to deal with as all Tesla’s are produced at its factory in Fremont, California. The company is set to open a China factory in the 2nd half of 2019. This could be big as China is the world’s largest market for electric vehicles. Tesla Model S is the top-selling luxury sedan in Europe, and is expected to start deliveries of its Model 3 in Europe in the 2nd half of 2019. Increased production and expansion into China and Europe could prove to be catalysts for this stock in 2019. In addition, the stock market has been in a Bear Market for three months, and TSLA stock has held its own. With the stock fitting the mold, TSLA could break out to new highs and make a big move higher. In my professional opinion, I think the stock could be ten-bagger in ten years. In November 2016, with TSLA at $200, billionaire fund manager Ron Baron felt investors could make 30 to 50 times their money in TSLA in 15 years. TSLA was last in the Growth Portfolio Power Rankings last qtr, and shoots to #1 in the Power Rankings this qtr. I will add to my position today, and also put the stock in the Aggressive Growth Portfolio as well. |

One Year Chart |

These charts and tables were done on 12/14 with the stock at $368, today is 12/28 and TSLA is set to open at $316. These charts and tables were done on 12/14 with the stock at $368, today is 12/28 and TSLA is set to open at $316.

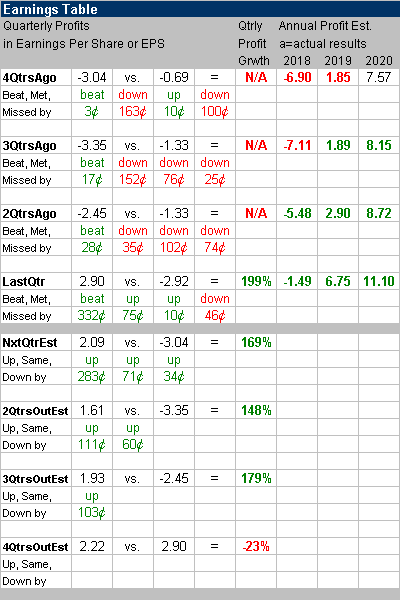

Last qtr TSLA lost $2.45 a share, which was worse than the $1.33 loss a year ago. But there are a lot of positive s here, most noteworthy being profit estimates climbed this qtr. Well they surged actually. Next qtr’s estimate jumped 75 cents, and now analysts only expect a loss of 42 cents. TSLA beat by 28 cents last qtr, so its possible the company could be making profits right now. Profitability is more likely 2QtrsOut as this estimate rose 71 cents this qtr, with analysts now expecting a profit of $0.74. Qtrly profit Estimates for the net 4 qtrs are N/A, 76%, 85% and 63%. The Est. LTG of -7% is odd, I imagine that could shoot up to between 35% and 75% if profitability comes. |

Earnings Table |

Last qtr TSLA had sales growth of 129% (wow) and 199% profit growth. The company made a surprise profit of $2.90 a share, which beat estimates of -$0.42, which was 199% . That quarter was BIG for this company, as it was having cash concerns and was single-digit weeks of collapse. Essentially, the stock went from being on the verge of crashing to the verge of breaking out to new highs — and perhaps running higher. Last qtr TSLA had sales growth of 129% (wow) and 199% profit growth. The company made a surprise profit of $2.90 a share, which beat estimates of -$0.42, which was 199% . That quarter was BIG for this company, as it was having cash concerns and was single-digit weeks of collapse. Essentially, the stock went from being on the verge of crashing to the verge of breaking out to new highs — and perhaps running higher.

I’m really impressed with the sales growth number (129%). TSLA had 43% sales growth 2QtrsAgo. Tesla went from doing between $2.7 billion and $4 billion in sales per qtr to around $7 billion a qtr from here on out. If TSLA beats revenue estimates, it could have triple-digit sales growth the next 3 qtrs. Annual Profit Estimates jumped higher. 2019’s estimate went from $2.90 to $6.75. That’s a lotta profit! And it really puts the stock at around 50x earnings (2019). 2020’s increased from $8.72 to $11.10. Now if TSLA went from losing money one year to making $10 in profits two years later, would the stock be worthy of a 80 P/E? Qtrly profit Estimates for the next 4 qtrs surged higher, and now stand at 169%, 148%, 179% and -23%. So triple-digit growth is expected for the next three qtrs. The 4QtrsOut estimate is vs the monster qtr Tesla just delivered, and probably needs time to bake. |

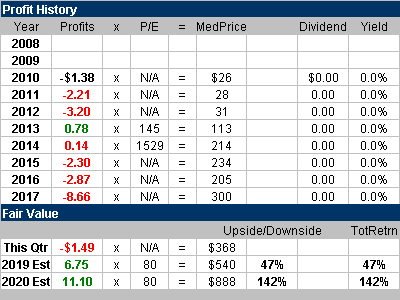

Fair Value |

I’m giving TSLA a Fair Value of 80x earnings, which is $540 for 2019 and $888 for 2020. But there’s not much certainty in these profit estimates, and we don’t have past history to use as a guide to the valuation (P/E). I’m giving TSLA a Fair Value of 80x earnings, which is $540 for 2019 and $888 for 2020. But there’s not much certainty in these profit estimates, and we don’t have past history to use as a guide to the valuation (P/E). |

Bottom Line |

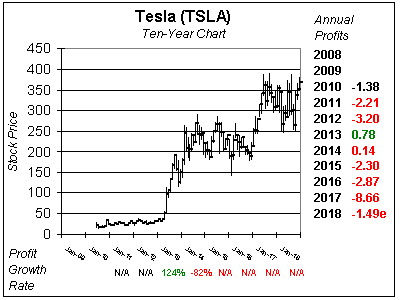

Tesla (TSLA) has had a history of basing, then making a big move higher, and basing again. I love this ten-year chart. If the stock brakes past $380 it could go another level higher. Tesla (TSLA) has had a history of basing, then making a big move higher, and basing again. I love this ten-year chart. If the stock brakes past $380 it could go another level higher.

TSLA is one of the greatest investment opportunities of our lifetime, but the stock carries risk. The stock “fits the mold” of a superstar with triple-digit profit growth, its beating the street, upping estimates, and the stock is looking like a leader in the overall market. Most importantly, the company has a catalyst in its Model 3, and International sales could be tremendous in 2019 (Europe) and 2020 (China). Last qtr TSLA ranked dead last in the Growth Portfolio Power Rankings. It was on the verge of going under. Now everything’s changed. TSLA ranks 1st in the Growth Portfolio Power Rankings, and I will add it to the Aggressive Growth Portfolio, where it will rank 1st as well. |

Power Rankings |

Growth Stock Portfolio

1 of 46Aggressive Growth Portfolio 1 of 20Conservative Stock Portfolio N/A |