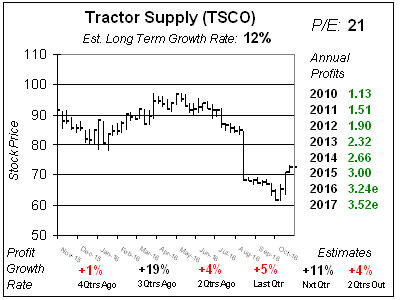

Tractor Supply’s (TSCO) Sales & Profits Seem to Have Lost That Growing Feeling

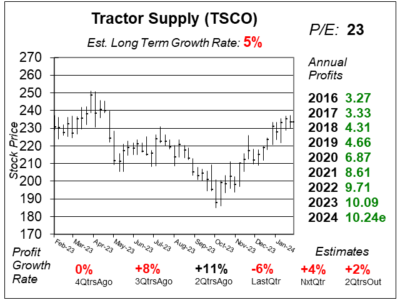

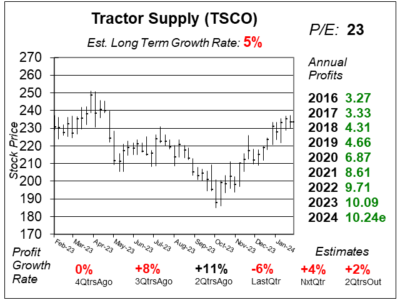

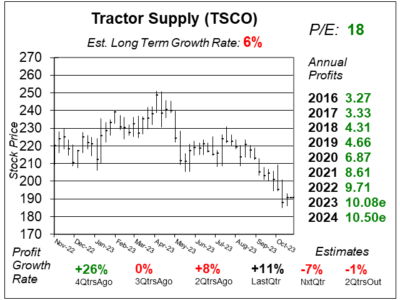

Tractor Supply (TSCO) seems to be in a slow-growth period. In addition, the stock doesn’t seem to have much upside at these levels.

Tractor Supply (TSCO) seems to be in a slow-growth period. In addition, the stock doesn’t seem to have much upside at these levels.

High inflation & credit card debt are hurting consumers, which is maing them hold-off on big ticket items at Teactor Supply (TSCO).

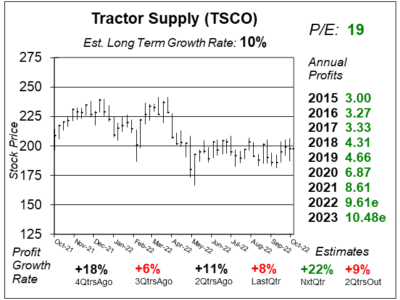

Tractos Supply (TSCO) missed profit est. last qtr as big ticket items like riding lawnmowers, generators & recreational vehicles were weak.

Spring was a little late to arrive this year, causing Tractor Supply’s (TSCO) customers to delay buying Spring seasonal items.

Tractor Supply (TSCO) just delivered a marvalous quarter as Winter weather pushed up demand for heaters, clothes, and pet food.

The “need for feed” — chicken and bird feed as well as dog food — keeps customers coming back to Tractor Supply (TSCO).

Tractor Supply (TSCO) is delivering stable results as people move to rural areas and require food and fencing for their pets.

Tractor Supply (TSCO) is a buy because dogs need food. Horses too. And other animals you would find on a farm need food too.

Tractor Supply (TSCO) is in a good area for growth as the southern migration could require farm equipment and livestock items.

Tractor Supply (TSCO) has been on a wild ride the past two years as it went from $90 to $50. But now TSCO is back in a big way. Is this time to sell?

Tractor Supply (TSCO) has been down-and-out for the past year. Now with hurricane season in full effect, TSCO could beat lowered expectations this qtr.

Last qtr Tractor Supply (TSCO) laid yet another egg and…get this…blamed weather once again. Is it time to give up on Tractor Supply entirely?

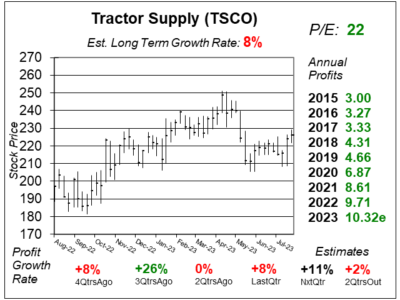

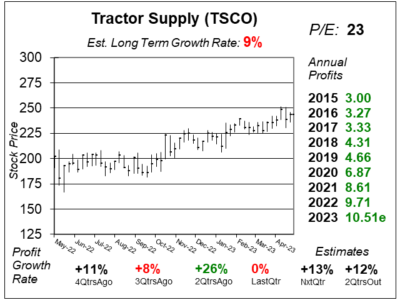

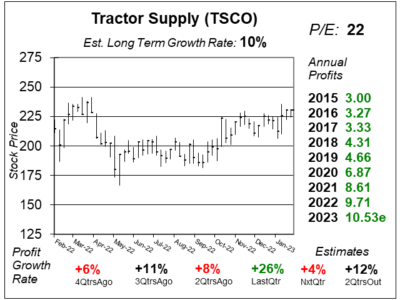

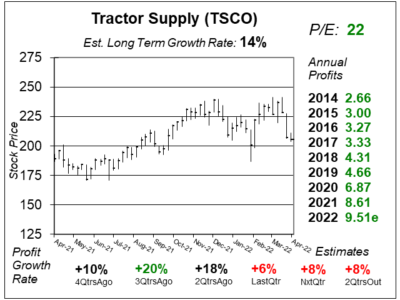

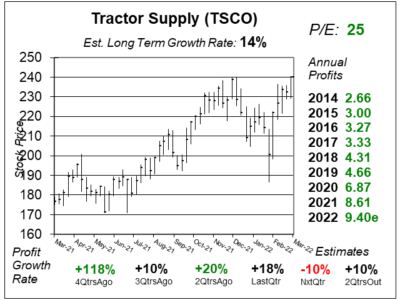

Tractor Supply (TSCO) used to be considered a 17% grower. Now profits are growing in the high single-digits, and investors have factored in slower growth.

Tractor Supply (TSCO) continues to miss earnings estimates as warm weather and a slow energy market are hurting same store sales.

Tractor Supply (TSCO) dropped from $84 to $71 at the open after the company lowered 2016 profit estimates. Let’s see if this is a good buy.

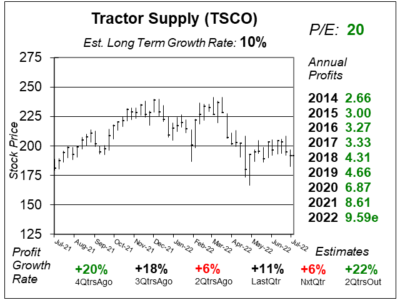

Good weather conditions helped Tractor Supply (TSCO) post 19% profit growth last qtr, but at this price the stock is richly valued.

Tractor Supply (TSCO) missed earnings estimates by 9 cents last qtr. But even in a wicked stock market downturn, investors shrugged off the bad news.

Tractor Supply (TSCO) is a better business than you know — and so is TSCO stock.

All stock markets correct eventually. In the meantime keep Tractor Supply (TSCO) on your radar, and be prepared to buy if or when it corrects.

From 2009 to 2013 Tractor Supply (TSCO) was a stock market leader. 2014’s a different story. TSCO has lost its luster.

Shares of Tractor Supply (TSCO) have really fallen of the perch. Let’s examine TSCO and find a price we could get in at.

Tractor Supply (TSCO) is a very good stock to own. Still, at 27 times 2014 earnings, TSCO has gone too far. It’s like a runaway tractor.

Things are going well for building stocks. But Tractor Supply (TSCO) seems to be too high to buy right now. Here’s why.

The best stock in the Homebuilder sector isn’t a homebuilder at all, its Tractor Supply (TSCO), a company that systematically puts out 20% profit growth.

Tractor Supply (TSCO) is solid. The company almost always grows profits as it grows into fertile ground. This is a good investment — when it dips.

Tractor Supply (TSCO) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.71 vs. $1.65 = +4%

Revenue Est: +3%