Stock (Symbol)

|

Tractor Supply (TSCO)

|

Stock Price

|

$73

|

Sector

|

| Retail & Travel |

Data is as of

|

| November 21, 2016 |

Expected to Report

|

| Feb 1 |

Company Description

|

Tractor Supply Company is an operator of rural lifestyle retail stores in the United States. The Company focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. As of December 27, 2014, it operated 1,382 retail stores in 49 states under the names Tractor Supply Company, Del’s Feed & Farm Supply and HomeTown Pet. It also operates a Website under the name TractorSupply.com. It offers a portfolio of products, which include equine, livestock, pet and small animal products; hardware, truck, towing and tool products; seasonal products, including lawn and garden items, power equipment, gifts and toys; work/recreational clothing and footwear, and maintenance products for agricultural and rural use. Its products are offered under various brands, which include 4health, Blue Mountain, Countyline, Equistages, Groundwork, Huskee, JobSmart, Dumor, C.E. Schmidt, Paws & Claws, Producer’s Pride and Redstone, among others. Source: Thomson Financial Tractor Supply Company is an operator of rural lifestyle retail stores in the United States. The Company focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. As of December 27, 2014, it operated 1,382 retail stores in 49 states under the names Tractor Supply Company, Del’s Feed & Farm Supply and HomeTown Pet. It also operates a Website under the name TractorSupply.com. It offers a portfolio of products, which include equine, livestock, pet and small animal products; hardware, truck, towing and tool products; seasonal products, including lawn and garden items, power equipment, gifts and toys; work/recreational clothing and footwear, and maintenance products for agricultural and rural use. Its products are offered under various brands, which include 4health, Blue Mountain, Countyline, Equistages, Groundwork, Huskee, JobSmart, Dumor, C.E. Schmidt, Paws & Claws, Producer’s Pride and Redstone, among others. Source: Thomson Financial

|

Sharek’s Take

|

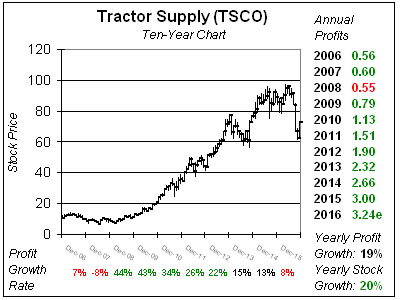

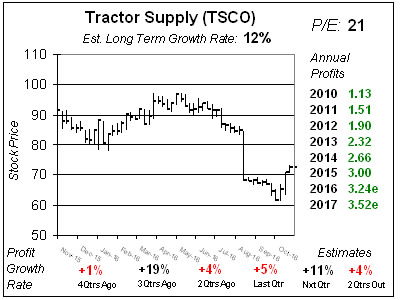

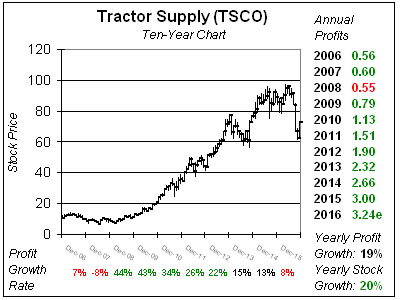

Tractor Supply (TSCO) has been in a funk for a while as warm weather conditions and a slow energy market are dampening sales. TSCO has in fact missed earnings estimates in three of the last four qtrs, although the stock has only been weak recently because investors were giving TSCO the benefit of the doubt that these sluggish conditions were only temporary. Last qtr TSCO had -1% same store sales (SSS) growth and that’s not going to get a stock moving materially higher. But the shares did pop after the election as Trump is more open to pumping out energy such as coal and oil — which would help business for Tractor Supply, which is big in Texas. This is a solid well-run company. When business is clicking, TSCO’s combination of store growth of 7% to 8% per year, same store sales growth of 3% to 4%, expanding profit margins, and stock buybacks could produce profit growth in the high-teens. But that’s not happening now. Management projects expanding from 1,500 locations to 2,500 long-term as it grows from the Midwest & South to the West and populated Northeast. TSCO sells for 21x earnings, which is below the 27x I normally think the company is worth. But SSS growth will have to move up to 3-5% to get this stock to push the trend higher long-term. Tractor Supply (TSCO) has been in a funk for a while as warm weather conditions and a slow energy market are dampening sales. TSCO has in fact missed earnings estimates in three of the last four qtrs, although the stock has only been weak recently because investors were giving TSCO the benefit of the doubt that these sluggish conditions were only temporary. Last qtr TSCO had -1% same store sales (SSS) growth and that’s not going to get a stock moving materially higher. But the shares did pop after the election as Trump is more open to pumping out energy such as coal and oil — which would help business for Tractor Supply, which is big in Texas. This is a solid well-run company. When business is clicking, TSCO’s combination of store growth of 7% to 8% per year, same store sales growth of 3% to 4%, expanding profit margins, and stock buybacks could produce profit growth in the high-teens. But that’s not happening now. Management projects expanding from 1,500 locations to 2,500 long-term as it grows from the Midwest & South to the West and populated Northeast. TSCO sells for 21x earnings, which is below the 27x I normally think the company is worth. But SSS growth will have to move up to 3-5% to get this stock to push the trend higher long-term. |

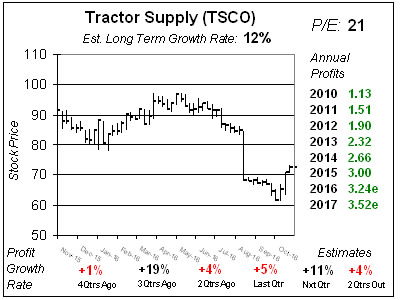

One Year Chart

|

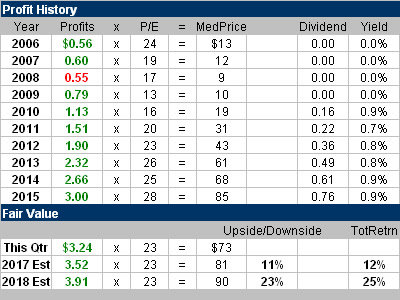

So TSCO had poor results 4 qtrs ago and investors shrugged it off as a one-time thing from warm weather. Well then after the company missed 2QtrsAgo investors threw in the towel and the stock tanked. Last qtr things were bad as well, with profits growing just 5% (missing the 13% estimate) on 5% sales growth. After Tractor Supply reported, analysts took 2016 profit estimates down from $3.38 to $3.24, 2017’s from $3.87 to $3.52, and 2018’s from $4.44 to $3.91. Ugh. Also, the Estimated Long Term Growth Rate just fell from 15% to 12%. So TSCO had poor results 4 qtrs ago and investors shrugged it off as a one-time thing from warm weather. Well then after the company missed 2QtrsAgo investors threw in the towel and the stock tanked. Last qtr things were bad as well, with profits growing just 5% (missing the 13% estimate) on 5% sales growth. After Tractor Supply reported, analysts took 2016 profit estimates down from $3.38 to $3.24, 2017’s from $3.87 to $3.52, and 2018’s from $4.44 to $3.91. Ugh. Also, the Estimated Long Term Growth Rate just fell from 15% to 12%. |

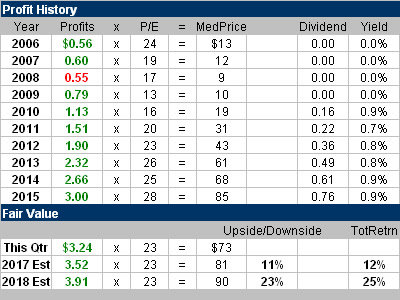

Fair Value

|

I’m placing my Fair Value on this stock at 23x earnings, which to be frank might be a little rich with business slow the way it is. But then again this company started having problems a year ago so maybe the easy comparisons will help the “impression” of results beginning next qtr. From the looks of this Profit History table, TSCO has decent upside here, but keep in mind annual profit estimates just got slashed for the third time in four qtrs and that could happen again. I’m placing my Fair Value on this stock at 23x earnings, which to be frank might be a little rich with business slow the way it is. But then again this company started having problems a year ago so maybe the easy comparisons will help the “impression” of results beginning next qtr. From the looks of this Profit History table, TSCO has decent upside here, but keep in mind annual profit estimates just got slashed for the third time in four qtrs and that could happen again. |

Bottom Line

|

Tractor Supply is going through a slow period right now but the company does have loyal shoppers who use the store on a continuous basis to purchase farming supplies and more. This is a quality company that’s produced record profits in 9-of-10 years. Management also pays a dividend and buys back shares. Although I like this stock a lot I wish to point out Tractor Supply is off its lows due to a Trump election, not because business is great. TSCO ranks 20th of 29 stocks in the Conservative Growth Portfolio Power Rankings. I have the stock on the radar for the Growth Portfolio. Tractor Supply is going through a slow period right now but the company does have loyal shoppers who use the store on a continuous basis to purchase farming supplies and more. This is a quality company that’s produced record profits in 9-of-10 years. Management also pays a dividend and buys back shares. Although I like this stock a lot I wish to point out Tractor Supply is off its lows due to a Trump election, not because business is great. TSCO ranks 20th of 29 stocks in the Conservative Growth Portfolio Power Rankings. I have the stock on the radar for the Growth Portfolio. |

Power Rankings

|

Growth Stock Portfolio

N/A

Aggressive Growth Portfolio

N/A

Conservative Stock Portfolio

20 of 29

|

Tractor Supply Company is an operator of rural lifestyle retail stores in the United States. The Company focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. As of December 27, 2014, it operated 1,382 retail stores in 49 states under the names Tractor Supply Company, Del’s Feed & Farm Supply and HomeTown Pet. It also operates a Website under the name TractorSupply.com. It offers a portfolio of products, which include equine, livestock, pet and small animal products; hardware, truck, towing and tool products; seasonal products, including lawn and garden items, power equipment, gifts and toys; work/recreational clothing and footwear, and maintenance products for agricultural and rural use. Its products are offered under various brands, which include 4health, Blue Mountain, Countyline, Equistages, Groundwork, Huskee, JobSmart, Dumor, C.E. Schmidt, Paws & Claws, Producer’s Pride and Redstone, among others. Source: Thomson Financial

Tractor Supply Company is an operator of rural lifestyle retail stores in the United States. The Company focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. As of December 27, 2014, it operated 1,382 retail stores in 49 states under the names Tractor Supply Company, Del’s Feed & Farm Supply and HomeTown Pet. It also operates a Website under the name TractorSupply.com. It offers a portfolio of products, which include equine, livestock, pet and small animal products; hardware, truck, towing and tool products; seasonal products, including lawn and garden items, power equipment, gifts and toys; work/recreational clothing and footwear, and maintenance products for agricultural and rural use. Its products are offered under various brands, which include 4health, Blue Mountain, Countyline, Equistages, Groundwork, Huskee, JobSmart, Dumor, C.E. Schmidt, Paws & Claws, Producer’s Pride and Redstone, among others. Source: Thomson Financial Tractor Supply (TSCO) has been in a funk for a while as warm weather conditions and a slow energy market are dampening sales. TSCO has in fact missed earnings estimates in three of the last four qtrs, although the stock has only been weak recently because investors were giving TSCO the benefit of the doubt that these sluggish conditions were only temporary. Last qtr TSCO had -1% same store sales (SSS) growth and that’s not going to get a stock moving materially higher. But the shares did pop after the election as Trump is more open to pumping out energy such as coal and oil — which would help business for Tractor Supply, which is big in Texas. This is a solid well-run company. When business is clicking, TSCO’s

Tractor Supply (TSCO) has been in a funk for a while as warm weather conditions and a slow energy market are dampening sales. TSCO has in fact missed earnings estimates in three of the last four qtrs, although the stock has only been weak recently because investors were giving TSCO the benefit of the doubt that these sluggish conditions were only temporary. Last qtr TSCO had -1% same store sales (SSS) growth and that’s not going to get a stock moving materially higher. But the shares did pop after the election as Trump is more open to pumping out energy such as coal and oil — which would help business for Tractor Supply, which is big in Texas. This is a solid well-run company. When business is clicking, TSCO’s