Arm (ARM) Surges on AI Demand, Becomes First Choice for AI Cloud Deployments

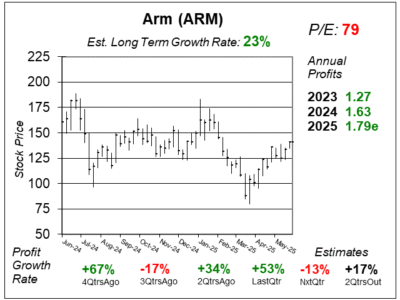

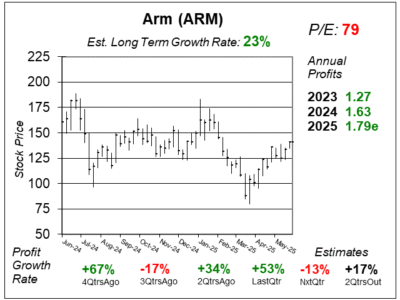

Arm (ARM) delivered solid growth last quarter as profits jumped 53% on a 34% rise in revenue. But what is the stock really worth?

Arm (ARM) delivered solid growth last quarter as profits jumped 53% on a 34% rise in revenue. But what is the stock really worth?

Arm (ARM) has strong demand for its semiconductor manufacturing technology. But with a P/E of 100, ARM is high-risk, high-reward.

Arm (ARM) recorded a poor quarter as profits fell 17% last quarter on just 5% revenue growth. But AI makes ARM’s future bright.

Arm’s (ARM) is an industry leader in building CPUs. Semiconductors are hot right now due to AI. But is this stock too high to buy?

Arm (ARM) is expected to report qtrly profits (EPS) and revenues:

Arm (ARM) reports qtrly profits (EPS) and revenues:

Arm (ARM) reports qtrly profits (EPS) and revenues:

Arm (ARM) reports qtrly profits (EPS) and revenues:

Arm (ARM) reports qtrly profits (EPS) and revenues: