Stocks seem to have stopped free-falling, an encouraging sign that could mean the Bear Market is over.

Stocks seem to have stopped free-falling, an encouraging sign that could mean the Bear Market is over.

On Friday, July 15, 2022, the stock market rose almost 2% as investors warmed up to the idea the Bear Market could be behind us. Overall, the S&P 500 was up 1.9% on the day while the NASDAQ increased 1.8%.

Recent strength has been seen in Healthcare stocks, while semiconductors have been weak.

But the chip stocks might get a rally if the CHIPS for America act gains funding. Some “smart investors” are putting their money where their mouth is:

Tweet of the Day

The Pelosi's have accumulated 20,000 shares of $NVDA worth $8M+

All while a $52B CHIPS act has been stalled in Congress.

Yesterday Pelosi states, "We are determined that we will pass a bill" before congress heads to August recess.$NVDA stock jumps 4% on the news.

— Nancy Pelosi Stock Tracker (@PelosiTracker_) July 15, 2022

Although Pelosi has invested in NVDA, the stock that might benefit the most is a company that actually manufactures the semiconductors, GlobalFoundries (GFS).

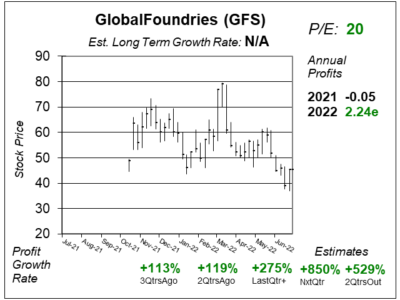

Chart of the Day

Our chart of the day is this one-year chart of GlobalFoundries. Many semiconductor stocks only design the chips, then send the plans to foundries that actually do the manufacturing. GFS is one company that’s actually making the electronic devices.

Our chart of the day is this one-year chart of GlobalFoundries. Many semiconductor stocks only design the chips, then send the plans to foundries that actually do the manufacturing. GFS is one company that’s actually making the electronic devices.

GFS currently operates five manufacturing sites: One in Germany, one in Singapore, one in Vermont, and two in New York. GFS is the only scaled pure-play foundry with a global footprint that is not based in China or Taiwan, which helps customers mitigate geopolitical risk and provide greater supply chain certainty.

GFS currently has a P/E of around 20. That seems too low. My Fair Value is a P/E of 35, which would be $78 a share. With the stock around $46, that’s good upside.