Stock (Symbol) |

Oracle (ORCL) |

Stock Price |

$162 |

Sector |

| Technology |

Data is as of |

| May 14, 2025 |

Expected to Report |

| June 9 |

Company Description |

Oracle Corporation offers integrated suites of applications plus secure, autonomous infrastructure in the Oracle Cloud. The Company’s segments include cloud and license, hardware, and services. The cloud and license segment markets, sells and delivers a broad spectrum of enterprise applications and infrastructure technologies through its cloud and license offerings. The hardware segment provides a broad selection of enterprise hardware products and hardware-related software products including Oracle Engineered Systems, servers, storage, operating systems, virtualization, management and other hardware-related software and related hardware support. The services segment helps customers and partners maximize the performance of their investments in Oracle applications and infrastructure technologies. Its products and services are delivered worldwide through a variety of flexible and interoperable IT deployment models. These models include on-premise, cloud-based and hybrid deployments. Source: Refinitiv |

Sharek’s Take |

Oracle (ORCL) is expected to have strong revenue growth in the coming years as its AI services are in high demand. Last qtr the company had its largest booking quarter every by a huge margin as the company added $48 billion to its backlog. Now ORCL’s Remaining Performance Obligations (RPO) balances is $130 billion, up 63% from $80 billion a year earlier. Management expects 31% of total RPO to be recorded as revenue in the next 12 months. Oracle Record AI demand pushed Oracle Cloud Infrastructure revenue up 51% last qtr. Growth in Oracle’s AI segment of its infrastructure business was “extraordinary” as consumption revenue is 3.5x the size it was a year ago. ORCL has a May 31 Fiscal year end. Management expects next year’s revenue growth to accelerate to 15% then grow an additional 20% the year after, That’s big news as revenue grew just 6% last qtr. Oracle (ORCL) is expected to have strong revenue growth in the coming years as its AI services are in high demand. Last qtr the company had its largest booking quarter every by a huge margin as the company added $48 billion to its backlog. Now ORCL’s Remaining Performance Obligations (RPO) balances is $130 billion, up 63% from $80 billion a year earlier. Management expects 31% of total RPO to be recorded as revenue in the next 12 months. Oracle Record AI demand pushed Oracle Cloud Infrastructure revenue up 51% last qtr. Growth in Oracle’s AI segment of its infrastructure business was “extraordinary” as consumption revenue is 3.5x the size it was a year ago. ORCL has a May 31 Fiscal year end. Management expects next year’s revenue growth to accelerate to 15% then grow an additional 20% the year after, That’s big news as revenue grew just 6% last qtr.

Founded in 1977 and incorporated in 2005, Oracle provides products and services that address enterprise information technology (IT) needs through its three business segments: Cloud and License, Hardware, and Services. These offerings address IT needs across on premise, cloud, and hybrid deployment models, enabling flexibility and integration for customers. Key products include Oracle Cloud Infrastructure (OCI), Fusion Cloud Applications, databases, and hardware like Engineered Systems. It also offers professional services to assist its customers in technical tasks. Here are some of ORCL’s Applications Technologies

ORCL’s business segments are:

ORCL’s is the world’s second-largest enterprise software company, known for its strong position in databases and cloud infrastructure. Looking ahead, analysts have an Estimated Long-Term Growth Rate of 11% on the stock. In fiscal 2023, management repurchased $4.7 billion in stock. ORCL also has a dividend yield of 1%. With a P/E of 24, the stock is nicely priced when you consider how much revenue is expected to climb in the coming years. ORCL stock will be added to the Conservative Growth Portfolio tomorrow. |

One Year Chart |

This stock has had big swings during the past year. A few weeks ago I wasn’t hot on the stock after I saw this chart (and profit growth of just 4%). But then I read the earnings call and got bullish on the stock. This stock has had big swings during the past year. A few weeks ago I wasn’t hot on the stock after I saw this chart (and profit growth of just 4%). But then I read the earnings call and got bullish on the stock.

ORCL has a P/E of 24 when we look to next year’s earnings estimates. We are in the company’s Fiscal Q4 so I’m using next year’s (2025) profit estimates to calculate the P/E. Notice the Est. LTG is 11%. That’s a pretty good figure for a conservative stock like this. |

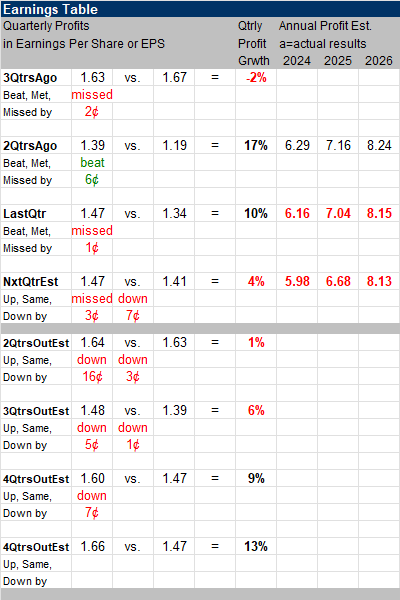

Earnings Table |

Last qtr, Oracle reported 4% profit growth and missed estimates of 6%. Revenue increased 6% year-over-year, missed analyst’s expectation of 8% revenue growth. Operating margin was 43.8%, up from 43.6% a year ago. Total cloud revenue was up 25%. SaaS revenue increased 10% year ago; and IaaS revenue increased 51% from year ago. Last qtr, Oracle reported 4% profit growth and missed estimates of 6%. Revenue increased 6% year-over-year, missed analyst’s expectation of 8% revenue growth. Operating margin was 43.8%, up from 43.6% a year ago. Total cloud revenue was up 25%. SaaS revenue increased 10% year ago; and IaaS revenue increased 51% from year ago.

Oracle is building a gigantic 64,000 GPU liquid-cooled NVIDIA GB 200 cluster for AI training. Also, Oracle’s multi-cloud business at Amazon, Google and Microsoft grew 200% in the last three months alone.GPU consumption for training grew 244% year-over-year. These numbers in the Earnings Table don’t look good. The company missed estimates, and analysts lowered Annual Profit Estimates and qtrly estimates fell hard. Qtrly Profit Estimates are for 1%, 6%, 10%, and 13% growth in the next 4 qtrs. Analyst think revenue will grow 9% next quarter. That would mean accelerated growth from 6% last qtr. |

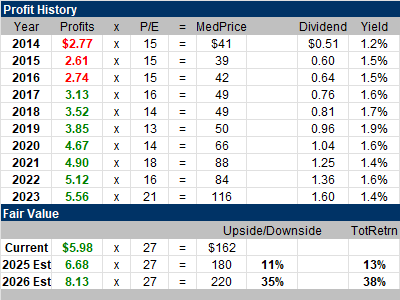

Fair Value |

|

My Fair Value is a P/E of 27, which equates to $180 a share for 2025, giving the stock upside of around 11%. 2027 Fair Value is $220, giving the stock upside of 35%. ORCL has a May 31 Fiscal Year end. I’m calling next year 2025 because it has 7 months in it. |

Bottom Line |

Oracle (ORCL) has been a strong performer over the last decade, with consistent revenue growth, particularly from its cloud services and AI initiatives. Oracle (ORCL) has been a strong performer over the last decade, with consistent revenue growth, particularly from its cloud services and AI initiatives.

ORCL stock has found new life as estimates for the coming years look great. I like this stock because its a tech stock that is also suitable for conservative accounts. ORCL will be added to the Conservative Growth Portfolio. The stock will rank 8th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 22 |

Notice this stock used to have a P/E between 13 and 18. Now the stock has a P/E of 27 when we calculate it using 2024 profit estimates (Current).

Notice this stock used to have a P/E between 13 and 18. Now the stock has a P/E of 27 when we calculate it using 2024 profit estimates (Current).