Stock (Symbol) |

Eli Lilly (LLY) |

Stock Price |

$762 |

Sector |

| Healthcare |

Data is as of |

| April 10, 2024 |

Expected to Report |

| April 30 |

Company Description |

Eli Lilly is a drug manufacturing company. The Company is engaged in the discovery, development, manufacturing, marketing, and sales of pharmaceutical products across the world. Eli Lilly is a drug manufacturing company. The Company is engaged in the discovery, development, manufacturing, marketing, and sales of pharmaceutical products across the world.

The Company’s diabetes products include Baqsimi, Basaglar, Humalog, Humulin, Jardiance, Lyumjev, Trajenta and Trulicity. Its oncology products include Alimta, Cyramza, Erbitux, Retevmo, Tyvyt and Verzenio. The Company’s immunology products consist of Olumiant and Taltz. Its neuroscience products include Cymbalta, Emgality, Reyvow and Zyprexa. Its other therapies consist of Bamlanivimab, etesevimab, Cialis and Forteo. The Company manufactures and distributes its products through facilities in the United States, including Puerto Rico, and about eight other countries. Its products are sold in approximately 120 countries. Its subsidiaries include Acanthas Pharma, Inc., Alnara Pharmaceuticals, Inc., ARMO Biosciences, Inc., and Avid Radiopharmaceuticals, Inc., among others. |

Sharek’s Take |

Eli Lilly’s (LLY) Mounjaro sales zoomed higher last quarter, becoming the company’s #1 drug on the market. LLY has three-billion dollar (per quarter) drugs: Mounjaro, Trulicity, and Verzenio for breat cancer. Mounjaro sales soared 690% year-over-year last quarter. Demand is increasing for this type-2 Diabetes drug, and the company cannot fulfill orders. My Mom is on Moujaro and hasn’t been able to get it for weeks. Lilly has gained approval for the Mounjaro sister drug, Zepbound. Zepbound is prescribed to treat obesity, and was approved by the FDA in November 2023. This is a significant moment for patients and the field because Zepbound is the only treatment approved to activate 2 important hormones, GIP and GLP-1, to address one of the main reasons for excess weight.The medication behind both drugs, Tirzepatide, has proven effective not just for treating type 2 diabetes but also for helping non-diabetic patients lose a remarkable 22.5% of their body weight in 72 weeks. In addition, Mounjaro has shown signs of decreasing heart risk. Eli Lilly seems to have a do-it-all drug that can treat diabetes, help with weight loss, and reduce the risk of a heart attack. Eli Lilly’s (LLY) Mounjaro sales zoomed higher last quarter, becoming the company’s #1 drug on the market. LLY has three-billion dollar (per quarter) drugs: Mounjaro, Trulicity, and Verzenio for breat cancer. Mounjaro sales soared 690% year-over-year last quarter. Demand is increasing for this type-2 Diabetes drug, and the company cannot fulfill orders. My Mom is on Moujaro and hasn’t been able to get it for weeks. Lilly has gained approval for the Mounjaro sister drug, Zepbound. Zepbound is prescribed to treat obesity, and was approved by the FDA in November 2023. This is a significant moment for patients and the field because Zepbound is the only treatment approved to activate 2 important hormones, GIP and GLP-1, to address one of the main reasons for excess weight.The medication behind both drugs, Tirzepatide, has proven effective not just for treating type 2 diabetes but also for helping non-diabetic patients lose a remarkable 22.5% of their body weight in 72 weeks. In addition, Mounjaro has shown signs of decreasing heart risk. Eli Lilly seems to have a do-it-all drug that can treat diabetes, help with weight loss, and reduce the risk of a heart attack.

Eli Lily discovers, develops, manufactures, and markets human pharmaceuticals to approximately 120 countries worldwide. The company was founded in 1876 in Indianapolis Indiana by Colonel Eli Lilly. Eli Lilly’s products are therapies for diabetes, oncology, immunology, and neuroscience. The company just closed on its acquisition of Point Biopharma, which delivers pinpointed radiation to tumors directly. And this past week the company launched LillyDirect which allows patients to get prescriptions online without having to visit a doctor’s office, and ship the drug directly to the patient. Here are the top products of Eli Lilly:

Here are the two potential blockbuster drugs in testing:

Eli Lilly is a super safe stock with a plump Est. LTG of 51% per year, and a dividend yield of 2%. The growth rate is so high because of the Mounjaro potential. Management has raised the dividend every year since 2015. In 2022, management repurchased $1.5 billion in LLY stock and paid $3.5 billion in cash dividends to shareholders. With a P/E of 61, the stock is pretty expensive. LLY is part of the Conservative Growth Portfolio and Growth Portfolio. This stock is extended, but demand exceeding supply is the great signal for the stock long-term. |

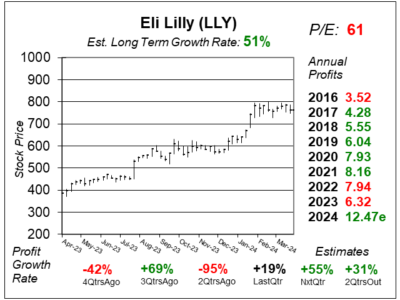

One Year Chart |

A nice looking chart for LLY! It is currently basing between $700 and $800. The stock beat the previous All-Time high of $630 last quarter and reached a new All-Time high of $800. The stock might do another push above All-Time high if the basing continues. A nice looking chart for LLY! It is currently basing between $700 and $800. The stock beat the previous All-Time high of $630 last quarter and reached a new All-Time high of $800. The stock might do another push above All-Time high if the basing continues.

The P/E is at 61. Definitely too high for a drug stock. Qtrly profit growth estimates look really good. The Est. LTG is at 51%. That’s fantastic! Note that’s a long-term profit estimate, some of that is already priced into the stock. |

Earnings Table |

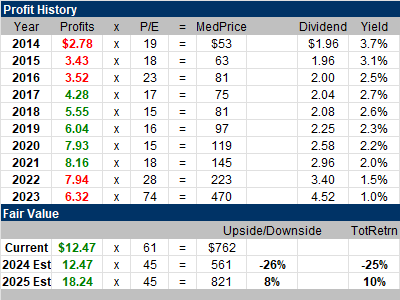

Last qtr, LLY delivered +19% profit growth versus expectations of +33% growth. Revenue grew 28% and beat estimates of 22%. Revenue was driven by increase of 16% due to higher realized prices, 11% in volume. Gross margin increased 31%. Primarily driven by higher realized prices. Note there was a couple one-time charges 2QtrsAgo which took a profit into a loss. That’s fine. Last qtr, LLY delivered +19% profit growth versus expectations of +33% growth. Revenue grew 28% and beat estimates of 22%. Revenue was driven by increase of 16% due to higher realized prices, 11% in volume. Gross margin increased 31%. Primarily driven by higher realized prices. Note there was a couple one-time charges 2QtrsAgo which took a profit into a loss. That’s fine.

US revenue increased 39%, driven by 27% increase in realized prices and a 12% increase in volume. Higher realized prices were driven by Mounjaro, partially offset by lower realized prices for Humalog and Trulicity. Increase in volume was driven by Moujaro, Zepbound, Verzenio, Jardiance and Taltz. Revenue outside US increased 10%, driven by a 10% increase in volume, partially offset by a 3% decrease due to lower realized prices. Annual Profit Estimates slightly improved this qtr. Here are the estimates for the succeeding years. 2024: 12.47 Qtrly profit Estimates are for 55%, 31%, 55%, and 53% profit growth expected the next 4 qtrs. Analysts think that LLY revenue will grow 29% next qtr. |

Fair Value |

My Fair Value P/E remains at 45, which gives us a price of $557 for 2024 and $821 for 2025. LLY stock is $762 this quarter. Investors clearly envision much higher profits in the upcoming years. My Fair Value P/E remains at 45, which gives us a price of $557 for 2024 and $821 for 2025. LLY stock is $762 this quarter. Investors clearly envision much higher profits in the upcoming years.

2027’s profit estimates are $30 per share (in EPS). A P/E of 35 x $30 in profits gives us $1050. Maybe the stock gets past $1000 in a few years? Tirzeparide could b a miracle drug to treat diabetes, weight, and reduce risk of a stroke. So the potential profits are really unknown. Thus, I can’t complain about the high valuation. |

Bottom Line |

Eli Lilly (LLY) was a slow moving stock in the early part of the decade, then the stock started moving up in price in July 2018. Looking at the news at the time, the company announced it would take its Elanco animal health business public and beat revenue estimates due to strength in Trulicity and Humalog. Eli Lilly (LLY) was a slow moving stock in the early part of the decade, then the stock started moving up in price in July 2018. Looking at the news at the time, the company announced it would take its Elanco animal health business public and beat revenue estimates due to strength in Trulicity and Humalog.

Eli Lilly seems overvalued this quarter, but profits could grow behind analyst estimates. So for now, the stock is above its 2024 Fair Value, but is is under its 2025 Fair Value. Looking at the ten-year chart, LLY stock is extended and could break lower in what looks like a stock market correction ahead. LLY ranks 1st in the Conservative Growth Portfolio Power Rankings. The stock moves down from 7th to 9th in the Growth Portfolio Power Rankings. because it’s overvalued right now. Lilly moves from 7th to 8th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

9 of 33Aggressive Growth Portfolio 8 of 14Conservative Stock Portfolio 1 of 25 |