Stock (Symbol) |

Eli Lilly (LLY) |

Stock Price |

$582 |

Sector |

| Healthcare |

Data is as of |

| December 27, 2023 |

Expected to Report |

| February 6 |

Company Description |

Eli Lilly is a drug manufacturing company. The Company is engaged in the discovery, development, manufacturing, marketing, and sales of pharmaceutical products across the world. Eli Lilly is a drug manufacturing company. The Company is engaged in the discovery, development, manufacturing, marketing, and sales of pharmaceutical products across the world.

The Company’s diabetes products include Baqsimi, Basaglar, Humalog, Humulin, Jardiance, Lyumjev, Trajenta and Trulicity. Its oncology products include Alimta, Cyramza, Erbitux, Retevmo, Tyvyt and Verzenio. The Company’s immunology products consist of Olumiant and Taltz. Its neuroscience products include Cymbalta, Emgality, Reyvow and Zyprexa. Its other therapies consist of Bamlanivimab, etesevimab, Cialis and Forteo. The Company manufactures and distributes its products through facilities in the United States, including Puerto Rico, and about eight other countries. Its products are sold in approximately 120 countries. Its subsidiaries include Acanthas Pharma, Inc., Alnara Pharmaceuticals, Inc., ARMO Biosciences, Inc., and Avid Radiopharmaceuticals, Inc., among others. |

Sharek’s Take |

Eli Lilly (LLY) has a new blockbuster drug with its diabetes drug Mounjaro. Now the drug has been approved by the FDA for weight loss under the name Zepbound, and is now available. The medication behind both drugs, Tirzepatide, has proven effective not just for treating type 2 diabetes but also for helping non-diabetic patients lose a remarkable 22.5% of their body weight in 72 weeks. In addition, Novo Nordisk’s similar drug Wegovy reduces the risk of heart attack, stroke, or cardiovascular related death by 20%. Eli Lilly seems to have a do-it-all drug that can treat diabetes, help with weight loss, and reduce the risk of a heart attack. What’s great is now insurance companies will be more likely to cover these drugs under insurance. Together, Mounjaro and Zepbound have the potential to do $30 billion in sales in 2028 (source: IBD). In comparison, LLY is expected to do $34 billion in sales throughout all of 2023. Eli Lilly (LLY) has a new blockbuster drug with its diabetes drug Mounjaro. Now the drug has been approved by the FDA for weight loss under the name Zepbound, and is now available. The medication behind both drugs, Tirzepatide, has proven effective not just for treating type 2 diabetes but also for helping non-diabetic patients lose a remarkable 22.5% of their body weight in 72 weeks. In addition, Novo Nordisk’s similar drug Wegovy reduces the risk of heart attack, stroke, or cardiovascular related death by 20%. Eli Lilly seems to have a do-it-all drug that can treat diabetes, help with weight loss, and reduce the risk of a heart attack. What’s great is now insurance companies will be more likely to cover these drugs under insurance. Together, Mounjaro and Zepbound have the potential to do $30 billion in sales in 2028 (source: IBD). In comparison, LLY is expected to do $34 billion in sales throughout all of 2023.

Eli Lily discovers, develops, manufactures, and markets human pharmaceuticals to approximately 120 countries worldwide. The company was founded in 1876 in Indianapolis Indiana by Colonel Eli Lilly. Eli Lilly’s products are therapies for diabetes, oncology, immunology, and neuroscience. The company just closed on its acquisition of Point Biopharma, which delivers pinpointed radiation to tumors directly. And this past week the company launched LillyDirect which allows patients to get prescriptions online without having to visit a doctor’s office, and ship the drug directly to the patient. Here are the top products of Eli Lilly:

Here are the two potential blockbuster drugs in testing:

Eli Lily is a super safe stock with a plump Est. LTG of 29% per year, and a dividend yield of 2%. The growth rate is so high because of the Mounjaro potential. Management has raised the dividend every year since 2015. In 2022, management repurchased $1.5 billion in LLY stock and paid $3.5 billion in cash dividends to shareholders. With a P/E of 47, the stock is pricey. LLY is part of the Conservative Growth Portfolio. I will add the stock tithe Growth Portfolio and Aggressive Growth Portfolio tomorrow. |

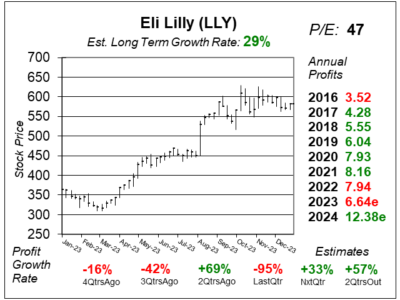

One Year Chart |

LLY jumped from $454 to $522 on August 8 after earnings were released that morning. That was a breakout, and it held which is bullish. Now the stock is basing. I’m wondering if LLY might beat the street in a big way when lex quarter’s earnings are released. The stock is close to its All-Time high of $630 and could break out to new highs with positive news. LLY jumped from $454 to $522 on August 8 after earnings were released that morning. That was a breakout, and it held which is bullish. Now the stock is basing. I’m wondering if LLY might beat the street in a big way when lex quarter’s earnings are released. The stock is close to its All-Time high of $630 and could break out to new highs with positive news.

The P/E is 47. That’s high for a drug stock an assumes a lot of future profits already. Note, this P/E in this chart is based off of 2024 profit estimates. Qtrly profit growth was bad last quarter due to some one-time charges. That’s fine. Growth looks good for the next two quarters. The Est. LTG of 29% is very good. That figure is up from 25% last quarter But its tough to tell what this company is capable of earning in the years to come. |

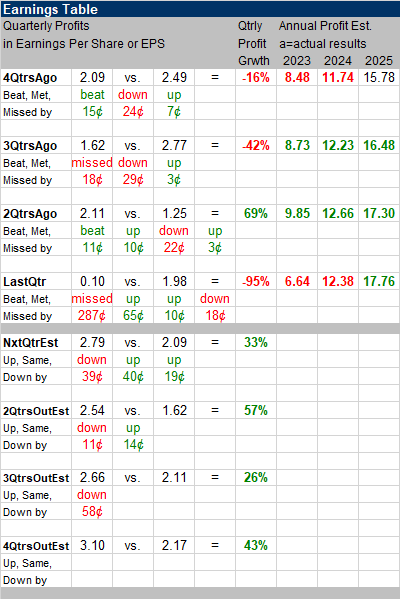

Earnings Table |

Last qtr, LLY delivered -95% profit growth versus expectations of 50% growth. Revenue grew 37% and beat estimates of 28%. Last qtr, LLY delivered -95% profit growth versus expectations of 50% growth. Revenue grew 37% and beat estimates of 28%.

Profit decreased due to one-time charges. Management explained this in the earnings call: “We delivered earnings per share of $0.10 in Q3, a 95% decrease versus Q3 2022, inclusive of an increase of $1.22 of EPS associated with the divestiture of the olanzapine portfolio and a negative impact of $3.29 from the acquired IPR&D charges.” US revenue increased by 21%, driven by 9% increase in product sales and 13% price rise. This growth was due to popular products like Mounjaro, Verzenio, Trulicity, Jardiance, and Taltz, offset somewhat by the absence of revenue from COVID-19 antibodies. Internationally, revenue climbed by 64%, fueled by a 69% increase in sales volume offset by a 7% decrease in prices. Annual Profit Estimates decreased for 2023 due to those one-time charges last qtr qtr. 2026 estimates are $21.09 while 2027 profit estimates are $28.55. Qtrly profit Estimates are for 33%, 57%, 26%, and 43% profit growth expected the next 4 qtrs. Analysts think that LLY revenue will grow 22% next qtr. Note quarterly profit growth is set to accelerate with the added revenue from Mounjaro. I’m wondering if management is being coy on this quarter’s potential. |

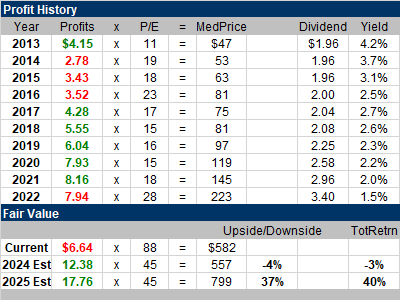

Fair Value |

My Fair Value P/E is 45, which works out to $557 for 2024. With the stock at $582 this quarter, it seems slightly overvalued. My Fair Value P/E is 45, which works out to $557 for 2024. With the stock at $582 this quarter, it seems slightly overvalued.

2025 Fair Value is $799 a share, equating to 37% upside. But I’m not confident in this assessment. A 45 P/E is high for a drug company. 2027 profit estimates are $28.55. A 35 P/E on that would be $999. But that profit estimate could be way off. |

Bottom Line |

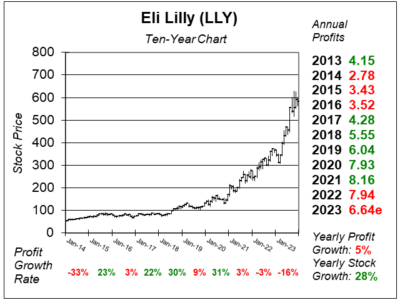

Eli Lilly (LLY) was a slow moving stock in the early part of the decade, then the stock started moving up in price in July 2018. Looking at the news at the time, the company announced it would take its Elanco animal health business public and beat revenue estimates due to strength in Trulicity and Humalog. Eli Lilly (LLY) was a slow moving stock in the early part of the decade, then the stock started moving up in price in July 2018. Looking at the news at the time, the company announced it would take its Elanco animal health business public and beat revenue estimates due to strength in Trulicity and Humalog.

Eli Lilly has great growth opportunity, but a lot of that is already priced in. Still, as investors we often underestimate the potential of a catalyst. Perhaps that’s the case here. LLY ranks 1st in the Conservative Growth Portfolio Power Rankings. The stock will rank 7th in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

7 of 34Aggressive Growth Portfolio 7 of 17Conservative Stock Portfolio 1 of 30 |