Stock (Symbol) |

Intuit (INTU) |

Stock Price |

$610 |

Sector |

| Financial |

Data is as of |

| April 1, 2025 |

Expected to Report |

| May 21 |

Company Description |

Intuit Inc. offers financial technology platform that helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services. Intuit Inc. offers financial technology platform that helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services.

It operates through four segments: Small Business & Self-Employed, Consumer, Credit Karma and ProTax. The Small Business & Self-Employed segment serves small businesses and the self-employed around the world, and the accounting professionals who assist and advise them. Its offerings include QuickBooks financial and business management online services and desktop software, payroll solutions, time tracking, merchant payment processing solutions, and financing for small businesses. Consumer segment serves consumers and includes do-it-yourself and assisted TurboTax income tax preparation products and services. Credit Karma segment serves consumers with a personal finance platform that provides personalized recommendations of credit card, home, auto and personal loans, and insurance products. Source: Refinitiv |

Sharek’s Take |

Intuit’s (INTU) AI-driven platform, Intuit Assist, drove growth last quarter as the company delivered 26% profit growth on 17% revenue growth. Intuit Assist combines AI and human expertise to digitize processes for the customer. Intuit Assist automates tasks and workflows and connects customers to over 12,000 AI‑powered experts. On the tax side, Intuit brought TurboTax and Credit Karma together to make filing taxes faster and more personalized. DIY users could now pull info from 90% of the most common forms, and those getting help were matched with an expert in seconds and got their taxes done in under two hours. Intuit’s (INTU) AI-driven platform, Intuit Assist, drove growth last quarter as the company delivered 26% profit growth on 17% revenue growth. Intuit Assist combines AI and human expertise to digitize processes for the customer. Intuit Assist automates tasks and workflows and connects customers to over 12,000 AI‑powered experts. On the tax side, Intuit brought TurboTax and Credit Karma together to make filing taxes faster and more personalized. DIY users could now pull info from 90% of the most common forms, and those getting help were matched with an expert in seconds and got their taxes done in under two hours.

Intuit makes financial, accounting, and tax software for individuals and small businesses. The company founded in 1983 and its first product was Quicken, a personal budgeting tool. Over the years, Intuit became well known for other popular products like QuickBooks, used by small businesses for accounting, and TurboTax, which helps people prepare and file their taxes. As of fiscal 2024, the company serves approximately 100 million customers. Intuit’s flagship products include:

Intuit has four operating segments:

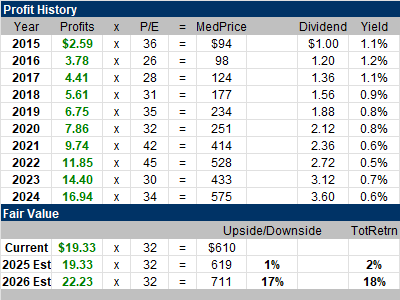

Intuit has a remarkable track record in growing profits on an annual basis. During the past two decades, profits (EPS) hit record highs every year except 2015 and 2009. Further back, INTU didn’t hit record profits in 2000, 2001 or 2002 as its software was sold in boxes on retail shelves and people cut back on spending after the 2000 stock market crash. Analysts give the stock an Estimated Long-Term Growth Rate of 14% a year, and INTU has a dividend yield of less than 1%. In Fiscal 2024, INTU paid $3.60 per share in dividends, totaling $1.0 billion, up from $3.12 per share or $900 million in 2023. INTU will be added to the Conservative Portfolio. |

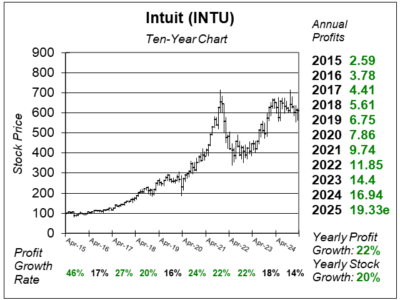

One Year Chart |

INTU stock has been expensive for a while now. That’s why its been trending lower. Software companies often have high valuations (P/Es) due to recurring annual revenue. INTU stock has been expensive for a while now. That’s why its been trending lower. Software companies often have high valuations (P/Es) due to recurring annual revenue.

Notice profits were up every year. I think the stock is where it’s supposed to be with a P/E of 32. My Fair Value is a P/E of 32. The Est. LTG is 14%. Not quite the 15% growth rate I look for in growth stocks, but this is a healthy growth rate for a conservative stock. Qtrly profit growht has been erratic. But the average for the past four qtrs is a healthy 15%. |

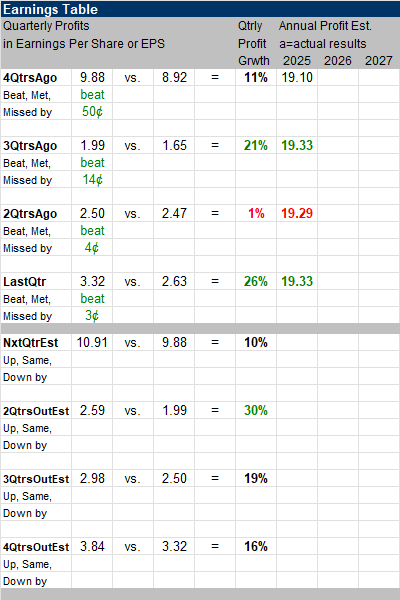

Earnings Table |

Last qtr, Intuit delivered 26% profit growth and beat estimates of 25%. Revenue was up 17%, year-on-year. Last qtr, Intuit delivered 26% profit growth and beat estimates of 25%. Revenue was up 17%, year-on-year.

There are some good highlights in the earnings call:

Annual Profit Estimates increased for 2025. Note 2026 estimates are $22.21 and 2027’s are $25.29. Qtrly Profit Estimates are for 10%, 30%, 19%, and 16% growth the next 4 qtrs. These are nice, healthy numbers. For the next qtr, analysts estimate sales growth will be 12%. |

Fair Value |

My Fair Value P/E is 32, which gives us a price of target of $619 for 2025. Note these charts and tables were done 4/1 when the stock was $610. Today, 4/14, INTU is $587 (as of Friday’s close). My Fair Value P/E is 32, which gives us a price of target of $619 for 2025. Note these charts and tables were done 4/1 when the stock was $610. Today, 4/14, INTU is $587 (as of Friday’s close).

This stock isn’t a value. But it seems like a mid-teens grower and those are hard to come by. |

Bottom Line |

Intuit (INTU) has a very nice ten-year chart. The stock went on a parabolic move higher in 2021 as a lot of stocks did. The stock then pulled back, digested its gains, and has now pushed higher again. Intuit (INTU) has a very nice ten-year chart. The stock went on a parabolic move higher in 2021 as a lot of stocks did. The stock then pulled back, digested its gains, and has now pushed higher again.

INTU is a quality company with a nice recurring revenue stream. It’s products are segment leaders, and I like how the company can raise prices a little each year if they want. INTU will be added to the Conservative Portfolio. The stock will rank 12th of 22 stocks in this portfolio’s Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Growth Portfolio 12 of 22 |