Stock (Symbol) |

CrowdStrike (CRWD) |

Stock Price |

$490 |

Sector |

| Technology |

Data is as of |

| October 3, 2025 |

Expected to Report |

| November 24 |

Company Description |

CrowdStrike provides cloud-delivered solutions for endpoint and cloud workload protection via a software-as-a-service (SaaS) subscription-based model. CrowdStrike provides cloud-delivered solutions for endpoint and cloud workload protection via a software-as-a-service (SaaS) subscription-based model.

The Company offers Falcon platform in a SaaS subscription-based model, which delivers integrated, technologies that deliver protection and performance, while reducing customer complexity. The Company’s Falcon platform leverages a single lightweight-agent architecture with integrated cloud modules spanning multiple security markets, including corporate workload security, managed security services, security and vulnerability management, information technology (IT) operations management, threat intelligence services, identity protection and log management. It also offers approximately 22 cloud modules on its Falcon platform, which include Falcon Prevent, Falcon Insight, Falcon Device Control, Falcon Firewall Management, Falcon XDR, Falcon Discover, Falcon Spotlight and others. Source: Refinitiv |

Sharek’s Take |

In last quarter’s earnings call, CrowdStrike (CRWD) saw strong growth in its identity security business as companies deal with new risks from AI. The main risk is cyberhacks with AI agents. Management stated demand is rising sharply as more AI systems are acting like users (agentic identities or AI-driven accounts and systems) and enter the workplace, creating new risks of misuse and breaches. To handle this agentic identities, CrowdStrike launched its Next-Gen Identity Protection, which now protects both people and AI systems. Including Falcon Shield, the company’s Next-Gen Identity Protection business grew 21% year-over-year, as more customers look to reliable ways to secure their data. The company recently introduced a new Privileged Access Management (PAM) tool to replace old, expensive systems helping companies cut costs and make their security setup easier. Together, these new tools highlight how CrowdStrike is becoming a key player in protecting identities in the AI era. In last quarter’s earnings call, CrowdStrike (CRWD) saw strong growth in its identity security business as companies deal with new risks from AI. The main risk is cyberhacks with AI agents. Management stated demand is rising sharply as more AI systems are acting like users (agentic identities or AI-driven accounts and systems) and enter the workplace, creating new risks of misuse and breaches. To handle this agentic identities, CrowdStrike launched its Next-Gen Identity Protection, which now protects both people and AI systems. Including Falcon Shield, the company’s Next-Gen Identity Protection business grew 21% year-over-year, as more customers look to reliable ways to secure their data. The company recently introduced a new Privileged Access Management (PAM) tool to replace old, expensive systems helping companies cut costs and make their security setup easier. Together, these new tools highlight how CrowdStrike is becoming a key player in protecting identities in the AI era.

CrowdStrike is one of the world’s largest cybersecurity companies, serving 556 of the Global 2000, 271 of the Fortune 500, and 15 of the top US banks as of January 21, 2023. The company provides crowd-sourced security, which is software that learns from cyberattacks. The company has a threat intel platform that is spying on customer traffic. When one customer gets hit by an attempted cyberattack, CRWD sees this first attack and can strike the threat for all its customers. CRWD is about endpoint protection for PCs, laptops, iPads, and mobile phones. This is defending the hardware at the end of the internet, like when Norton became famous with PC protection. On the other hand, Zscaler protects the traffic that flows. Crowdstrike is #1 in endpoint market share, ahead of Microsoft (source: Canalys). Charlotte AI is cybersecurity for AI agents. It is an intelligent assistant tha helps users quickly understand and respond to cyber threats by using advanced security data, making it easier for cybersecurity teams to protect systems without needing deep technical skills. Charlotte AI increases CrowdStrike’s total addressable market each and every day, as its a new product. CRWD’s products are modules that can be packaged or bought separately. As of last qtr, the company had 28 modules, including:

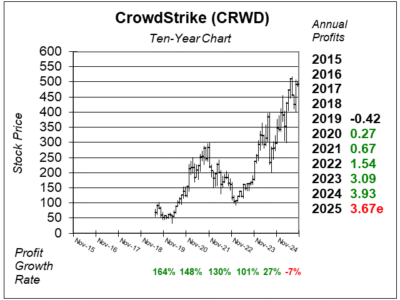

CrowdStrike is one of the fastest-growing publicly traded companies with great growth opportunities ahead. CRWD was the second fastest cloud-native software as a service company (SaaS) to reach over $2 billion in ARR, behind only Zoom (ZI). And last year the company did $4 billion in annual revenue, keeping the company on pace for $10 billion a year in 2029. CRWD is part of the Growth Portfolio. The stock has been so hot lately that it seems overvalued. |

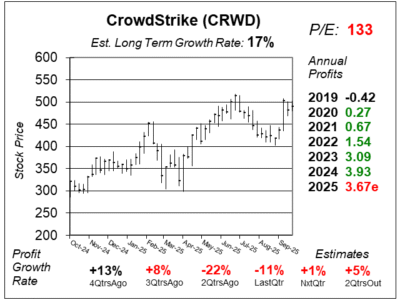

One Year Chart |

Quarterly profit growth has simmered down due to CRWD giving customer discounts or incentives after an update took down some computer systems. Investors don’t seem to mind as the stock is around All-Time highs. Quarterly profit growth has simmered down due to CRWD giving customer discounts or incentives after an update took down some computer systems. Investors don’t seem to mind as the stock is around All-Time highs.

The P/E is high at 133. The P/E was 140 last quarter. I value CRWD on a price-to-revenue basis, my valuation analysis is below. The Est. LTG of 17% is up from 14% last qtr. But revenue increased 21% last qtr and in normal conditions I feel that should convert into 25% profit growth. I feel CRWD is a 25% profit grower. Notice CRWD’s Annual Profits used to climb briskly. |

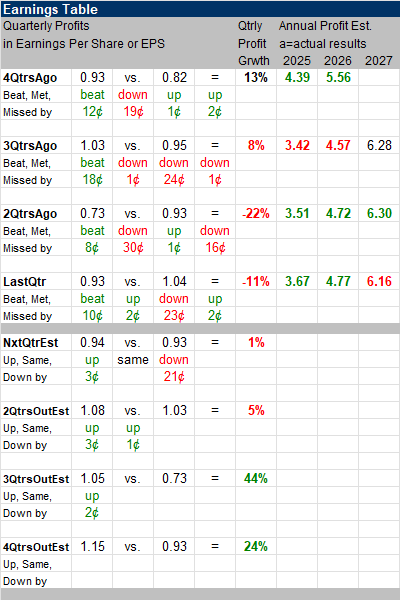

Earnings Table |

Last qtr, CrowdStrike posted -11% profit growth and beat expectations of -20%. Revenue increased 21% and beat analyst’s expectations of 19%. Operating margin was 22% compared to 25% a year ago. Last qtr, CrowdStrike posted -11% profit growth and beat expectations of -20%. Revenue increased 21% and beat analyst’s expectations of 19%. Operating margin was 22% compared to 25% a year ago.

Annual Profit Estimates increased this quarter. For 2025, management expects revenue to grow ~21%. Qtrly Profit Estimates are 1%, 5%, 44%, and 24% profit growth for the next 4 qtrs. Profit growth looks to be coming back in a big way, but keep in mind comparisons from the past year should be easy. Analysts expect revenue to grow 20% next qtr. |

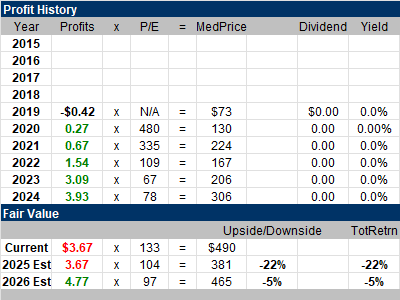

Fair Value |

I price CRWD stock on a multiple of annual revenue estimates. This qtr the stock is $490 a share, and sells for 26x 2025 revenue estimates. My Fair Value is 20x revenue estimates. I price CRWD stock on a multiple of annual revenue estimates. This qtr the stock is $490 a share, and sells for 26x 2025 revenue estimates. My Fair Value is 20x revenue estimates.

Current: 2025 Est: 2026 Est: |

Bottom Line |

CrowdStrike (CRWD) stock has had a volatile history. When I look back to my CRWD 2021 Q3 research report when the shares were $271, the stock sold for 43x 2021 revenue estimates. In retrospect, that was too high. Then in 2023 Q2 it sold for 11x revenue, which was too low. I think 20x revenue is just right. CrowdStrike (CRWD) stock has had a volatile history. When I look back to my CRWD 2021 Q3 research report when the shares were $271, the stock sold for 43x 2021 revenue estimates. In retrospect, that was too high. Then in 2023 Q2 it sold for 11x revenue, which was too low. I think 20x revenue is just right.

CrowdStrike is one of the top cybersecurity companies. But its stock is a little lofty as tech stocks are hot this year. CRWD ranks 28th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

28 of 32Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |