Stock (Symbol) |

Credo Technology (CRDO) |

Stock Price |

$145 |

Sector |

| Technology |

Data is as of |

| September 25, 2025 |

Expected to Report |

| December 1 |

Company Description |

Credo Technology Group Holding Ltd delivers high-speed solutions to break bandwidth barriers on every wired connection in the data infrastructure market. Credo Technology Group Holding Ltd delivers high-speed solutions to break bandwidth barriers on every wired connection in the data infrastructure market.

It provides high-speed connectivity solutions that deliver improved power efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market. Its connectivity solutions are optimized for optical and electrical Ethernet applications, including the emerging 100 gigabits per second (G), 200G, 400G, 800G and the emerging 1.6 terabits per second (T) port markets. Its products are based on its Serializer/Deserializer (SerDes) and Digital Signal Processor (DSP) technologies. Its product families include integrated circuits (ICs) for the optical and line card markets, active electrical cables (AECs) and SerDes Chiplets. The Company’s intellectual property (IP) solutions consist primarily of SerDes IP licensing. Source: Refinitiv |

Sharek’s Take |

Credo Technology (CRDO) saw surging demand for its high-speed, energy-efficient cables and chips as big tech companies and data centers race to build more AI infrastructure. Last qtr, the company managed to deliver 1200% profit growth on 274% revenue growth, both astounding numbers. A big driver is Credo’s Active Electrical Cables (AECs), which are 1000x more reliable than traditional optical solutions and use about the half power, making them perfect for the massive AI clusters being built. Old, thick, black copper cables take a lot of space on the rack. So much space they block air flow, making it harder to cool the rack. Credo’s purple HiWire AEC’s are thinner, with 1/4 the volume and weight of traditional cables. Major cloud providers are already big customers and customer adoption is broadening quickly, with three hyperscalers each contributing over 10% of revenue, and a fourth on the way. Management stated this growing demand puts the company in a strong position to power the next wave of AI data centers across both cable and chip solutions. Credo Technology (CRDO) saw surging demand for its high-speed, energy-efficient cables and chips as big tech companies and data centers race to build more AI infrastructure. Last qtr, the company managed to deliver 1200% profit growth on 274% revenue growth, both astounding numbers. A big driver is Credo’s Active Electrical Cables (AECs), which are 1000x more reliable than traditional optical solutions and use about the half power, making them perfect for the massive AI clusters being built. Old, thick, black copper cables take a lot of space on the rack. So much space they block air flow, making it harder to cool the rack. Credo’s purple HiWire AEC’s are thinner, with 1/4 the volume and weight of traditional cables. Major cloud providers are already big customers and customer adoption is broadening quickly, with three hyperscalers each contributing over 10% of revenue, and a fourth on the way. Management stated this growing demand puts the company in a strong position to power the next wave of AI data centers across both cable and chip solutions.

Credo Technology Group provides high-speed and power-efficient connectivity solutions for the data infrastructure market. The company’s products serve the hyperscale data center, AI compute, enterprise networking, and edge computing markets. Credo specializes in energy-efficient, high-performance SerDes (Serializer/Deserializer) and optical DSPs (Digital Signal Processor), which are foundational to unlocking the bandwidth demands of AI and cloud infrastructure. Credo is benefiting from a surge in demand tied to the AI build out cycle. Management has emphasized the acceleration of optical interconnect adoption, which is crucial for high-speed links between AI servers. Credo’s product portfolio includes:

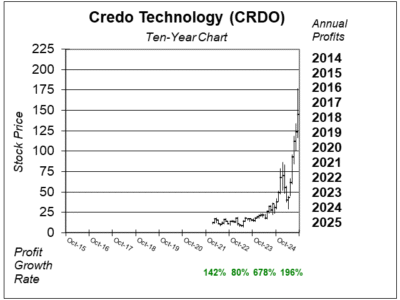

Credo is a recent IPO from January 2022. The stock has been on a wild ride recently, and is currently around its highs. The stock has an Estimated Long-Term Growth Rate of 187%, but I think that’s too high. CRDO stock will be purchased for the Growth Portfolio and Aggressive Growth Portfolio today. |

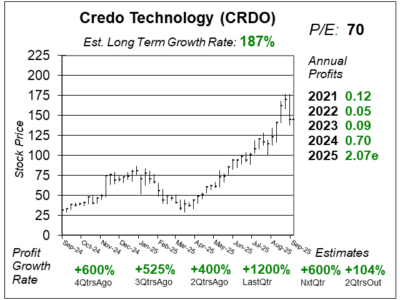

One Year Chart |

I just bought CRDO stock for clients on June 16 around $79 a share. Today, 10/16, it closed at $136. It’s been a hot time period for AI infrastructure stocks. Note the charts and tables in this article are from 9/25 when CRDO was $145. I just bought CRDO stock for clients on June 16 around $79 a share. Today, 10/16, it closed at $136. It’s been a hot time period for AI infrastructure stocks. Note the charts and tables in this article are from 9/25 when CRDO was $145.

The Est. LTG is 187% this qtr, up from 172% last qtr. That’s insanely high! Note, that’s an analyst estimate of what profits could grow over the next 3-5 years, not estimated stock growth. The P/E of 70 is what I imagine a rapid grower like this should be selling for. Qtrly profit growth has been excellent and Estimates are looking good! Notice the company is projected to maintain triple-digit profit growth. Top stocks often have triple-digit growth. |

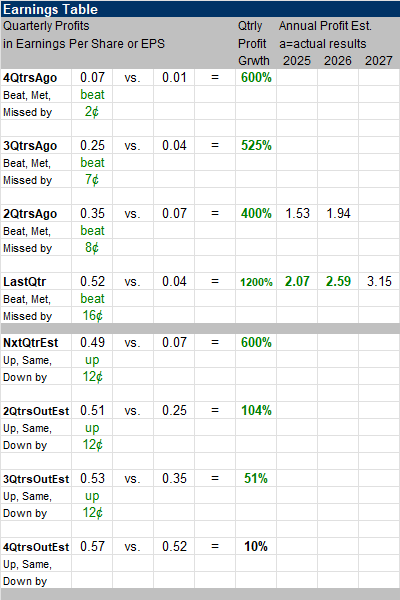

Earnings Table |

Last qtr, Credo generated 1200% profit growth and beat estimates of 800%. Revenue increased 274% year-on-year, beat analyst’s expectation of 218%. Profits just went from $0.07 to $0.25 to $0.35 to $0.52 during the past four quarters! Gross margin was 67.6%, compared to 62.9% a year ago. Operating Margin was 43.1%, compared to 3.7% a year ago. Last qtr, Credo generated 1200% profit growth and beat estimates of 800%. Revenue increased 274% year-on-year, beat analyst’s expectation of 218%. Profits just went from $0.07 to $0.25 to $0.35 to $0.52 during the past four quarters! Gross margin was 67.6%, compared to 62.9% a year ago. Operating Margin was 43.1%, compared to 3.7% a year ago.

Annual Profit Estimates jumped this qtr. Ballooning profit estimates are a characteristic top stocks often possess. Qtrly Profit Estimates for the next 4 qtrs are 600%, 104%, 51%, and 10%. Note that 4QtrsOut estimate needs time to adjust as last qtr was so strong. Analysts think revenue will grow 226% next qtr. |

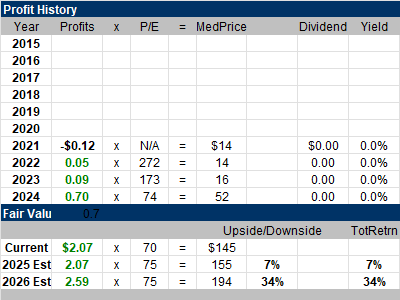

Fair Value |

This qtr, CRDO has a P/E of 70, with the stock priced at $145 a share. Note, PE was just 47 last qtr. This qtr, CRDO has a P/E of 70, with the stock priced at $145 a share. Note, PE was just 47 last qtr.

My Fair Value P/E is 75, up from 65, which is $155 a share, giving the stock upside of 7%. Upside for 2026 is a solid 34%. So I feel CRDO stock might take a breather. The key when analyzing this stock is what might the company make in profits? 2025 estimates just jumped from around $1.50 to ~$2.00. |

Bottom Line |

Credo Technology (CRDO) has its IPO in 2022 and opened at $12 a share. The stock had its big breakout in October 2024 as it pushed past $40. Then it doubled, got cut in half, and has since gone parabolic. Credo Technology (CRDO) has its IPO in 2022 and opened at $12 a share. The stock had its big breakout in October 2024 as it pushed past $40. Then it doubled, got cut in half, and has since gone parabolic.

Credo’s HiWire AEC purple cables are the rage right now for hyperscalers. Revenue is set to triple next quarter, which is incredible for a company selling physical products. The only issue is the stock’s on a parabolic run and could come back down due to profit taking. CRDO moves down from 4th to 6th in the Growth Portfolio Power Rankings. 2025 upside has fallen from 38% last qtr to 7% this qtr due to the stock’s strong move higher. CRDO ranks 3rd in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

6 of 32Aggressive Growth Portfolio 3 of 14Conservative Stock Portfolio N/A |