Stock (Symbol) |

Cadence Design Systems (CDNS) |

Stock Price |

$266 |

Sector |

| Technology |

Data is as of |

| July 24, 2024 |

Expected to Report |

| October 21 |

Company Description |

Cadence Design Systems, Inc. is an electronic system designing company. Cadence Design Systems, Inc. is an electronic system designing company.

The Company’s Custom IC Design and Simulation offerings are used by its customers to create schematic and physical representations of circuits down to the transistor level for analog, mixed-signal, custom digital, memory and radio frequency (RF) designs. Its Digital IC Design and Signoff solutions are used to create logical representations of a digital circuit or an integrated circuit (IC) that can be verified for correctness prior to implementation. The Company’s Functional Verification products are used by its customers to verify that the circuitry or the software they have designed is consistent with the functional specification. Its IP offerings consist of pre-verified, customizable functional blocks. Its System Design and Analysis offerings are used by its customers to develop printed circuit boards (PCBs) and advanced IC packages and to analyze electromagnetic, electro-thermal and other multi-physics effects. Source: Refinitiv |

Sharek’s Take |

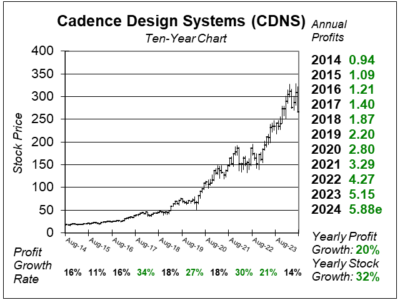

Cadence Design Systems’ (CDNS) stock is settling down after a strong move higher. This big jump — from $225 to $325 with a year — was made possible by investors who are optimistic about the future of Artificial Intelligence as Cadence’s software is used to make semiconductors. More recently, chip stocks have been weak, and that’s a main reason for the stock’s pullback. In addition, CDNS has been delivering some weak growth figures. Last qtr the company delivered just 5% profit growth on 9% revenue growth. That’s not much growth for a stock with a plump P/E of 45. But on the bright side, the stock is not overvalued anymore, so this is an opportunity for investors to buy in, just not at a discount. Cadence Design Systems enables its customers to design electronics including smartphones, computers, autonomous driving systems, cloud data centers equipment, AI systems, medical equipment, as well as aerospace and defense systems. The company offers software, hardware, services, and reusable integrated circuit (IC) blocks to help customers develop complex electronic devices and systems, as well as conduct verification tasks to ensure that systems are working correctly. Partners include NVIDIA which is using Cadence for data analysis, system analysis, and AI, as well as Tesla which deploys Cadence solutions for the development of its Dojo AI supercomputer. Cadence recently launched the 3rd generation of its Dynamic Due combination of Palladium Z3 emulation and Protium X3 prototyping platforms. This hardware offers higher performance and increased capacity for AI computing, autonomous driving, and 5G. The Palladium Z3 emulation and Protium Xs prototyping platforms deliver more than 2x the capacity and 1.5x the performance of the prior generation. The 1st generation Z1 and X1 were launched in 2015, and the 2nd generation was introduced in 2021. NVIDIA uses the Z2 to design Blackwell. But manufacturing teams need time to build inventory of the new system, thus management sees hardware revenue weighed more towards the 2nd half of 2024. Here are the company’s main segments, with stats from last qtr:

CDNS has been an amazing stock this past decade as its climbed more than ten-fold in price. The stock has an Estimated Long-Term-Growth Rate of 17%, and the company seems to be growing profits at around that rate now. Management does not pay dividends but repurchases stock. CDNS on the radar for the Growth Portfolio. With a P/E of 45, the stock seems fairly valued. I’d love to see the shares pull back so I can buy in. |

One Year Chart |

These charts and tables in those post are from 7/24. I’ve been monitoring the stock, looking to get in at a discount. But the shares have since risen from $266 to $281. I’ll keep waiting. These charts and tables in those post are from 7/24. I’ve been monitoring the stock, looking to get in at a discount. But the shares have since risen from $266 to $281. I’ll keep waiting.

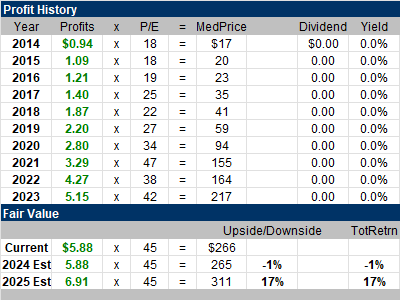

The stock has a P/E of 45, Which is around where I think it should be. The Est. LTG is 17%. That’s a nice growth rate, but not an exceptional one. 45x earnings for a 17% grower makes this stock rich. |

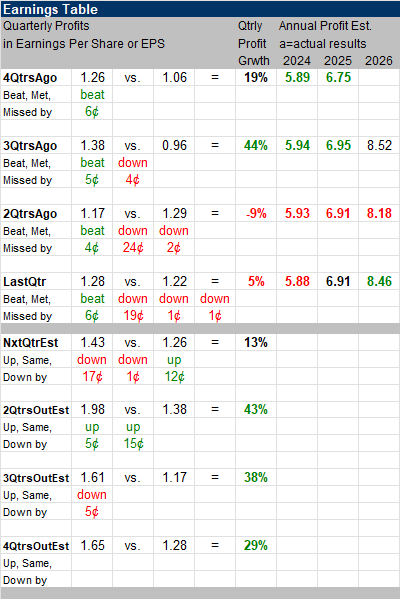

Earnings Table |

Last quarter, profit grew 5% and beat estimates 0f 0%. Revenue of $1.061 billion, compared to $977 million in year ago or a revenue growth of 9%. Operating margin was 40% compared to 42% a year ago. Last quarter, profit grew 5% and beat estimates 0f 0%. Revenue of $1.061 billion, compared to $977 million in year ago or a revenue growth of 9%. Operating margin was 40% compared to 42% a year ago.

Bookings were stronger than expected, giving the company a healthy backlog. In the earnings call, management stated generational trends such as hyperscale computing, 5G, and autonomous driving are driving strong design activity, especially in dacacenter and automotive. Annual Profit Estimates are mixed this quarter. Checkout these annual estimates for the upcoming years: 2024: $5.88 Qtrly Profit Estimates are 13%, 43%, 38%, and 29%, for the next 4 qtrs. Analysts expect revenue to increase 15% next quarter. Notice quarterly profit estimates are for profits to vault higher. |

Fair Value |

My Fair Value P/E is 45, or a stock price of $265. The current P/E is 45, so I feel the stock around where it should be. My Fair Value P/E is 45, or a stock price of $265. The current P/E is 45, so I feel the stock around where it should be.

For 2025 I have 17% upside. |

Bottom Line |

Cadence Design Systems (CDNS) has been a publicly traded company since 1998, but the stock only started growing at a faster pace in 2017 when it broke out at $30. Last quarter the ten ywar chart was perfect. Too perfect. Now we see a little correction, but it doesn’t seem like the stock’s fallen enough. Cadence Design Systems (CDNS) has been a publicly traded company since 1998, but the stock only started growing at a faster pace in 2017 when it broke out at $30. Last quarter the ten ywar chart was perfect. Too perfect. Now we see a little correction, but it doesn’t seem like the stock’s fallen enough.

Gosh, I wish this stock would have pulled back a little more so I could buy in. Now the shares are off their lows and I missed a good opportunity. CDNS is on the radar for the Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |