In the stock market today, technology, energy and consumer discretionary sectors led the upside.

In the stock market today, technology, energy and consumer discretionary sectors led the upside.

Overall, the S&P 500 rose 1.5% to 3903, while the NASDAQ grew 2.3% to 11621.

David Sharek, the Founder of The School of Hard Stocks, thinks that the Bear Market is over.

Stocks were very strong today across the board. Every stock in our Growth Portfolio was up on the day. This chart action makes me think the Bear Market is over.

Tweet of the Day

$GTLB Needham Starts at Buy

“We initiate coverage of GitLab with a Buy rating and a $70 Price Target. The company delivers a single application to drive cross-function collaboration and improve customer efficiencies for Application Development processes. We believe GitLab is..

— Kaushik (@BigBullCap) July 7, 2022

Chart of the Day

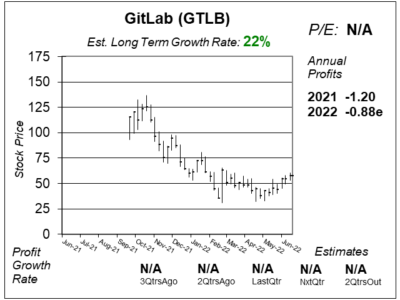

Our chart of the day is the one-year chart of GitLab (GTLB).

GTLB operates under a DevOps Platform. It is a single end-to-end unified application that brings together development, operations, information technology, security and business teams. Basically, GTLB allows their customers/organizations to build and optimize software development, while intensifying security.

GTLB is a recent IPO. This young company isn’t making a profit yet, so I price it on a price-to-sales basis. My Fair Value is 20x revenue, or $54 a share. The stock sold for 21x revenue as of July 6, 2022 at $58, thus I think the stock was fairly valued here.

The Estimated Long-Term Growth (Est. LTG) Rate of 22% is modest and I think it should be higher.

GTLB will be on the radar for the Aggressive Growth Portfolio. This stock could be a future market leader for the next Bull Market. The company reports profits on August 3, and a strong report could cause the stock to break out. If that happens, I’ll look to be a buyer.