Stock (Symbol) |

Arm (ARM) |

Stock Price |

$160 |

Sector |

| Technology |

Data is as of |

| February 18, 2025 |

Expected to Report |

| May 7 |

Company Description |

Arm Holdings plc is a semiconductor intellectual property (IP) company. The Company develops and licenses IP for various devices worldwide, and it provides development tools that accelerate product development, from sensors to smartphones to servers. Its central processing unit (CPUs) and nomenclature for properties and units (NPUs) include Cortex-A, Cortex-M, Cortex-R, Neoverse, Ethos and SecurCore. It provides processor IP, offering a range of cores to address the performance, power and cost requirements of every device, from Internet of things sensors to supercomputers, and from smartphones and laptops to autonomous vehicles. Its graphics and camera technology drives the visual experience across a range of devices, including mass-market to high-performance smartphones, Android OS-based tablets, and digital televisions. It provides foundation physical IP and processor implementation solutions to address the performance, power and cost requirements for all application markets. Source: Refinitiv |

Sharek’s Take |

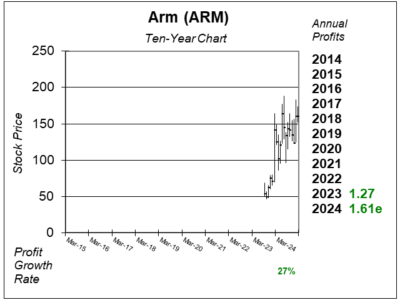

Arm (ARM) is a high-risk, high-reward stock in this shaky stock market. During February 2024, recent IPO ARM stock jumped from $71 to $141 on high volume and grabbed investors attention. Now, a year later, the stock is around $160 and investors wonder if the stock can go on another strong move. Last quarter, Arm reported 34% profit growth on 19% revenue growth driven by strong AI-related demand, widespread adoption of its v9 architecture, and Compute Subsystems (CSS): Arm (ARM) is a high-risk, high-reward stock in this shaky stock market. During February 2024, recent IPO ARM stock jumped from $71 to $141 on high volume and grabbed investors attention. Now, a year later, the stock is around $160 and investors wonder if the stock can go on another strong move. Last quarter, Arm reported 34% profit growth on 19% revenue growth driven by strong AI-related demand, widespread adoption of its v9 architecture, and Compute Subsystems (CSS):

Arm is the industry leader in building CPUs. The company architects, develops and licenses energy-efficient CPU products and technology for semiconductor and Original Equipment Manufacturers (OEM) to develop products. Arm was founded in 1990 as a joint venture of Acorn Computers, Apple, and VLSI technology. The goal was to develop a processor that is:

Arm was instrumental in the evolution of mobile phones into smartphones. Today, Arm CPUs run the vast majority of the world’s software, including the operating systems and applications for smartphones, smartwatches, tablets, PCs, drones, automobiles, and data centers (source: Company Prospectus). Management estimates it has around 50% market share. Arm has shipped more than 285 billion chips since inception, including over 99% of the world’s smartphones. 18 million software developers use Arm. The company also has partnerships with third party hardware and software companies, including app developers and game engine vendors. Organizations build prototype chips to using Arm’s vast chip design portfolio of technology and tools. Arm licensing fees give the company economies of scale allowing the company to charge each license only a fraction of what it would cost to build internally. Licensing Technology:

The company’s new Arm9 is the company’s ninth version of the Arm architecture. Armv9 is expected to replace most Armv8 chips in smartphones, servers, consumer electronics and most automotive applications. Chips based on Armv9 can command a substantially higher royalty per chip than previous generations. So profit growth expectations are high for the coming years, with the Estimated Long Term Growth Rate at 25%. But the stock is super expensive. The P/E is 100. Part of the reason the stock is so high is there is little shares to buy, as SoftBank owned 90% of the shares in February 2024. ARM is on the radar for the Growth Portfolio. |

One Year Chart |

ARM stock established a strong base between $125 and $150 levels before breaking out. Now the stock is in a $150 – $175 range. The tech stock market has been very weak recently, I like this stock’s resiliency. ARM stock established a strong base between $125 and $150 levels before breaking out. Now the stock is in a $150 – $175 range. The tech stock market has been very weak recently, I like this stock’s resiliency.

The Est. LTG dropped to 25% from 31% 2QtrsAgo. That’s still a solid figure. The P/E is 100. That’s too expensive. Qtrly profit growth is looking good.Just not consistent. |

Earnings Table |

Last qtr, Arm delivered 34% profit growth last qtr versus expectations of 17%. Revenue increased 19% year-over-year and beat analyst’s expectations of 15%. Operating margin increased to 45.0% from 43.8% in year ago period. Last qtr, Arm delivered 34% profit growth last qtr versus expectations of 17%. Revenue increased 19% year-over-year and beat analyst’s expectations of 15%. Operating margin increased to 45.0% from 43.8% in year ago period.

Royalty revenue from chips for smartphones, the data center, networking equipment, and automotive were all within expectations, while royalty revenue from IoT showed signs of recovery after multiple quarters of weakness. Annual Profit Estimates increased for 2024, and decreased for 2025 and 2026. For 2025, management expects revenue to be around $4 billion, which represents 24% year-on-year growth, ahead of management’s target of 20%. Qtrly Profit Estimates are for 44%, 7%, 53%, and 38% profit growth in the next 4 qtrs. For next quarter, analysts expect revenue to grow 31%. |

Fair Value |

This qtr, ARM has P/E of 100, and the stock is at $160 a share. This qtr, ARM has P/E of 100, and the stock is at $160 a share.

My Fair Value P/E is a P/E of 65, which is a price of $133 a share. Arm feels overvalued to me. My Fair Value for 2026 is $173. ARM has a Fiscal Year end on March 31. I’m calling this year 2024. |

Bottom Line |

Arm (ARM) was founded in 1990 as a joint venture of Acorn Computers, Apple, and VLSI technology. The company was public on the NASDAQ from 1998 until 2016, then was taken private by SoftBank. In 2023 the stock went public again, and opened for trading at $56 a share. Arm (ARM) was founded in 1990 as a joint venture of Acorn Computers, Apple, and VLSI technology. The company was public on the NASDAQ from 1998 until 2016, then was taken private by SoftBank. In 2023 the stock went public again, and opened for trading at $56 a share.

Arm seems to be a leader for the next technology era. But the stock market is hampering tech stocks right now. So its a shaky market to be buying a stock with a high P/E such as this. ARM is on the radar for the Growth Stock Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |