The stock market was mixed on Wednesday as the Federal Reserve cut its benchmark interest rates as expected. The central bank delivered a 25 basis points reduction and signaled two more rate cuts this year.

The stock market was mixed on Wednesday as the Federal Reserve cut its benchmark interest rates as expected. The central bank delivered a 25 basis points reduction and signaled two more rate cuts this year.

Overall, S&P 500 slid 0.1% to 6,600, while NASDAQ dropped 0.3% to 22,261.

Tweet of the Day

Great explaination of Rubrik $RBRK, a stock on my radar: https://t.co/RQPL2595uY

— David Sharek (@GrowthStockGuy) September 17, 2025

Chart of the Day

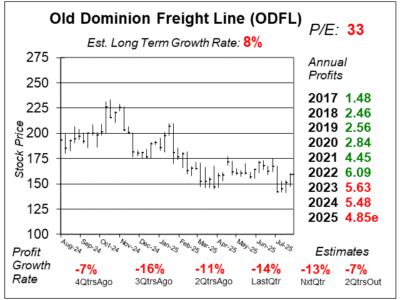

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of August 24, 2025, when the stock was at $159.

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of August 24, 2025, when the stock was at $159.

Old Dominion Freight Line posted weak results last quarter as the freight downturn persisted. Overall, the profit growth was -14% on -6% revenue growth.

The Less-than-Truckload (LTL) carrier reported drops in shipments per day (-7.3%), weight per shipment (-2.1%), and total tons per day (-9.3%).

Still, investors are sticking with this stock at a P/E of 33, which puts the current price at about 21% above our fair value estimate of $126.

Management stated there’s a challenging macroeconomic backdrop with softness in the domestic economy, but ongoing investments in its network put the company in an unparalleled position to respond to an inflection in demand when it materializes.

ODFL is on the radar for our Conservative Growth Portfolio.