High Inflation is Hurting Ross Stores’ (ROST) Low-Income Costomers

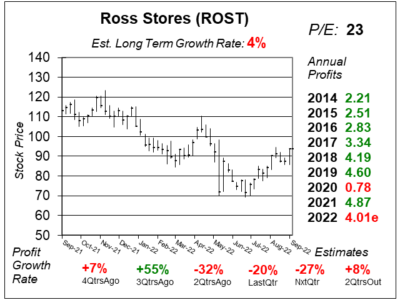

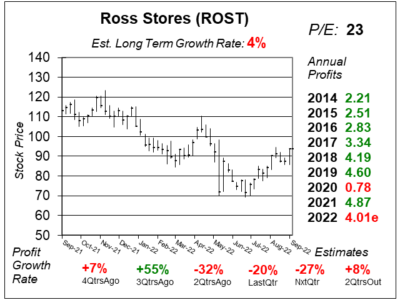

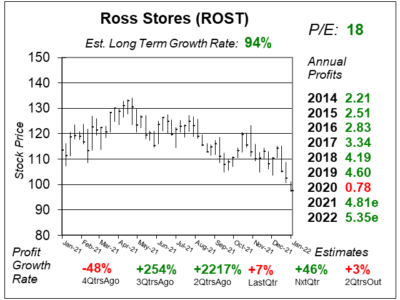

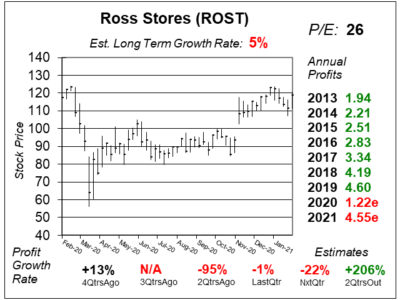

Ross Stores (ROST) had profits decline by 20% last qtr as its low-and-middle income consumers are feeling financial pressures.

Ross Stores (ROST) had profits decline by 20% last qtr as its low-and-middle income consumers are feeling financial pressures.

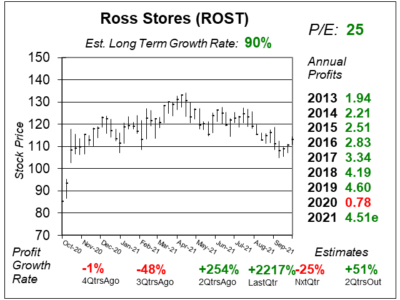

Ross Stores (ROST) dropped after it reported a bad quarter due to tough comparisons from last year & higher frieght and wage costs.

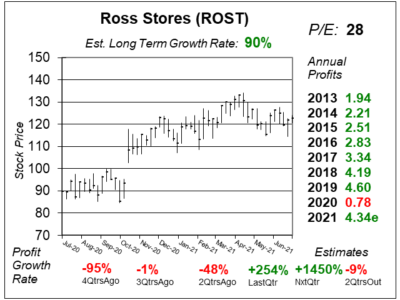

Ross Stores (ROST) stock is down-and-out due to higher wage, freight, and COVID expenses. But this is a big bounce-back candidate.

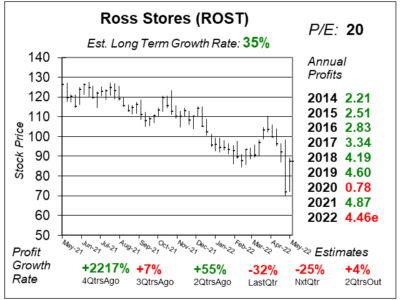

Ross Stores (ROST) stock fell as profits only grew 7% last qtr due to higher freight, wage, and COVID related costs. Time to buy.

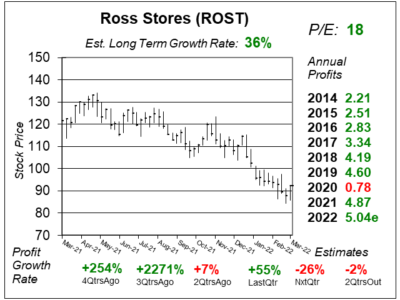

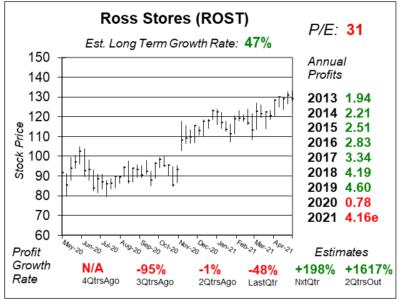

Ross Stores (ROST) just delivered a great qtr, but management lowered next qtr’s guidance due to issues getting supply.

Analysts aren’t bullish enough on Ross Stores (ROST). Here’s my thesis on why I think profits will be better than expected.

Ross Stores (ROST) stock has been hitting All-Time highs, but the company’s sales and profit growth is lagging.

Ross Stores (ROST) had rather flat results last qtr, but investors seem to like that as the stock is close to All-Time highs.

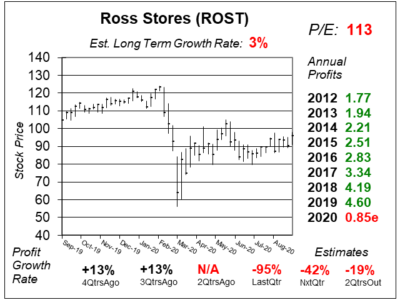

Ross Stores (ROST) sales are still sagging even though its stores have reopened. The company needs an online store.

Ross Stores (ROST) is selling some of its inventory below-cost to get rid of it while its clothing stores slowly re-open.

Ross Stores (ROST) should bounce back in a big way as management can use this slip in the stock to buyback shares.

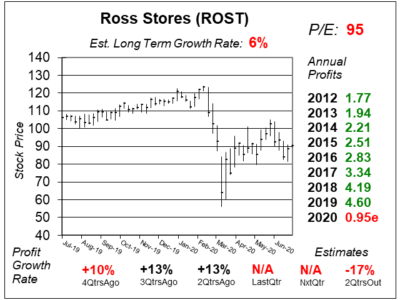

With malls closing up around the U.S, many retailers are closing stores. Ross Stores (ROST) isn’t just surviving — its thriving.

Last qtr, Ross Stores’ (ROST) strongest category was Menswear, as weakness in Ladies apparel might keep the stock where it is.

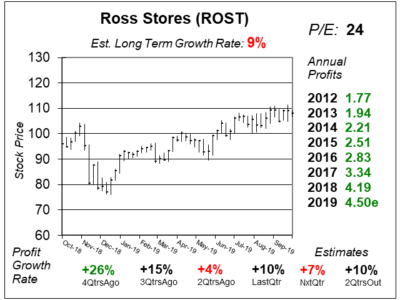

Ross Stores (ROST) is quietly winning in the retail game as bargain shoppers continue to boost sales (+6% last qtr).

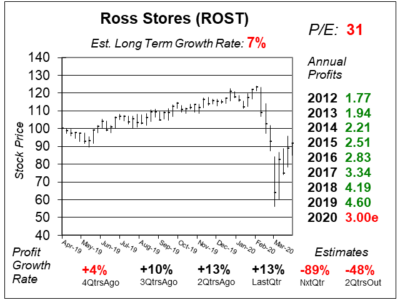

Ross Stores (ROST) is a leader in discount clothing and home accessories. Management is big on stock buybacks as well.

Investors aren’t taking Ross Stores (ROST) seriously enough. The discount retailer has consistently outperformed the S&P 500, yet doesn’t get the attention it deserves.

Ross Stores (ROST) management just raised its long-term projected store potential from 2,500 locations to 3,000.

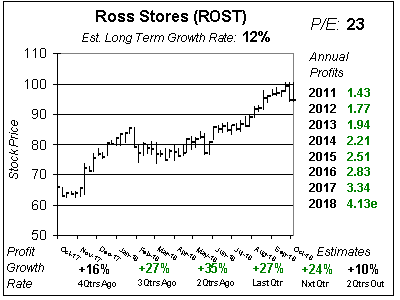

Ross Stores (ROST) is having a banner 2018 as stock buybacks and a lower tax rate are helping boost profits by more than 20%.

Ross Stores (ROST) is on a serious roll right now. But the big news is how investors really aren’t aware of what a quality stock ROST is.

So much for retailers closing. Ross Stores (ROST) is expected to have greater than 20% profit growth in each of the next four qtrs. Boom!

Last qtr Ross Stores (ROST) was down-and-out with the Retail sector. This qtr ROST is up in a big way. And really, nothing’s changed. Ross continues to pump out the goods.

Ross Stores (ROST) stock has fallen from $65 to $55 the past few months. But even in this harsh retail environment the company grew profits 12% last qtr.

Ross Stores (ROST) is thriving while other apparel retailers are just trying to survive. With mall closures coming head, more people will shop at Ross.

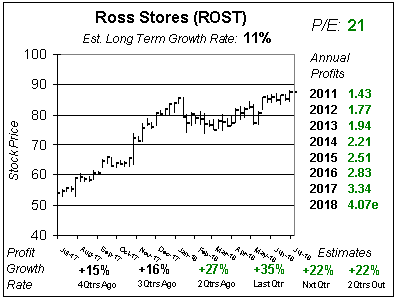

Retail stores have had a tough time growing in this e-commerce environment, but Ross Stores (ROST) continues to shine with double digit profit growth.

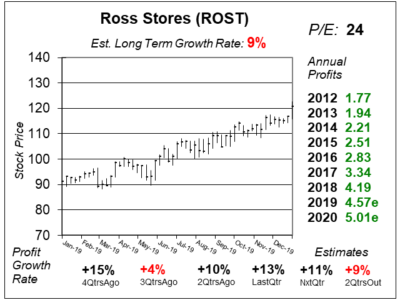

Ross Stores (ROST) delivered 13% profit growth last qtr, beating the 6% estimate, causing investors to push the stock to an All-Time high.

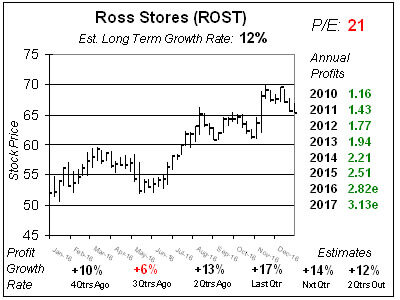

With 6% profit growth and a 21 P/E, I don’t understand investors infatuation with Ross Stores (ROST).

Ross Stores (ROST) is a conservative stock with a rich history of success, but ROST stock isn’t at a discount like its clothes are.

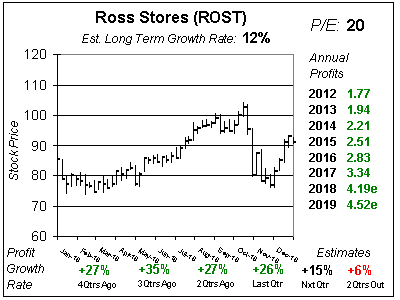

Ross Stores went from growing profits 18-19% and is now set to grow 6-11%. At 20x earnings, ROST needs to come down.

Ross Stores (ROST) has had a great run the last decade, growing 20% per year, but now the stock has little near-term upside, and growth is moderating.