Stock (Symbol) |

Snap (SNAP) |

Stock Price |

$66 |

Sector |

| Technology |

Data is as of |

| February 22, 2021 |

Expected to Report |

| April 20 |

Company Description |

Snap Inc. is a camera company. The Company’s flagship product, Snapchat, is a camera application that helps people to communicate through short videos and images known as a Snap. The Company provides Camera, Friends Page, Discover, Snap Map, Memories and Spectacles. Snapchat opens directly into the Camera, helping in creating a Snap and sending it to friends. It offers a range of creative tools that enables people to personalize and add content to their Snaps. Its chat services includes creating and watching stories, chatting with groups, making voice and video calls, and communicating through a range of stickers and Bitmojis. Memories enable users to create Snaps and stories from their saved snaps, as well as their camera roll. It also offers Spectacles, its sunglasses that make Snap. The Company’s advertising products include Snap Ads and Sponsored Creative Tools, such as Sponsored Lenses and Sponsored Geofilters. Source: Thomson Financial Snap Inc. is a camera company. The Company’s flagship product, Snapchat, is a camera application that helps people to communicate through short videos and images known as a Snap. The Company provides Camera, Friends Page, Discover, Snap Map, Memories and Spectacles. Snapchat opens directly into the Camera, helping in creating a Snap and sending it to friends. It offers a range of creative tools that enables people to personalize and add content to their Snaps. Its chat services includes creating and watching stories, chatting with groups, making voice and video calls, and communicating through a range of stickers and Bitmojis. Memories enable users to create Snaps and stories from their saved snaps, as well as their camera roll. It also offers Spectacles, its sunglasses that make Snap. The Company’s advertising products include Snap Ads and Sponsored Creative Tools, such as Sponsored Lenses and Sponsored Geofilters. Source: Thomson Financial |

Sharek’s Take |

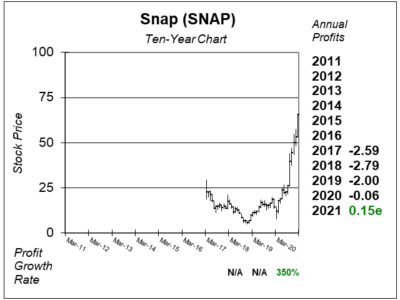

Snapchat (SNAP) has just wowed me in such a way that I feel this is the best social media stock in the world. And what’s impressing me most is how well the company has evolved into a premier source for marketing dollars by utilizing ever-advancing technology to keep its users happy while generating more ad revenue per user. In the upcoming years, this company could be rolling in the profits. Snapchat (SNAP) has just wowed me in such a way that I feel this is the best social media stock in the world. And what’s impressing me most is how well the company has evolved into a premier source for marketing dollars by utilizing ever-advancing technology to keep its users happy while generating more ad revenue per user. In the upcoming years, this company could be rolling in the profits.

Snapchat considers itself to be a camera company, but right now its more of a social network comprised of 265 million daily active users, up 22% year over year in 2020. The main component of Snapchat is the camera. The company has 600 issued patents and 1,100 patent applications relating to its camera platform. People that use Snapchat the most are referred to as the Snapchat Generation, and is comprised of Millennials and Gan Z. The Snapchat Generation is 150% more likely to communicate with pictures than words. 90% of the 13 to 24 year old U.S. population use Snapchat, as do 75% of the 13 to 34 year old U.S. population. But older audiences aren’t being ignored either. Snap continues to add new shows that appeal to older audiences, with a 25% increase in 35+ viewership last qtr. What really makes Snapchat special is the advancely-enhanced Augmented Reality (AR) pictures and videos. Augmented reality is a catalyst as you can try on brands and see what they look like in a view like you’re standing in front of the mirror. Last qtr, moer than 200 million people engaged with AR on Snapchat every day, on average. In a recent beta test, these AR users were 2.5x more likely to purchase. Snapchat is now trying to optimize ad campaigns to connect the most likely buyers to a brand that consumer likes. Another growth avenue is First Commercial, which lets brands reserve the first commercial that’s seen in a given day. Platforms on the Snapchat app include 5 main screens, and are represented in the action bar:

Snapchat comprises less than 2% of the US digital ad market, yet reaches nearly half of smartphone users. The U.S. digital ad market is expected to grow an average of 14% a year through 2024 (source: eMarketer), so this company might be in the sweet spot for growth opportunity. In 2020, Snap brought in $2.5 billion in revenue, and went profitable for the first time. From 2015 to to 2020 the Average Revenue Per User rose from $0.59, $2.71, $5.65, $6.29, $8.29 and $10.09. And with expenses per user around $10, I’m thinking profits now will come rolling in. SNAP was added to the Growth Portfolio last qtr, and this qtr I’ll put it in the Aggressive Growth Portfolio. This looks to be the next-big social media stock, and it also possesses a 3D software division which is valuable as well. Lens Studio is the Snap software used to create new faces. And it can also create 3D images from a 2D picture. Lens Studio might be an overlooked catalyst for SNAP, as the company may possess the best 3D development software in the world. |

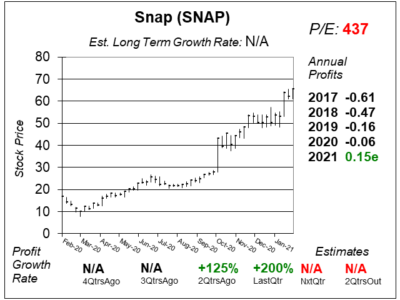

One Year Chart |

SNAP broke out on HUGH VOLUME when it reported earnings two qtrs ago, then broke out again after reporting last qtr’s results. These charts were done yesterday when the stock was $66. Today, Snap jumped to $70 on HIGH VOLUME in a huge stock market selloff after its first Virtual Investor Day. In the program, management said it could grow revenue 50% for years to come. This stock might be the strongest in my coverage now. SNAP broke out on HUGH VOLUME when it reported earnings two qtrs ago, then broke out again after reporting last qtr’s results. These charts were done yesterday when the stock was $66. Today, Snap jumped to $70 on HIGH VOLUME in a huge stock market selloff after its first Virtual Investor Day. In the program, management said it could grow revenue 50% for years to come. This stock might be the strongest in my coverage now.

The P/E of 437 seems high, but the profit figure is low. The stock doesn’t have an Est. LTG. Notice the two qtrs of triple-digit profit growth. Those came after the company was unprofitable in all the years since its IPO. So that was a breaking point when profits started to be realized. When stocks go from losing money to making money, they cam sometimes become very hot and perhaps compound in value (which SNAP just did). |

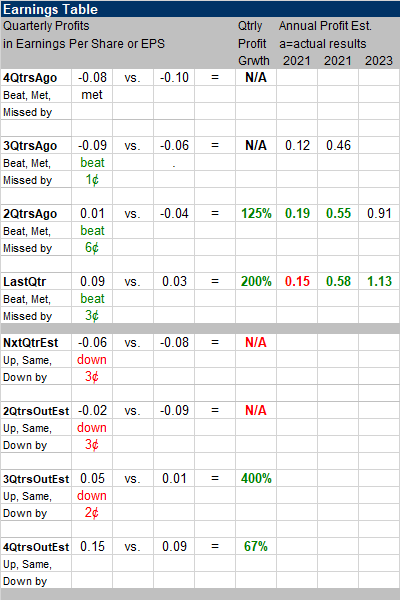

Earnings Table |

Last qtr Snap made a profit of 9 cents a share and and beat estimates by 6 cents a share. So instead of 100% profit growth, the company delivered 200%. Revenue rose 62%, which is accelerated growth from 52% 2QtrsAgo. Users increased 22% to 265 million. Breaking this down by region, U.S. growth was 6%, Europe was 10% and the resr of the world grew 55% to reach 99 million. International user growth is exceptional. Last qtr Snap made a profit of 9 cents a share and and beat estimates by 6 cents a share. So instead of 100% profit growth, the company delivered 200%. Revenue rose 62%, which is accelerated growth from 52% 2QtrsAgo. Users increased 22% to 265 million. Breaking this down by region, U.S. growth was 6%, Europe was 10% and the resr of the world grew 55% to reach 99 million. International user growth is exceptional.

Annual Profit Estimates are around where they were last qtr. Profits look to rise substantially in the coming years, here’s the estimates: 2021 $0.15 Qtrly profit Estimates are for losses the next 2 qtrs (which I think is unlikely) then triple-digit profits in the next 2 qtrs. |

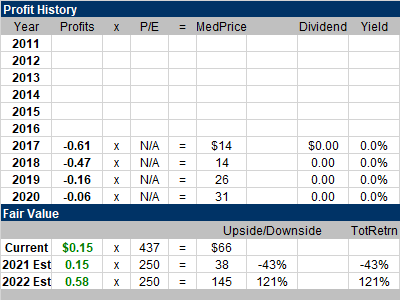

Fair Value |

I’m placing a Fair Value of 250x earnings for the stock. That’s a high valuation, but I feel it is justified with $2.24 in profits expected three years from now. I’m placing a Fair Value of 250x earnings for the stock. That’s a high valuation, but I feel it is justified with $2.24 in profits expected three years from now.

This stock has substantial upside to 2022’s Fair Value. Note the 2021 Fair Value is unfairly low, and I doubt the stock will come back down to $38 anytime soon. I think the stock goes to $145 from here. |

Bottom Line |

Snap (SNAP) is still a very young company, and I love the fact that this is expected to be its first year of profitability. I also love the $2.24 profit estimate for 2024. Snap (SNAP) is still a very young company, and I love the fact that this is expected to be its first year of profitability. I also love the $2.24 profit estimate for 2024.

Snapchat is my favorite social media stock right now, The company is way ahead of Facebook/Instagram with more entertaining videos. Although Tiktok has great videos, the company doesn’t have a publicly traded stock. I also admire the vision of Snapchat’s management. They are way ahead of the competition with their Augmented Reality camera (and patents) and are focused on delivering a top-notch advertising platform. SNAP jumps from 39th to 4th Growth Portfolio Power Rankings. I will add the stock to the Aggressive Growth Portfolio today, and it will rank 4th as well. |

Power Rankings |

Growth Stock Portfolio

4 of 57Aggressive Growth Portfolio 4 of 25Conservative Stock Portfolio N/A |