Stock (Symbol) |

Costco (COST) |

Stock Price |

$645 |

Sector |

| Food & Necessities |

Data is as of |

| January 3, 2024 |

Expected to Report |

| March 7 |

Company Description |

Costco Wholesale Corporation is a global retailer with warehouse club operations in eight countries. Costco Wholesale Corporation is a global retailer with warehouse club operations in eight countries.

The Company operates an international chain of membership warehouses, mainly under the Costco Wholesale name. The Company’s warehouses are designed to help small- to medium-sized businesses reduce costs in purchasing for resale and for everyday business use. The Company offers merchandise in various categories, which include groceries, candy, appliances, television and media, automotive supplies, tires, toys, hardware, sporting goods, jewelry, watches, cameras, books, housewares, apparel, health and beauty aids, furniture, office supplies and office equipment. Members can also shop for private label Kirkland Signature products. It operates approximately 829 warehouses worldwide. It also operates self-service gasoline stations. The Company operates e-commerce websites in the United States, Canada, Mexico, United Kingdom, Korea, Taiwan, Japan, and Australia. Source: Refinitiv |

Sharek’s Take |

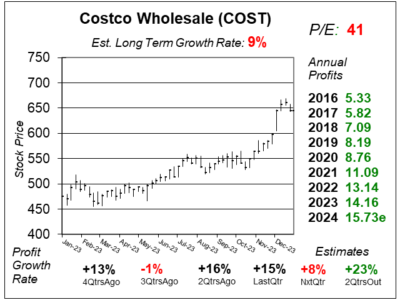

Costco (COST) is paying its investors a special one-time dividend of $15 per share. The payment hits today, January 12, 2024 to shareholders who owned the stock at the close of December 28, 2023. Previous one-time dividends include $7 in fiscal 2012, $7 in 2017, $10 in 2021. The company also pays a quarterly dividend of $1.02 per share. No wonder the stock is so richly valued. The P/E of 41 is high fora company with an Estimated Long-Term Growth Rate of 9% a year. In terms of retail production, the company did well last quarter and delivered 15% profit growth as revenue increased 6%. The sales of fresh foods were strong, and items like food and sundries did well. Non-food products showed improvement from September to November. Costco (COST) is paying its investors a special one-time dividend of $15 per share. The payment hits today, January 12, 2024 to shareholders who owned the stock at the close of December 28, 2023. Previous one-time dividends include $7 in fiscal 2012, $7 in 2017, $10 in 2021. The company also pays a quarterly dividend of $1.02 per share. No wonder the stock is so richly valued. The P/E of 41 is high fora company with an Estimated Long-Term Growth Rate of 9% a year. In terms of retail production, the company did well last quarter and delivered 15% profit growth as revenue increased 6%. The sales of fresh foods were strong, and items like food and sundries did well. Non-food products showed improvement from September to November.

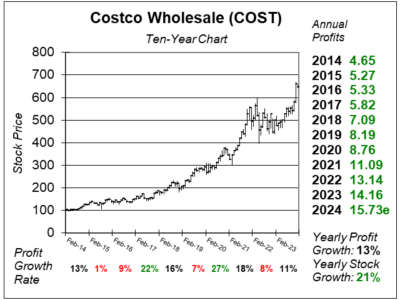

Costco is the 2nd largest global retailer with more than 120 million members. The company began operations in 1983 in Seattle, Washington. In 1993 the company merged with Price Club, which pioneered the membership warehouse concept in 1976 (and was a hot stock during its early years). It ended Fiscal 2022 with 838 locations worldwide, including 3/4 in the US and 1/4 Internationally (Canada, Mexico, the United Kingdom, Japan, and China). The company opens around 20 to 30 locations annually. The profit Costco makes is mostly made up of the annual membership fees it brings in. In Fiscal 2022, COST had retail sales of $222 billion, membership fees of $4.2 billion, and net income of $5.84 billion. Here are some stats from the last qtr:

Costco is one of the world’s safest stocks, but it’s basically a 10% to 12% grower with a lofty P/E. Analysts give the stock an Estimated Long Term Growth Rate of 8% per year and the stock yields around 1% per year. Management buys back stock, pays a quarterly dividend, and has also paid occasional one-time dividends ($7 in fiscal 2012, $7 in 2017, $10 in 2021). COST is a core holding in the Conservative Growth Portfolio. But it’s a small holding as this is a slow grower. Looking ahead, management should raise membership fees in the upcoming months, and that will boost revenue. |

One Year Chart |

COST has been trending higher for the past quarter. The stock was $564 last quarter and is $645 this quarter. I think the shares have gone too far too fast, but investors want to get hold of that fat dividend. Note these charts and tables were done on 1/3 when the stock was $645. Today, 1/12, the stock is $683. COST has been trending higher for the past quarter. The stock was $564 last quarter and is $645 this quarter. I think the shares have gone too far too fast, but investors want to get hold of that fat dividend. Note these charts and tables were done on 1/3 when the stock was $645. Today, 1/12, the stock is $683.

The P/E of 41 is high. My Fair Value is a 35 P/E. The Est. LTG of 9% is a little low, but this is a very consistent grower with a high safety rating.

|

Earnings Table |

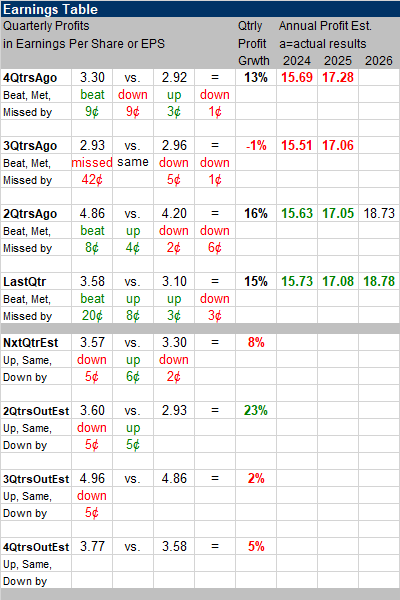

Last qtr, Costco delivered 15% profit growth and surpassed estimates of 9%. Revenue increased 6%, year-on-year just as expected. Traffic increased 4.7% including 3.6% in the US. Membership fee income increased 8%. Last qtr, Costco delivered 15% profit growth and surpassed estimates of 9%. Revenue increased 6%, year-on-year just as expected. Traffic increased 4.7% including 3.6% in the US. Membership fee income increased 8%.

E-commerce sales increased 6% with strength in various product categories such as food, e-gift cards, pet items, and snacks. Appliances showed a mid-20s growth compared to the previous year. Despite challenges in consumer electronics like computers, TV sales were up at a high single digit rate. Executive memberships represented a little over 46% of total memberships and these customers accounted for 73% of company sales. Annual Profit Estimates are up this qtr. Qtrly Profit Estimates are for 8%, 23%, 2%, and 5%, growth the next 4 qtrs. Quarterly profit growth estimates are all over the place. Note the 2QtrsOutEst. is big due to easy year-over-year comparisons (-1% in the year ago period). Analysts believe COST revenue will grow by 6% next quarter. |

Fair Value |

Costco’s P/E had risen steadily during the past decade. The stock get overvalued in March 2022 when the P/E was 42. The stock has a 41 P/E this qtr. Costco’s P/E had risen steadily during the past decade. The stock get overvalued in March 2022 when the P/E was 42. The stock has a 41 P/E this qtr.

My Fair Value P/E for this stock is 35, or $551 a share. The stock looks overvalued to me. The company has a Fiscal Year end on August 31. |

Bottom Line |

Costco (COST) is a quality Blue Chip stock with high certainty, a stock buyback program, qtrly dividends and a history of big surprise dividends. This has been a steady winner for many decades, thus investors really appreciate the stock. Costco (COST) is a quality Blue Chip stock with high certainty, a stock buyback program, qtrly dividends and a history of big surprise dividends. This has been a steady winner for many decades, thus investors really appreciate the stock.

But I feel these shares have gone on a parabolic run higher. Thus I will sell shares from client accounts on Tuesday (as the stock market is closed for a holiday on Monday). COST will be put on the radar for the Conservative Portfolio. I’ll look to buy back at a lower level. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |