Chipotle Mexican Grill (CMG) Continues Get More Sales Out of Locations

Chipotle (CMG) continues to get more out of each store as same store sales increased 8.4% last qtr with help from Chipotlanes.

Chipotle (CMG) continues to get more out of each store as same store sales increased 8.4% last qtr with help from Chipotlanes.

Chipotle (CMG) is developing automated digital make lines to make bowls and salads, which should keep profit growth rolling along.

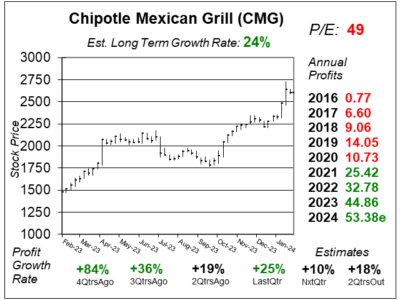

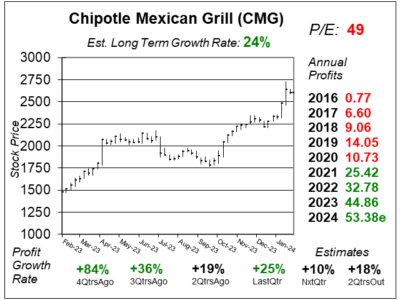

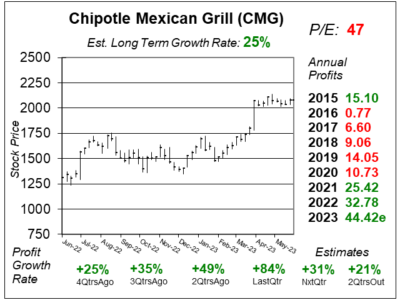

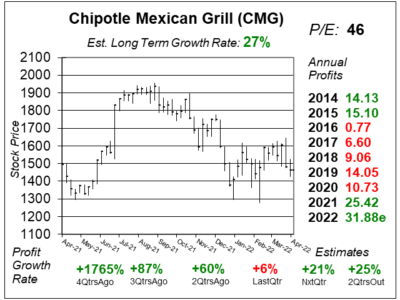

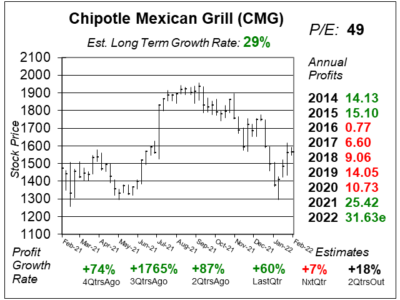

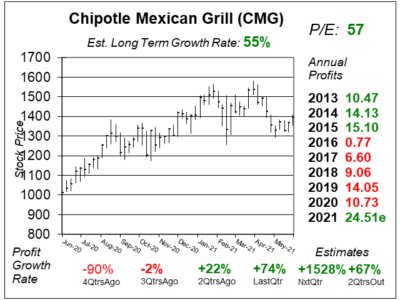

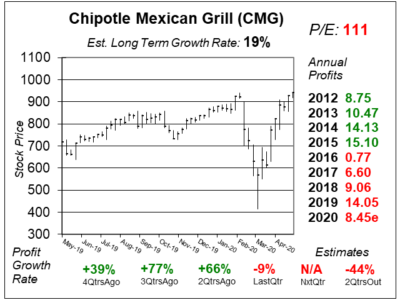

Chipotle (CMG) stock has been doing well as profits have been “off the chart”. But with a high P/E, CMG could decline as growth slows.

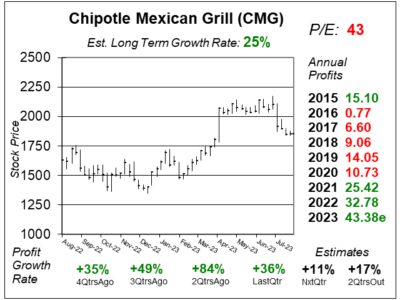

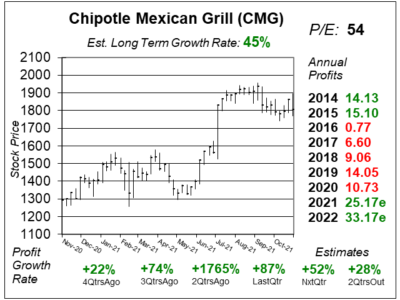

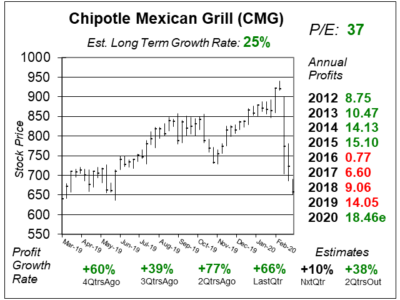

Chipotle (CMG) profits soared 84% last quarter as almost 40% of revenue came from digital sales, which improved profit margins.

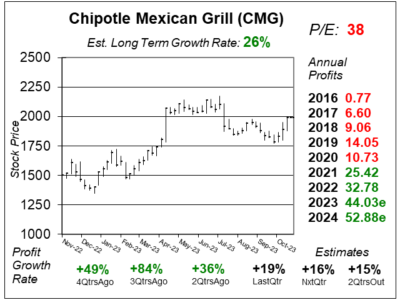

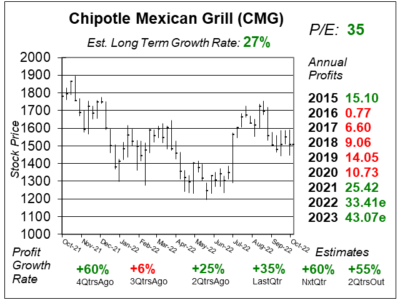

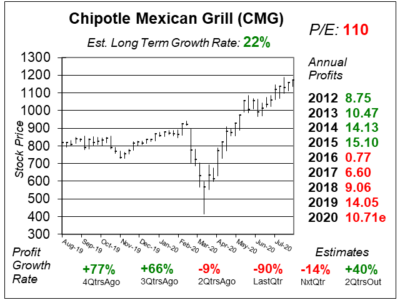

Chipotle’s (CMG) profit margins are surging higher — as digital sales and Chipotlanes are increasing restaurant effeciency.

Most of Chipotle’s (CMG) customers are higher-income, and they are eating at the restaurants more often, even in this recession.

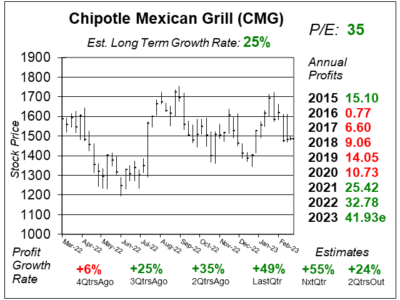

Chipotle (CMG) is growing profits (+25% last qtr) & sales (+17%) at healthy rates. Analysts expected bigger things in the years to come.

Chipotle (CMG) is seeing higher costs of items such as avocado. So its raised prices, and hasn’t seen a slowdown in demand. Great!

Chipotle (CMG) is facing higher costs, but the recent price increases helped offset their impact without affecting demand.

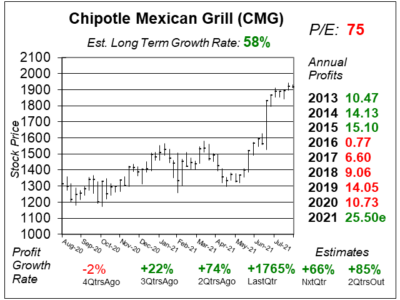

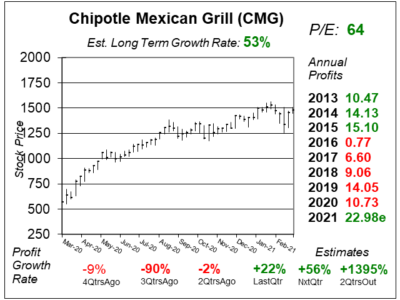

Chipotle (CMG) is doing great, but the stock went from $1300 to $1900 within the past year, and needs to digest its gains.

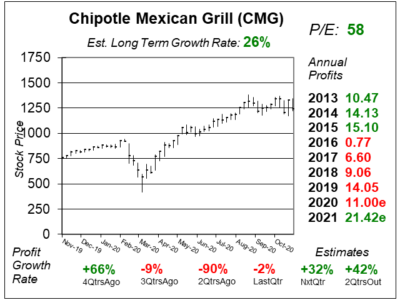

Chipotle’s (CMG) digital sales and Chipotlanes are boosting not only sales per restaurant, but also restaurant profit margins.

Chipotle (CMG) has TWO big catalysts for growth in its digital sales and Chipotlanes that could cause profits to soar.

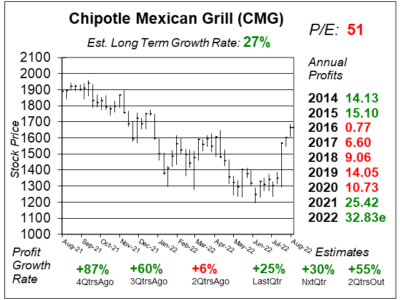

At almost $1500 a share, Chipotle (CMG) seems expensive with a P/E of 64. But the stock could be headed to $3000 by 2025.

Chipotle’s digital sales have given the company a catalyst for the coming years, as analysts predict profits will soar.

Chipltoe (CMG) is installing drive-thru lanes (named Chipotlanes) in many stores and these could be HUGE for profits.

Chipotle’s (CMG) digital sales soared 80% last qtr. Investors are loving the news, as CMG hit an All-Time high today.

During 2015-2018 Chipotle (CMG) suffered from customer illnesses caused by bacteria. Now profits are set to hit new highs.

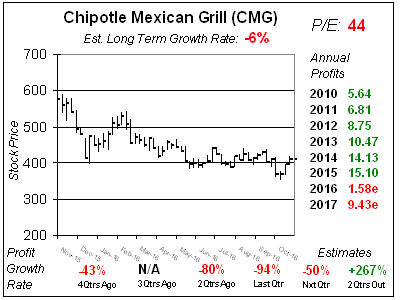

Chipotle (CMG) continues to have issues with sales and profits, and this time it’s from competition not E.coli. Also, the new chorizo has no flavor.

Chipotle (CMG) rallied last week on news a hedge fund took a 10% stake in the company, but CMG’s numbers still look terrible as the lines aren’t long anymore.

Chipotle may have lost its Midas touch with customers, as some may be gone for good. My take is management is lowering expectations to beat them later.

Chipotle (CMG) is down due to the E. coli outbreaks, but now the company has two objectives: get the lines back and impress investors.

Chipotle (CMG) is down on E. Coli concerns, but I see it as a great franchise we can collect at a discount.

Chipotle (CMG) is down from $750 to $650 in two weeks. Does CMG look appetizing now?

Chipotle (CMG) just jumped when it should have dropped and I feel CMG is at a top.

Shares of Chipotle (CMG) fell after the co reported earnings. But CMG still isn’t down enough.

This is a good time to short Chipotle (CMG) as the stock is worth $150 less than CMG is selling for.

Chipotle (CMG) is still smokin with 20% same store sales growth. Here’s what I think CMG is worth.

Chipotle (CMG) is skying higher on the back of an amazing quarter where same-store-sales rose 17%.

Shares of Chipotle (CMG) are still sky-high even though high beef prices are crimping profits.

Chipotle (CMG) has defied gravvity for 6 months now, CMG is still too high, but there’s good growth coming.

Chipotle (CMG) has gone on a parabolic run. I think now the stock could go up 30% max, but CMG can just as easily fall 30% as well.

Wow! Chipotle’s (CMG) P/E is as big as the burritos the restaurant serves. I wouldn’t touch this $400 stock until it got down to $300.

Chipotle (CMG) isn’t growing profits like it used to. The stock has a 32 P/E yet profit growth is only 8%. I’ll sell CMG stock.

Shares of Chipotle (CMG) have fallen from $400 to $250. Even after the drop the stock’s still not undervalued. CMG is right where it shoudl be.

Shares of

Chipotle (CMG) is one of the hottest stocks around. Profits jumped 35% last quarter as sales rose 26%. This is the hottest pepper — blazing hot yet dangerous.

Double digit same store sales continue to fuel Chipotle’s (CMG) run. Now profit growth is set to accelerate too. Still, CMG is high. I wouldn’t buy.

Chipotle (CMG) had another quarter of same store sales growth of at least 10%. That combined with a price increase of around 5% pushed profit growth up 25% even though food costs rose. Too bad CMG is fairly valued.

Chipotle Mexican Grill (CMG) hasn’t been great in two quarters now — yet the stock is still trending up. There’s two forees fighting here: Higehr food costs (bad) and positive store sales (good).

Rising food costs has caused Chipotle’s (CMG) profit growth to decelerate from 48% to 23%. That’s still good, but might not be high enough to support a 41 P/E.

Chipotle (CMG) has gone from $85 to $285 in just five quarters. The P/E of 42 makes the stock expensive. You could say the run is almost over, but solid same store sales growth could push the stock even higher.

Chipotle’s been on a breathtaking run in 2010, and with same store sales of 11% last quarter, the momentum should continue.

Chipotle (CMG) has been a fabulous stock in 2010, but tough comparisons might mean it’s time for this stock to take a breather.

Left: CMG’s P/E is in black, signifying the stock is neither undervalued (green) or overvalued (red).

Chipotle (CMG) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $11.51 vs. $10.50 = +10%

Revenue Est: +12%