The stock market closed lower on Friday after President Donald Trump’s latest tariff threats. He recently announced a 35% tariff on Canada and warned higher tariffs moving forward.

The stock market closed lower on Friday after President Donald Trump’s latest tariff threats. He recently announced a 35% tariff on Canada and warned higher tariffs moving forward.

Overall, S&P 500 fell 0.3% to 6,260, while NASDAQ dropped 0.2% to 20,586.

Tweet of the Day

This is Bearish https://t.co/wTFUegpQEV

— David Sharek (@GrowthStockGuy) July 10, 2025

Chart of the Day

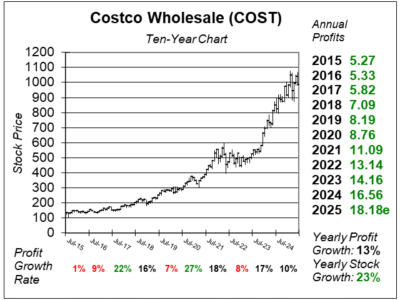

Here is the one-year chart of Costco (COST) as of June 16, 2025, when the stock was at $984.

Here is the one-year chart of Costco (COST) as of June 16, 2025, when the stock was at $984.

Costco’s ecommerce division delivered strong growth last quarter as sales increased 16% driven by a 31% rise in big and bulky item deliveries through Costco Logistics. Online sales of gold and jewelry, toys, health and beauty, housewares, and apparel grew by double digits.

Overall, Costco recorded 13% profit growth last quarter on 8% revenue growth. That was average for this company.

Lower input costs—such as eggs, butter, and olive oil—also contributed to margin expansion of 11.25% from 10.84% a year ago, particularly in food and sundries.

In addition, Costco is shifting more Kirkland Signature sourcing to local regions to reduce costs and minimize tariff impacts, helping the brand grow faster than overall company sales.

COST is on the radar for our Conservative Portfolio. David Sharek, Founder of School of Hard Stocks, will consider buying in if the stock drops.