The stock market dropped sharply on Thursday, extending a sell-off that’s now stretched across several sessions. Investors weighed Alphabet’s (GOOGL) aggressive AI investment plans, and digested new labor data pointing to renewed weakness in the jobs market.

The stock market dropped sharply on Thursday, extending a sell-off that’s now stretched across several sessions. Investors weighed Alphabet’s (GOOGL) aggressive AI investment plans, and digested new labor data pointing to renewed weakness in the jobs market.

Weekly jobless claims came in higher than expected, and job openings fell to their lowest level since 2020. Attention now turns to the government’s monthly jobs report, scheduled for release next Wednesday.

Overall, S&P 500 declined 1.2% to 6,798, while NASDAQ dipped 1.6% to 22,541.

Tweet of the Day

Eli Lilly $LLY reports earnings:

Reported: $7.54 vs. $5.32 = +42%

Estimates: $7.07 vs. $5.32 = +33%

Beat the street by $0.47

Revenue: +43%

Revenue Est: +31%— SchoolofHardStocks (@SchoolHardStock) February 4, 2026

Chart of the Day

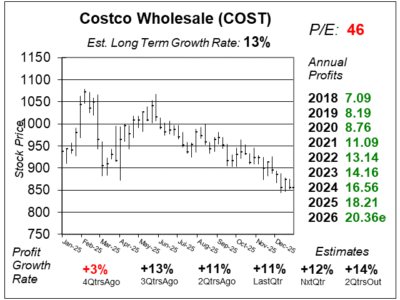

Here is the one-year chart of Costco (COST) as of January 2, 2026, when the stock was at $855.

Here is the one-year chart of Costco (COST) as of January 2, 2026, when the stock was at $855.

Costco’s (COST) growth last quarter has continued to be driven by its e-commerce division and membership strength. Digitally enabled comparable sales posted a strong growth of 21% last quarter, supported by continued web and app improvements, with site traffic up 24% and app traffic up 48%.

In the earnings call, management highlighted same-day delivery, via Instacart in the US and Uber Eats/DoorDash internationally, outpaced overall digital sales.

New personalization features boosted product recommendations, while AI-driven pharmacy inventory management improved in-stock rates to over 98%, driving mid-teen growth in prescriptions filled.

Meanwhile, Costco’s membership fee income rose 14% year over year, with high renewal rates. Overall, COST recorded 11% profit growth on 8% increase in revenue last quarter. Both numbers are in-line with the stock’s long-term growth rates.

The big issue with this stock is its expensive. David Sharek, Founder of School of Hard Stocks, sold COST from our Conservative Growth Portfolio in January 2024 because he felt P/E was too high at 41. This quarter it is 46. So COST is on the radar and if the stock drops some more, he’ll likely buy in.