The stock market slid Tuesday as technology shares pulled back on profit-taking and valuation worries, with investors reassessing sector leadership and rotating toward more economically sensitive and defensive areas.

The stock market slid Tuesday as technology shares pulled back on profit-taking and valuation worries, with investors reassessing sector leadership and rotating toward more economically sensitive and defensive areas.

Overall, S&P 500 fell 0.8% to 6,918, while NASDAQ dropped 1.4% to 23,255.

Chart of the Day

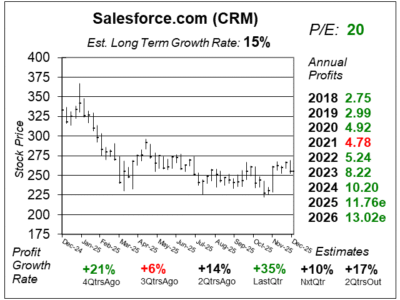

Here is the one-year chart of Salesforce (CRM) as of January 2, 2026, when the stock was at $255.

Here is the one-year chart of Salesforce (CRM) as of January 2, 2026, when the stock was at $255.

Last quarter, Agentforce Annual Recurring Revenue (ARR) grew 330% year over year as more companies used AI agents for customer service, sales, and employee work through tools like Slack.

Salesforce has built Agentforce into many of its products, so these AI agents can use company data to answer questions, complete tasks, and help workers do their jobs faster. Adoption is rising sharply, with customers in production up 70% quarter over quarter and the platform processing 3.2 trillion AI interactions, showing how deeply it is integrated across Salesforce’s apps. However, despite the fast growth, Agentforce and related data products will need more time before they meaningfully impact Salesforce’s $40+ billion in annual revenue base.

CRM is part of our Growth Portfolio. The CRM industry is slowing, as most organizations have already signed up. Now, what’s left is higher revenue from upgrades like Agentforce. However, that’s not enough to get revenue growth above 10%. This stock is a value with a P/E of 20, but there’s not a catalyst to have revenue growth accelerate back past 10% to get the P/E to move higher.