CrowdStrike (CRWD) is Seeing Demand for its Next-Gen Protection for AI Agents

CrowdStrike (CRWD) is helping organizations protect themselves from cyberhacks who get in the system through AI agents.

CrowdStrike (CRWD) is helping organizations protect themselves from cyberhacks who get in the system through AI agents.

CrowdStrike’s (CRWD) Charlotte AI provides cybersecurity for AI agents, which have access to internal data, applications, and machines.

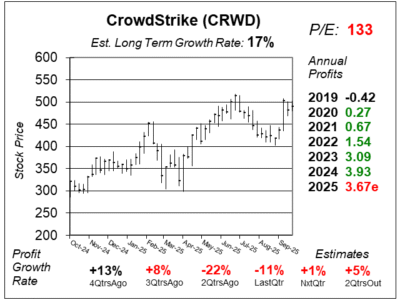

CrowdStrike (CRWD) has catalyst in its Falcon Flex program, which is good for revenue. But profit estimates just declined in a big way.

Cybersecurity company CrowdStrike (CRWD) is now doing $1 billion a quarter in revenue as its new pricing plan Falcon Flex thrives.

CrowdStrike (CRWD) management stated its customers have moved past the July 19th outage. Then why did profit estimates decline?

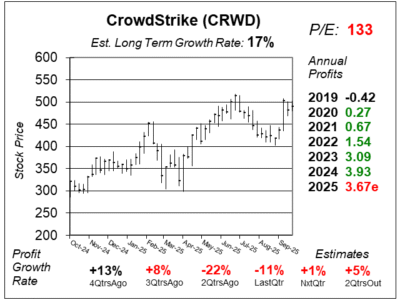

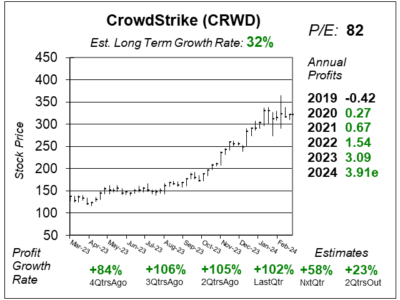

CrowdStrike (CRWD) is the most admired cybersecurity company today. But all the attention has pushed the stock sky high.

Crowdstrike (CRWD) delivered a superior quarter in terms of new deals. But with the stock’s recent rise, what’s the upside for the stock?

CrowdStrike (CRWD) continues to deliver excellent results. Investors have noticed, and they’ve been pushing the stock higher.

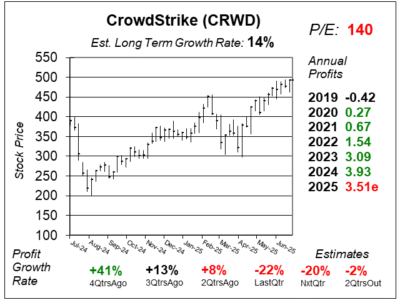

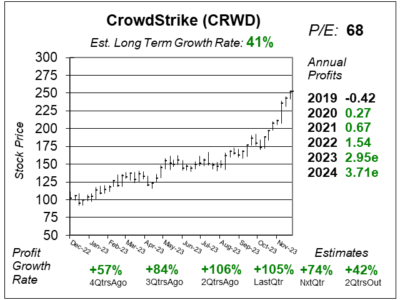

Crowdstrike (CRWD) delivered a strong qtr with record performance for Cloud Security, LogScale, and non-GAAP operating margin.

CrowdStrike (CRWD) continues t deliver impressive growth, and now the stock is reasonably priced with good upside potential.

CrowdStrikc (CRWD) delivered a surprisingly good quarter — it beat the street and upped guidance — and news sent the stock higher.

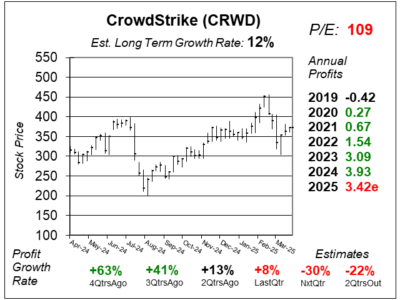

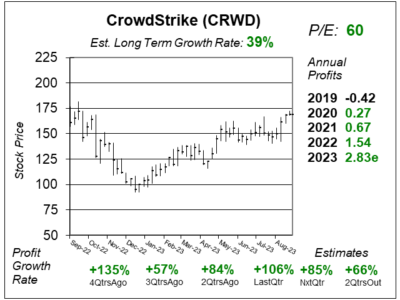

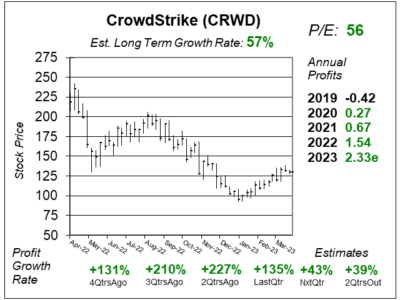

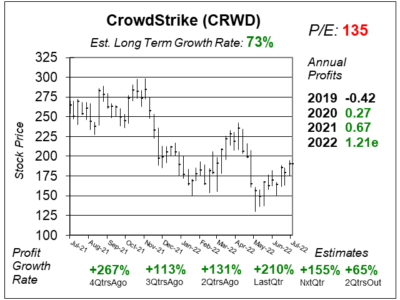

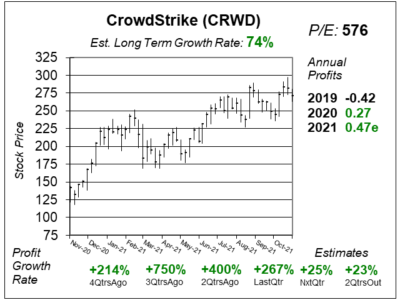

Crowdstrike (CRWD) just grew profits 135% and sales 53% but CRWD is one of the weakest in the stock market. Let’s look at why.

CrowdStrike (CWRD) contineus to see strong momentum even in this slow economy. And now it has a catalyst Identity Protection.

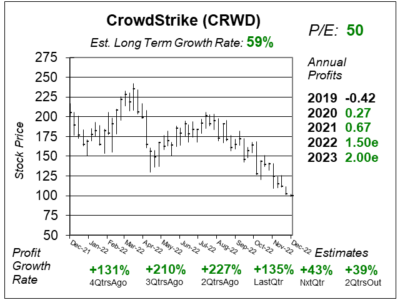

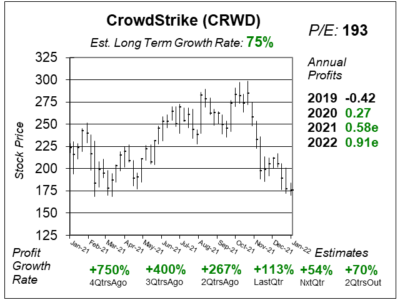

Crowdstrike’s (CRWD) demand environment is more robust today than this time last year, as cybersecurity isn’t discretionary.

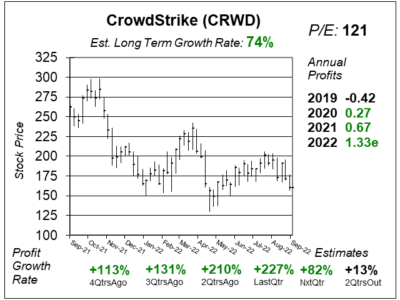

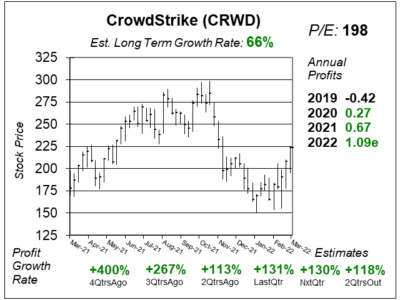

Cybersecurity company Crowdstrike (CRWD) is delivering exceptional growth, including 131% year-over-year profit growth last qtr.

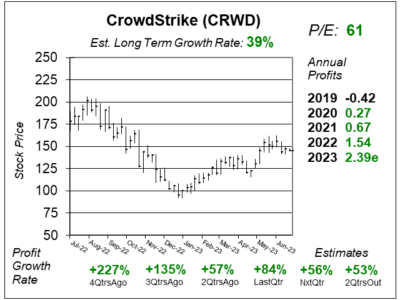

CrowdStrike (CRWD) has some of the best numbers this qtr as it is getting business from local, state, and U.S. governments.

Crowdstrike (CRWD) fell on high volume today after a brokerage firm said the stock is overvalued. Let’s see if that’s the case!

Cybersecurity stock Crowdstrike (CRWD) broke out this week, but with a high price-to-sales ratio the stock might not go far.

CrownStrike (CRWD) is one of the fastest growing software companies, but CWRD is still expensive even after a a 30% decline.

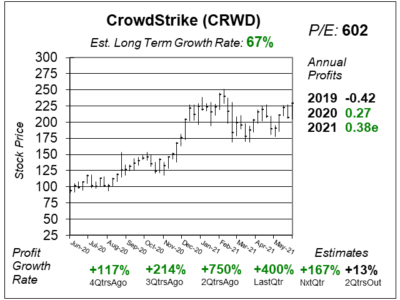

Crowdstrike (CRWD) is one of the top cybersecurity stocks around. But the stock sells for an expensive 40x 2021 revenue.

CrowdStrike (CRWD) is expected to report qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues:

CrowdStrike (CRWD) reports qtrly profits (EPS) and revenues: