AI Semiconductor Demand is a Key Driver Behind Broadcom’s (AVGO) Growth

Last quarter, Broadcom’s (AVGO) saw a massive rise in 74% AI semiconductor revenue growth, helping to boost profits 37%.

Last quarter, Broadcom’s (AVGO) saw a massive rise in 74% AI semiconductor revenue growth, helping to boost profits 37%.

Broadcom (AVGO) has an edge in AI as it allows big hyperscalers like Google and Microsoft to design their own custom chips.

Broadcom (AVGO) just saw a 170% year-over-year increase in AI networking sales as big hyperscalers invest in Artificial Intelligence.

Broadcom’s (AVGO) AI revenue jumped 77% year-over-year last qtr. Now the company is set to expand its hyperscalers from 3 to 7.

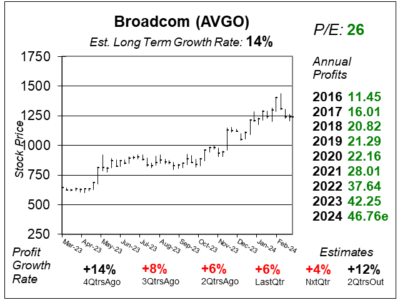

Investors have finally realized the power behind Broadcom’s (AVGO) AI products. Now, after a big run higher, the stock could settle back.

Broadcom (AVGO) is expected to have accelerated profit in the coming quarters as software sales and AI buildouts are strong.

Shares of Broadcom (AVGO) bolted higher after the company reported earnings last qtr. But at this price, the stock seems overvalued.

Broadcom (AVGO) is already reigning in revenue from AI infrastructure. Now it seems the company can compete with NVIDIA.

Broadcom (AVGO) is expected to have revenue jump 40% 2024, but profits are estimated to rise just 10% as it integrates VMware.

Broadcom’s (AVGO) would have had flattish year-over-year revenue growth last quarter if it were not for sales for generative AI.

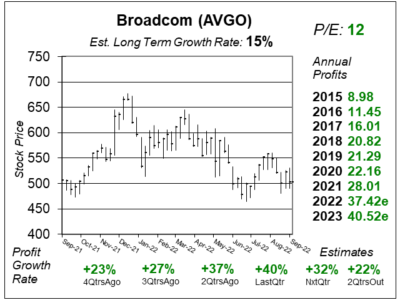

Broadcom Inc (AVGO) enjoyed a near-vertical rally to its all-time highs after it anounced an agreement with Apple to produce 5G chips.

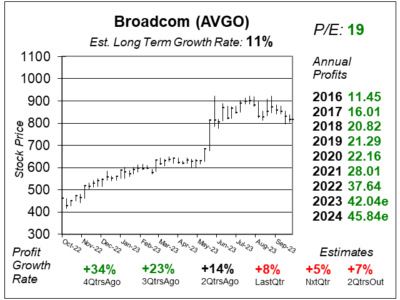

Broadcom (AVG) is seeing urgency and excitement for its AI switching and routing hardware used in data-intensive workloads.

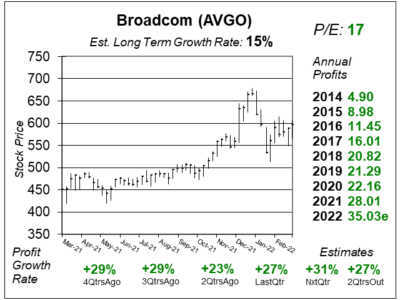

Broadcom (AVGO) is one tech stock that continues to deliver good results. And with a P/E of 13, this stock has good upside.

This Bear Market has given investors lots of stocks that are values. Broadcom (AVGO) seems to be one of the best deals out there.

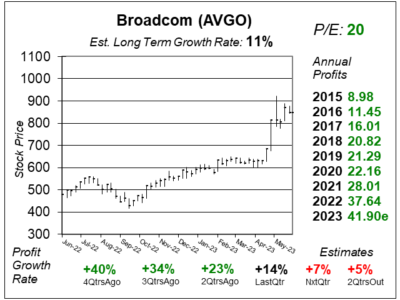

Broadcom (AVGO) is expected to acquire VMware, which will increase the company’s software revenue from 1/4 of total sales to 1/2.

Broadcom (AVG) is a semiconductor company, an electronic device manufacturer, and a cybersecurity stock wrapped in one.