The stock market declined on Wednesday amid rising concerns over renewed U.S.–China trade tensions.

The stock market declined on Wednesday amid rising concerns over renewed U.S.–China trade tensions.

With the government shutdown entering its fourth week, S&P 500 dropped 0.5% to 6,699, while Nasdaq fell 0.9% to 22,740.

Tweet of the Day

$VRT … Reports Q3 (Sep) earnings of $1.24 per share, excluding non-recurring items, $0.26 better than the FactSet Consensus of $0.98; revenues rose 29.0% year/year to $2.68 bln vs the $2.58 bln FactSet Consensus. Co issues guidance for Q4, sees EPS of $1.23-1.29, excluding… pic.twitter.com/7UEHrSeRCY

— Marty Chargin (@MartyChargin) October 22, 2025

Chart of the Day

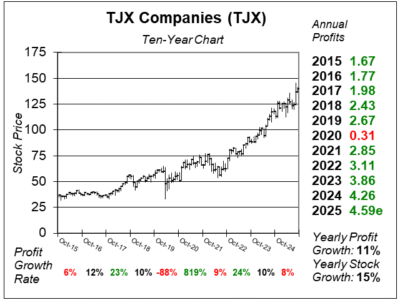

Here is the ten-year chart of TJX Companies (TJX) as of September 22, 2025, when the stock was at $139.

Here is the ten-year chart of TJX Companies (TJX) as of September 22, 2025, when the stock was at $139.

The world economy is tight right now, and many shoppers do not have extra funds to spend on clothes, kitchen gadgets, and home furnishings. This tight-wallet environment is helping discount chain TJX (TJX), which delivered strong performance last quarter with 15% profit growth on 7% sales growth.

The best division during the quarter was TJX International, which had sales growth up 13%. TJX Canada was also strong with 11% sales growth. Back in the US, HomeGoods sales grew 9% and Marmaxx (which includes TJ Maxx and Marshalls) rose 5%. Home products performed better than clothing, with customers drawn to the variety of unique items.

TJX continues to appeal to a wide range of income groups and is attracting younger shoppers.

TJX is a core holding in our Conservative Growth Portfolio.