The stock market sank on Monday as investors assessed Trump administration’s tariff implementation. S&P 500 fell 0.8% to 5,995, while NASDAQ dropped 1.2% to 19,392. These, however, were significantly up from early-session lows following an announcement that U.S. tariffs on Mexico would be delay by a month.

The stock market sank on Monday as investors assessed Trump administration’s tariff implementation. S&P 500 fell 0.8% to 5,995, while NASDAQ dropped 1.2% to 19,392. These, however, were significantly up from early-session lows following an announcement that U.S. tariffs on Mexico would be delay by a month.

Tweet of the Day

The US economy is fine. Homes aren't selling because homeowners are trying to be greedy and sell at premium prices.

Houses listed for $350,000 are really worth $250,000.

Refinitiv and real estate brokers are telling people their homes are worth the higher prices, but they… https://t.co/qWaxlmRcsS

— David Sharek (@GrowthStockGuy) January 29, 2025

Chart of the Day

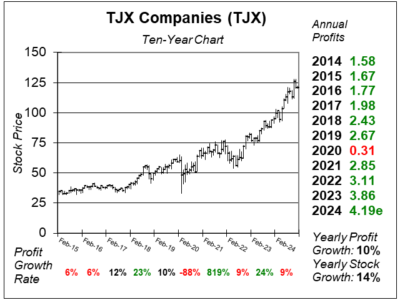

Here is the ten-year chart of TJX Companies (TJX) as of January 6, 2025, when the stock was at $121.

Here is the ten-year chart of TJX Companies (TJX) as of January 6, 2025, when the stock was at $121.

TJX Companies is aiming to dominate the International discount clothing markets. In fact, it is already doing so.

The company reported a n11% gain in profits last quarter, with a modest 6% increase in sales. Its International division (Europe & Australia) had a 16% gain in sales last quarter.

Management is excited to grow exposure in Mexico, UAE, and Saudi Arabia. Last quarter, TJX Companies completed its investment of $179 million in a joint venture with Grupo Axo, gaining a 49% stake in over 200 off-price stores across Mexico.

In the earnings call, TJX Companies announced plans for TJ Maxx to enter Spain in early 2026 with a potential for 100 stores in the country long-term. It is confident it can grow its brands all around the world, citing its very long track record of execution. We think they are the best in the business.

TJX is part of our Conservative Growth Portfolio.