The stock market surged on Friday after news that U.S. inflation data for September came in lower than anticipated.

The stock market surged on Friday after news that U.S. inflation data for September came in lower than anticipated.

The September Consumer Price Index report, which has been delayed for more than a week due to the U.S. government shutdown, showed a 0.3% increase, slightly below the 0.4% forecast. This brought the year-to-date inflation to 3%.

The softer inflation data boosted investor confidence that the Federal Reserve can cut interest rates next week.

Overall, S&P 500 rose 0.8% to 6,792, while NASDAQ went up 1.2% to 23,205.

Tweet of the Day

I’m going to work on a report that briefly covers the AI stocks I think are must-own. https://t.co/1NjtoczIOD

— David Sharek (@GrowthStockGuy) October 24, 2025

Chart of the Day

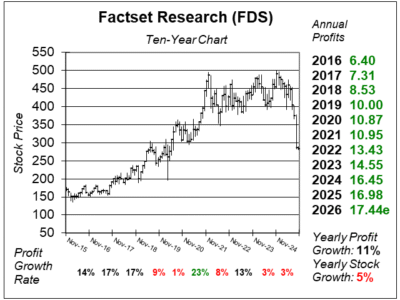

Here is the ten-year chart of Factset Research (FDS) as of October 2, 2025, when the stock was at $282.

Here is the ten-year chart of Factset Research (FDS) as of October 2, 2025, when the stock was at $282.

AI is capable of taking financial data and writing a research report. These capabilities make investment firms question whether $1000 a-month-plus software is needed any longer.

Although management did not disclose AI competition in its earnings call, David Sharek, Founder of School of Hard Stocks, can see the company’s numbers starting to slow.

Factset Research used to be a perennial 10% profit grower, but it just closed its Fiscal 2025 with 3% profit growth on the year, and 3% growth expected for Fiscal 2026.

Sales growth is weak too. Revenue grew just 6% last quarter with 6% estimated for this quarter.

Management is confident, stating in the Earnings Call it is “at an inflection point where its strategic investments are beginning to translate into measurable competitive advantages”.

FDS is part of our Conservative Stock Portfolio. This used to be a fabulous buy-and-hold stock, but profits need to accelerate for FDS to remain in our portfolio.